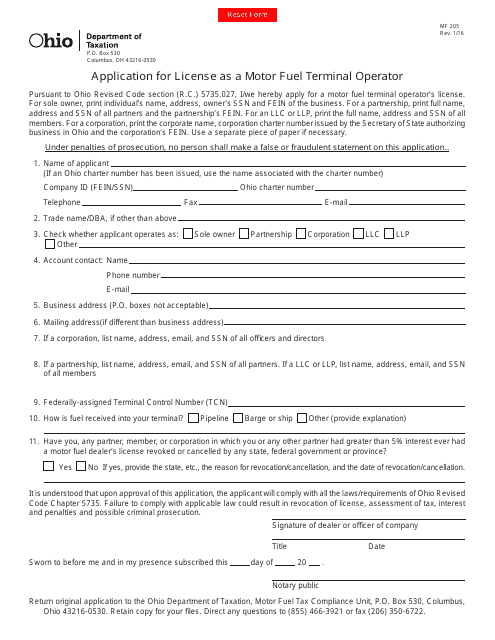

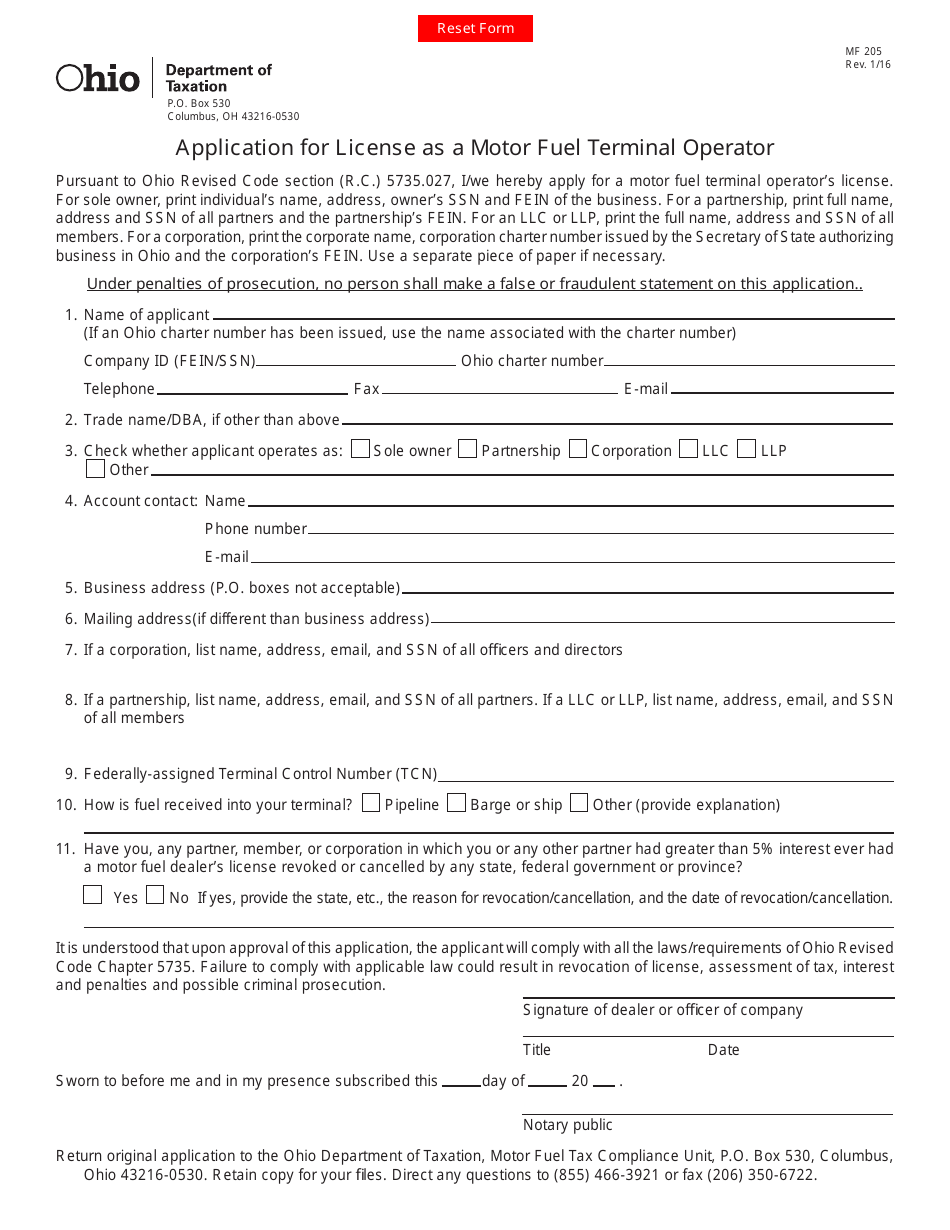

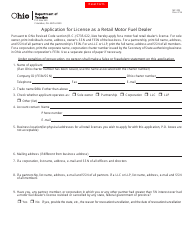

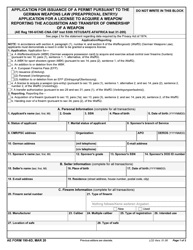

Form MF205 Application for License as a Motor Fuel Terminal Operator - Ohio

What Is Form MF205?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MF205?

A: Form MF205 is an application for a license as a motor fuelterminal operator in Ohio.

Q: How do I obtain a license as a motor fuel terminal operator in Ohio?

A: To obtain a license, you need to complete and submit Form MF205.

Q: What information is required on Form MF205?

A: Form MF205 requires information such as your business name, address, contact information, and other details about your operations.

Q: How long does it take to process the license application?

A: The processing time for the license application can vary. It is recommended to contact the Ohio Department of Taxation for more information on processing times.

Q: Can I operate as a motor fuel terminal operator without a license?

A: No, you cannot operate as a motor fuel terminal operator in Ohio without a license.

Q: What are the responsibilities of a motor fuel terminal operator?

A: Motor fuel terminal operators are responsible for various tasks such as receiving and storing motor fuel, blending fuel, and complying with state regulations.

Q: Is the license valid for a specific period of time?

A: Yes, the license is valid for a specific period of time. The duration of validity can be specified on the license.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MF205 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.