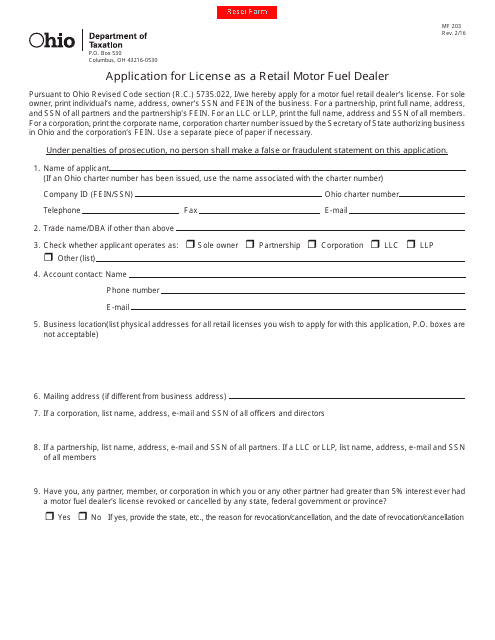

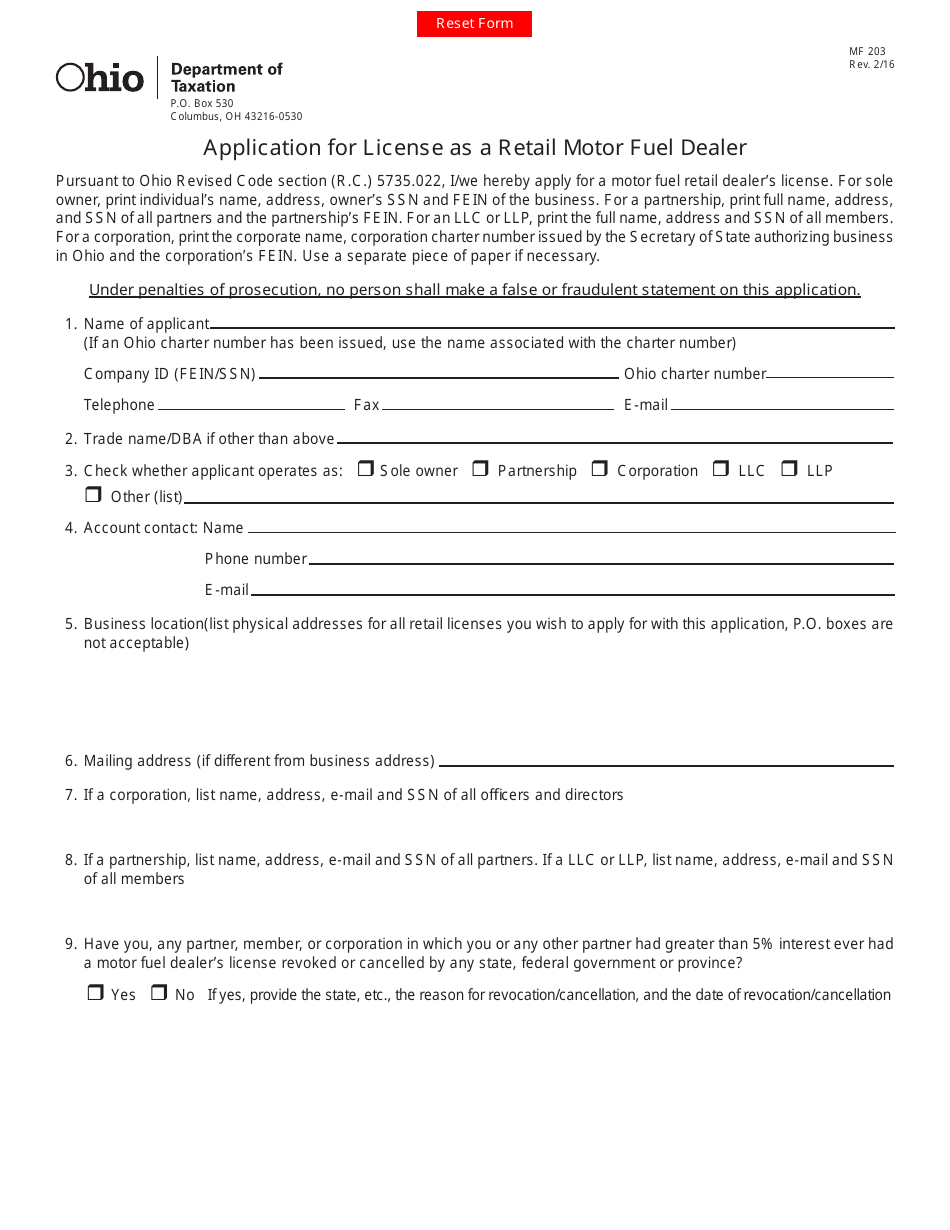

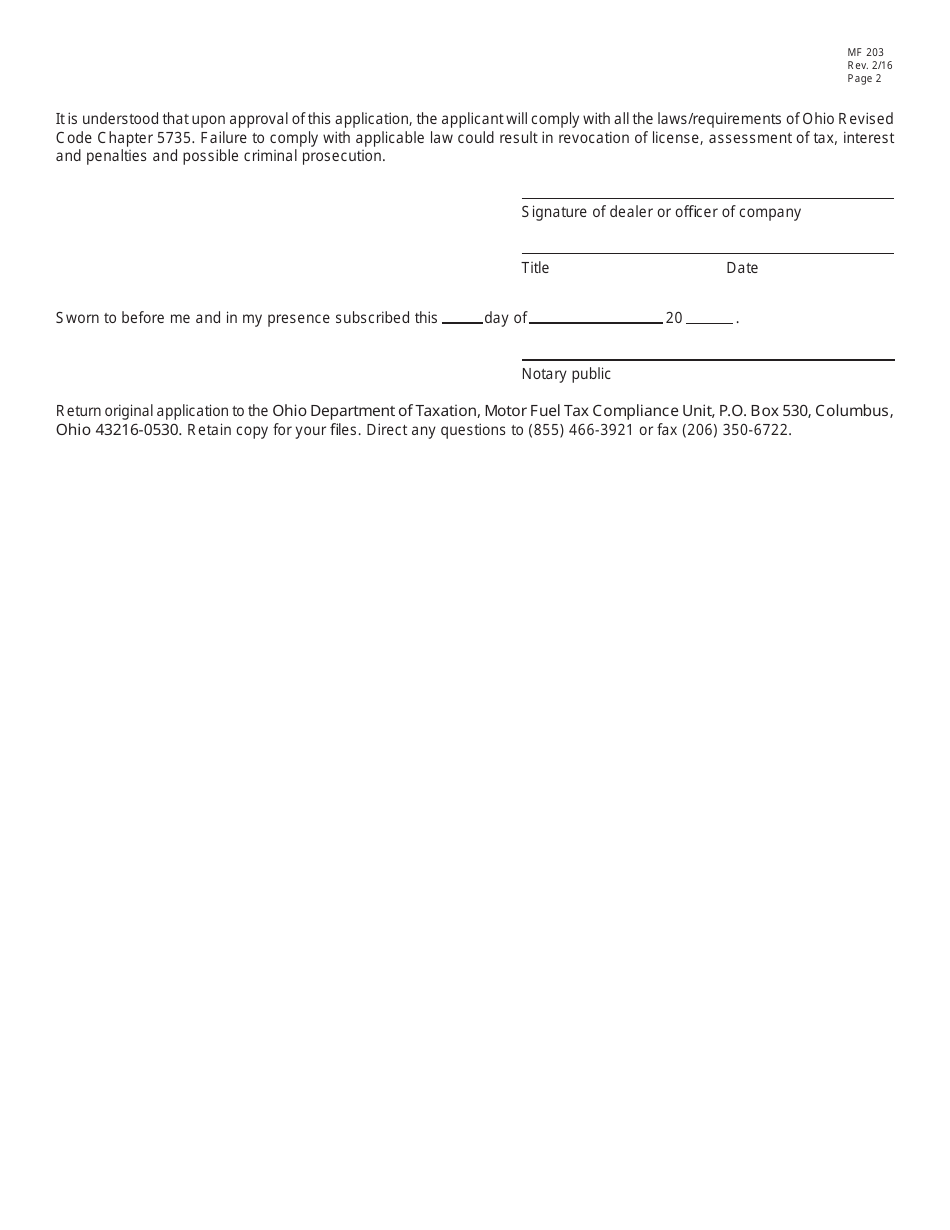

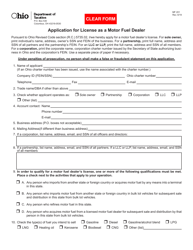

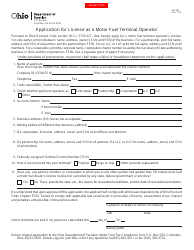

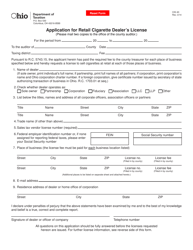

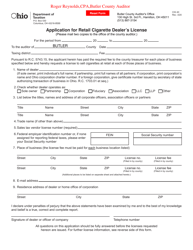

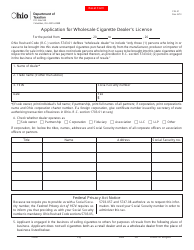

Form MF203 Application for License as a Retail Motor Fuel Dealer - Ohio

What Is Form MF203?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MF203?

A: Form MF203 is the application for a license as a retail motor fuel dealer in Ohio.

Q: Who needs to submit Form MF203?

A: Anyone who wishes to become a retail motor fuel dealer in Ohio needs to submit Form MF203.

Q: What can you do with a retail motor fuel dealer license?

A: With a retail motor fuel dealer license, you can legally sell motor fuel in Ohio.

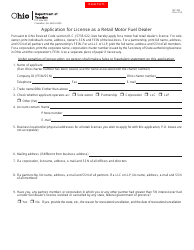

Q: What information is required on Form MF203?

A: Form MF203 requires information such as your name, contact information, business details, and financial information.

Q: What is the processing time for Form MF203?

A: The processing time for Form MF203 can vary. It is best to check with the Ohio Department of Taxation for current processing times.

Q: Are there any additional requirements to obtain a retail motor fuel dealer license in Ohio?

A: Yes, there may be additional requirements such as obtaining a surety bond and complying with environmental regulations. It is important to review the Ohio Department of Taxation's guidelines for complete information.

Q: Can I operate as a retail motor fuel dealer without a license?

A: No, it is illegal to operate as a retail motor fuel dealer in Ohio without a valid license.

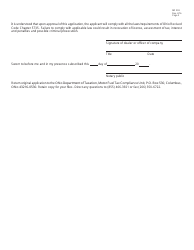

Q: What happens if my Form MF203 application is denied?

A: If your Form MF203 application is denied, you will receive notice of the denial and the reasons for it. You may have the opportunity to appeal the decision or make corrections to your application.

Form Details:

- Released on February 1, 2016;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MF203 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.