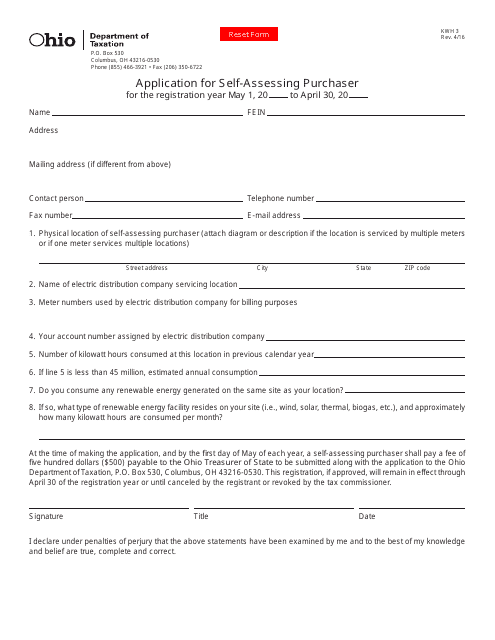

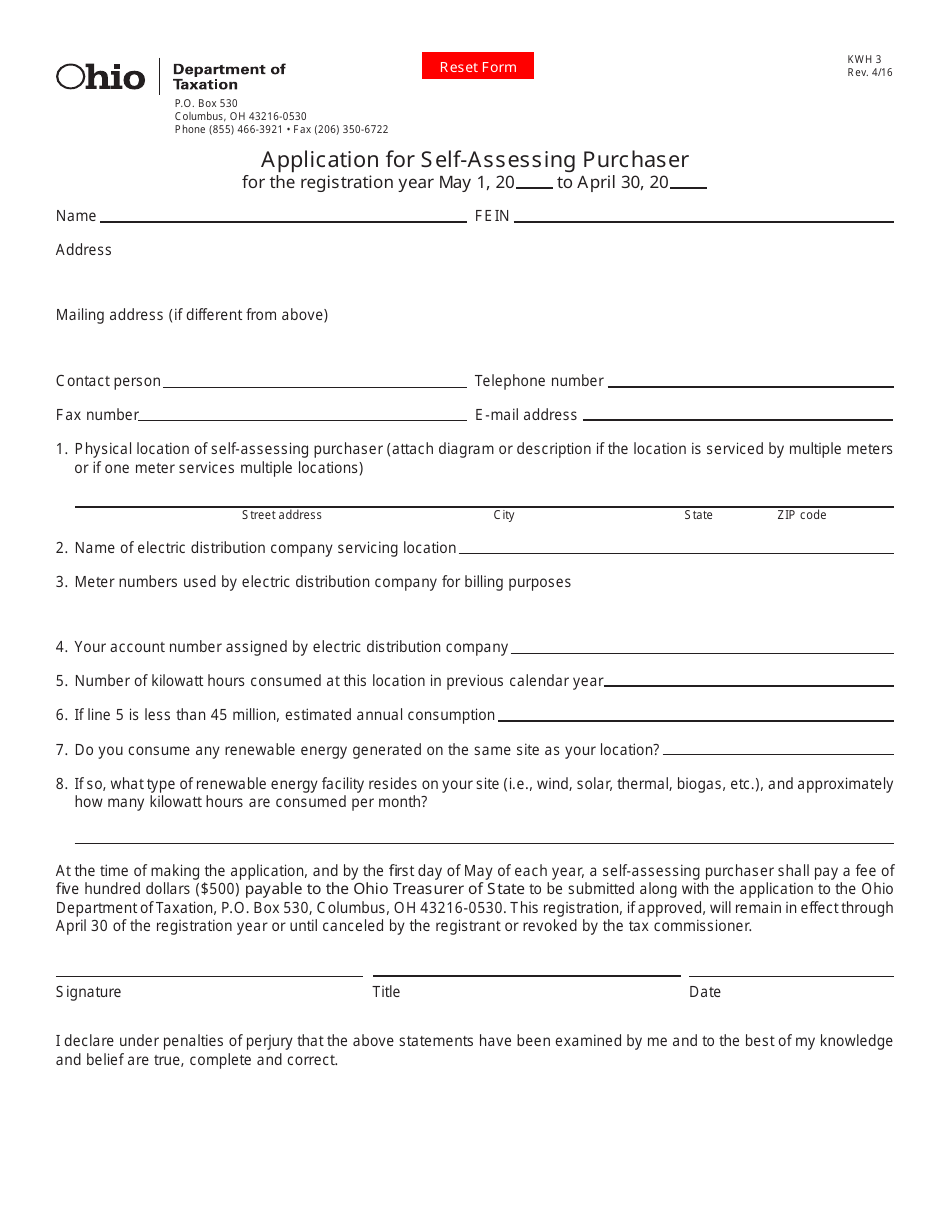

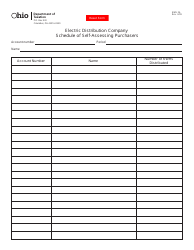

Form KWH3 Application for Self-assessing Purchaser - Ohio

What Is Form KWH3?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form KWH3?

A: Form KWH3 is an application for self-assessing purchasers in Ohio.

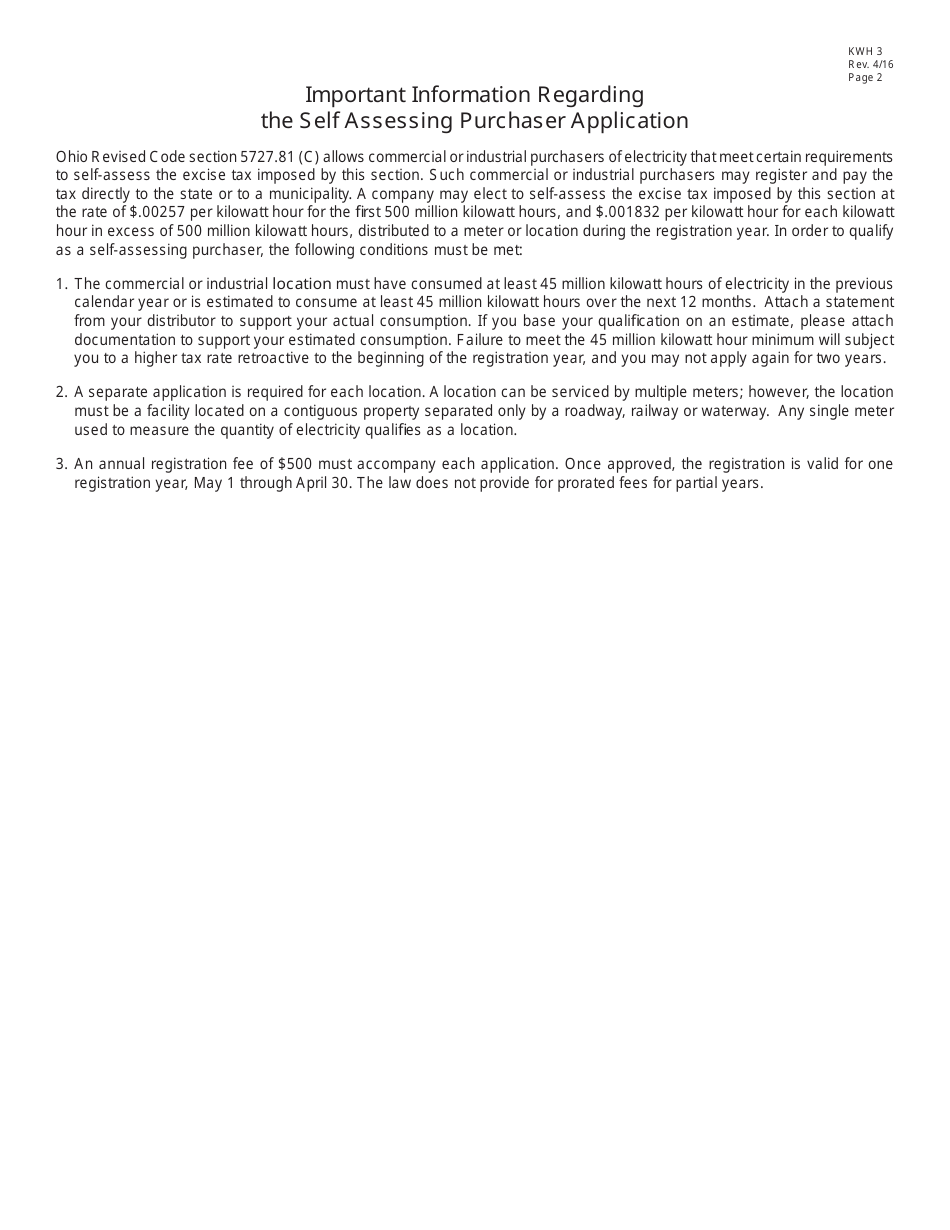

Q: Who should use Form KWH3?

A: Form KWH3 should be used by self-assessing purchasers in Ohio.

Q: What does self-assessing mean?

A: Self-assessing means that the purchaser is responsible for reporting and paying the use tax directly to the state.

Q: What is the purpose of Form KWH3?

A: The purpose of Form KWH3 is to report and pay the use tax on purchases made by self-assessing purchasers in Ohio.

Q: Are there any deadlines for filing Form KWH3?

A: Yes, self-assessing purchasers must file Form KWH3 on a monthly basis.

Q: Is there a penalty for late filing of Form KWH3?

A: Yes, there may be penalties for late filing of Form KWH3.

Q: What information is required on Form KWH3?

A: Form KWH3 requires the purchaser's name, address, tax ID number, and the amount of use tax owed.

Q: Are there any exemptions from the use tax?

A: Yes, there are certain exemptions from the use tax in Ohio. Please refer to the Ohio Department of Taxation for more information.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form KWH3 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.