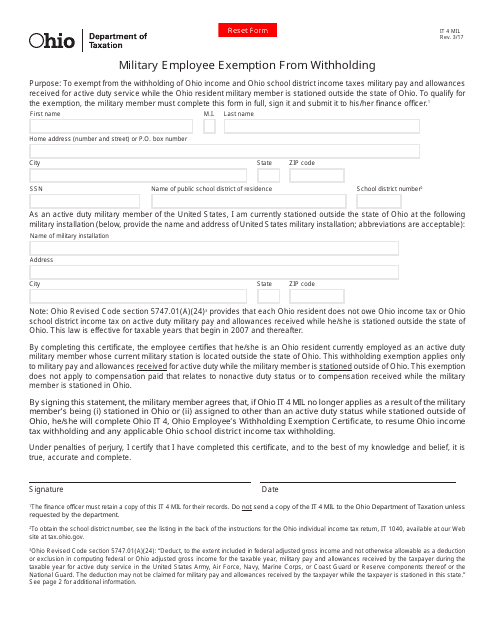

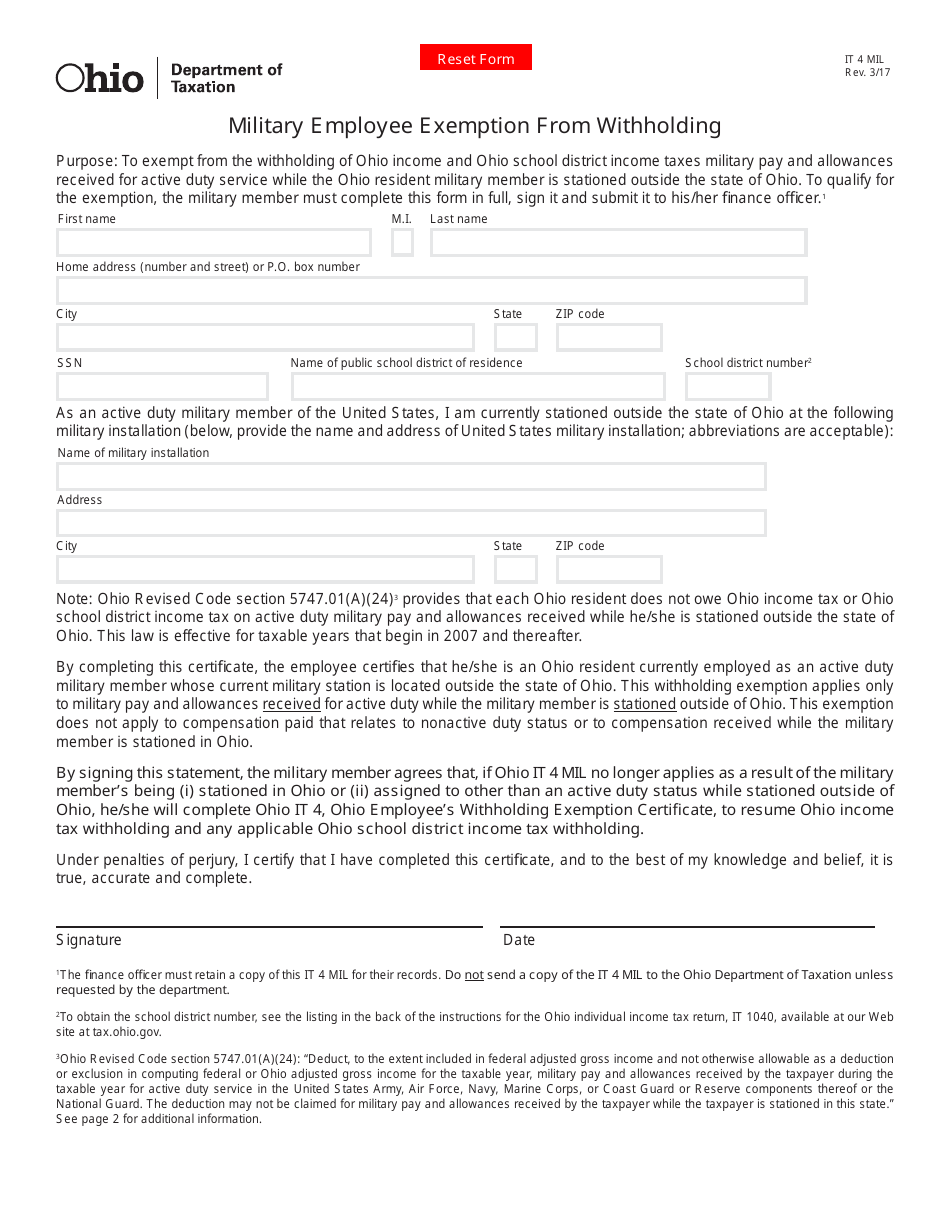

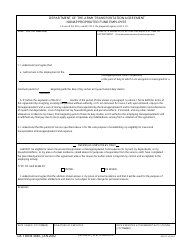

Form IT4 MIL Military Employee Exemption From Withholding - Ohio

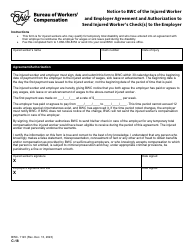

What Is Form IT4 MIL?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT4 MIL?

A: Form IT4 MIL is the Military Employee Exemption From Withholding form.

Q: Who is eligible to use Form IT4 MIL?

A: Military employees in Ohio are eligible to use Form IT4 MIL.

Q: What is the purpose of Form IT4 MIL?

A: The purpose of Form IT4 MIL is to claim exemption from withholding Ohio income tax for military employees.

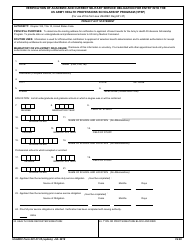

Q: What information do I need to provide on Form IT4 MIL?

A: You will need to provide your personal information, such as your name, Social Security number, and military status, on Form IT4 MIL.

Q: When should I submit Form IT4 MIL?

A: You should submit Form IT4 MIL to your employer as soon as possible after becoming a military employee in Ohio.

Q: Is Form IT4 MIL valid for multiple years?

A: No, Form IT4 MIL is only valid for the calendar year in which it is submitted. You will need to submit a new form each year.

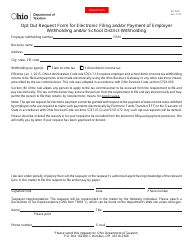

Q: Will using Form IT4 MIL exempt me from federal income tax withholding?

A: No, Form IT4 MIL only exempts you from Ohio income tax withholding. You may still be subject to federal income tax withholding.

Q: Can I use Form IT4 MIL if I am not a military employee?

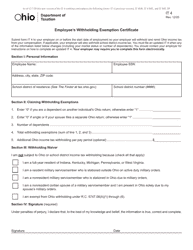

A: No, Form IT4 MIL is specifically for military employees in Ohio. If you are not a military employee, you should use the standard Ohio withholding forms.

Q: Can I make changes to Form IT4 MIL after submitting it?

A: Yes, if your military status or other information changes, you should submit a new Form IT4 MIL with updated information.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT4 MIL by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.