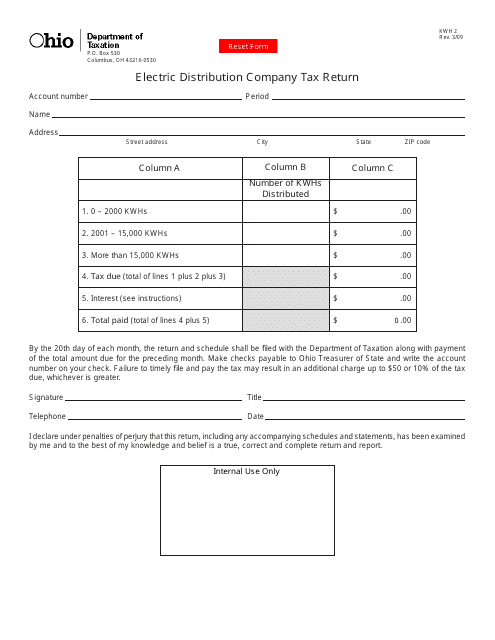

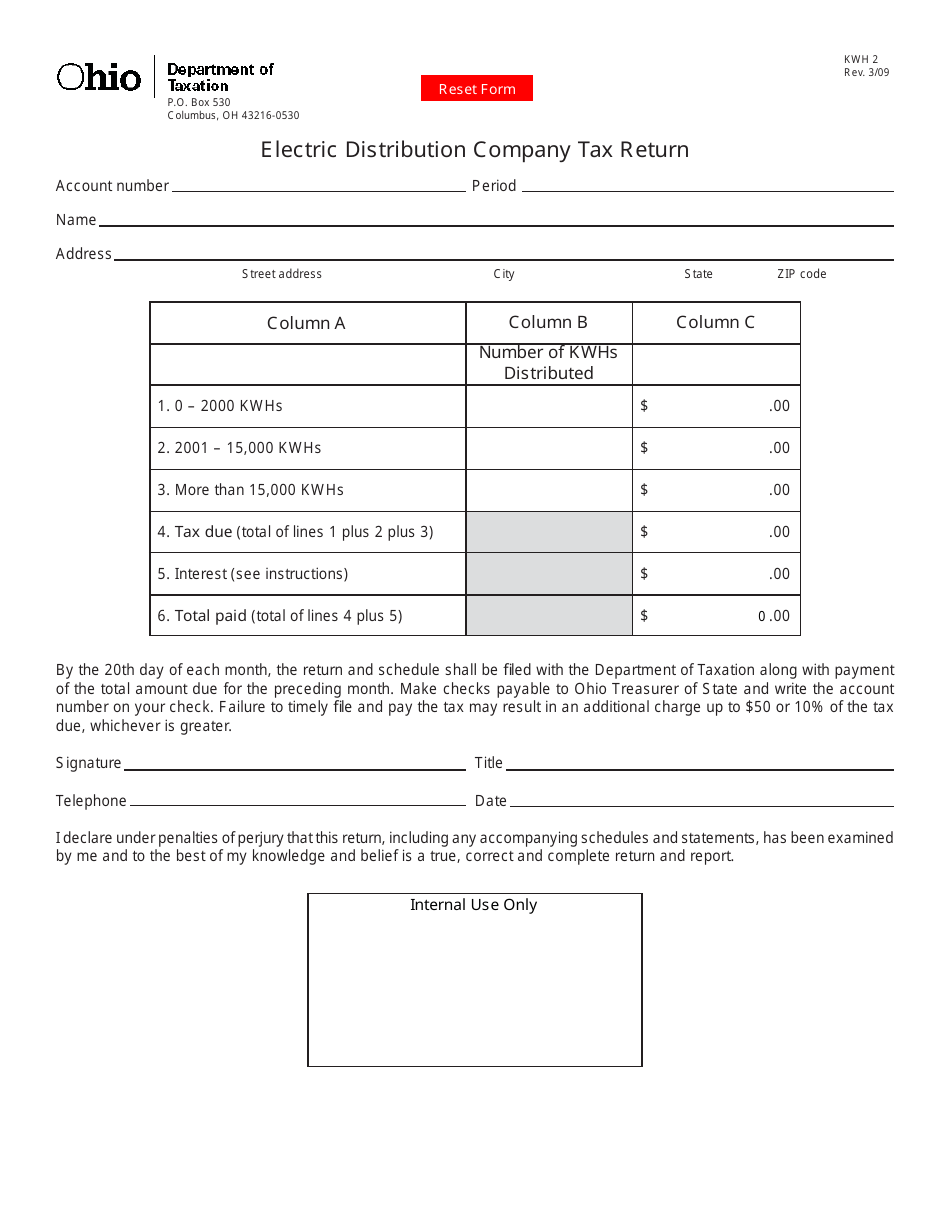

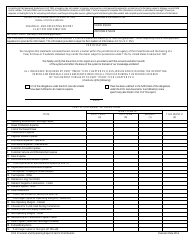

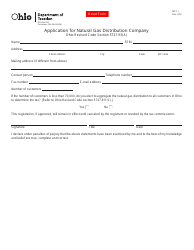

Form KWH2 Electric Distribution Company Tax Return - Ohio

What Is Form KWH2?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. Check the official instructions before completing and submitting the form.

FAQ

Q: Who needs to file the KWH2 Electric Distribution Company Tax Return?

A: Electric Distribution Companies in Ohio need to file the KWH2 Electric Distribution Company Tax Return.

Q: What is the purpose of the KWH2 Electric Distribution Company Tax Return?

A: The purpose of the KWH2 Electric Distribution Company Tax Return is to report and pay taxes related to electric distribution activities in Ohio.

Q: Are there any deadlines for filing the KWH2 Electric Distribution Company Tax Return?

A: Yes, the KWH2 Electric Distribution Company Tax Return must be filed annually by the specified due date. Please refer to the instructions on the form for the exact deadline.

Form Details:

- Released on February 1, 2009;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form KWH2 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.