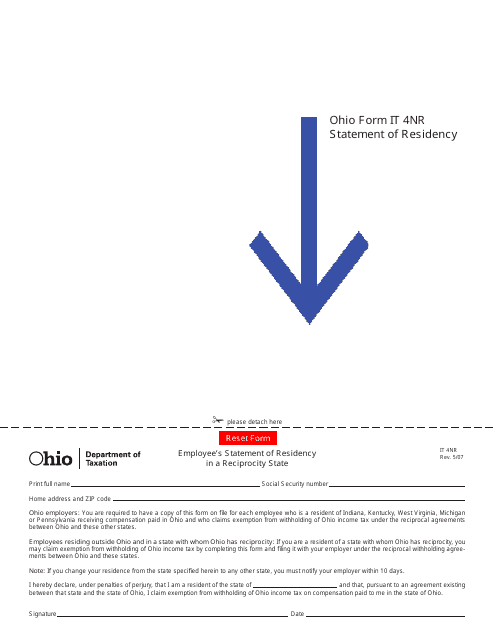

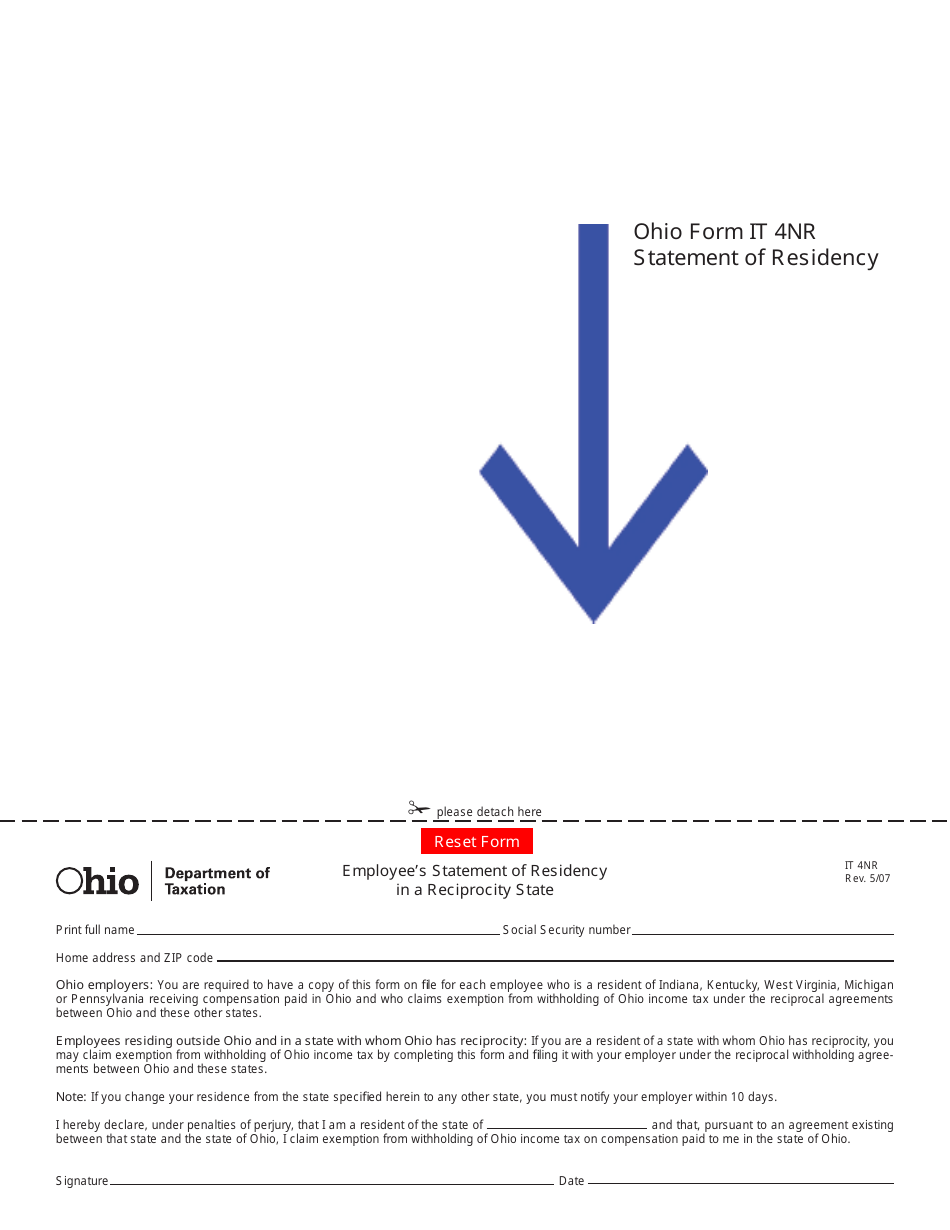

Form IT4NR Employee's Statement of Residency in a Reciprocity State - Ohio

What Is Form IT4NR?

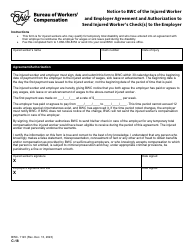

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT4NR?

A: Form IT4NR is the Employee's Statement of Residency in a Reciprocity State.

Q: What is the purpose of Form IT4NR?

A: The purpose of Form IT4NR is to indicate that the employee is a resident of Ohio and is subject to reciprocity with another state.

Q: Who needs to fill out Form IT4NR?

A: Form IT4NR needs to be filled out by employees who are residents of Ohio and work in another state that has a reciprocity agreement with Ohio.

Q: What is a reciprocity state?

A: A reciprocity state is a state that has an agreement with Ohio allowing residents of one state to pay income taxes to their home state only, even if they work in the other state.

Q: Are there any other requirements for filing Form IT4NR?

A: Yes, the employee must have already filed a tax return with Ohio and obtained a letter of good standing from the Ohio Department of Taxation.

Q: When should Form IT4NR be filed?

A: Form IT4NR should be filed as soon as possible, ideally before you start working in the reciprocity state.

Q: What information is required on Form IT4NR?

A: Form IT4NR requires the employee's personal information, including name, social security number, address, and employment details.

Q: Do I need to attach any documents with Form IT4NR?

A: Yes, you must attach a letter of good standing from the Ohio Department of Taxation and a copy of your most recent tax return.

Q: Will filing Form IT4NR exempt me from paying income taxes in the reciprocity state?

A: Yes, if you qualify for reciprocity, filing Form IT4NR will exempt you from paying income taxes in the reciprocity state.

Q: Is Form IT4NR only for residents of Ohio who work in reciprocity states?

A: Yes, Form IT4NR is specifically for residents of Ohio who work in states that have a reciprocity agreement with Ohio.

Q: What is the deadline for filing Form IT4NR?

A: The deadline for filing Form IT4NR is usually the same as the deadline for filing your annual tax return, which is April 15th.

Form Details:

- Released on May 1, 2007;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT4NR by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.