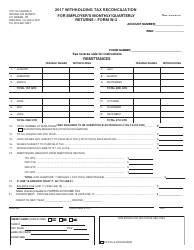

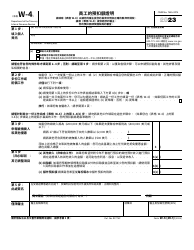

This version of the form is not currently in use and is provided for reference only. Download this version of

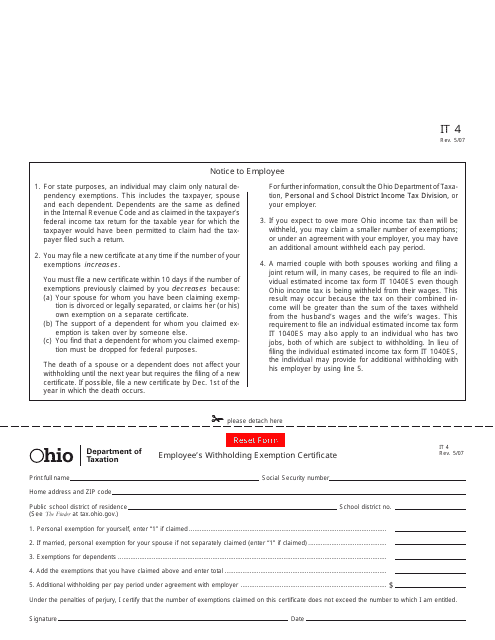

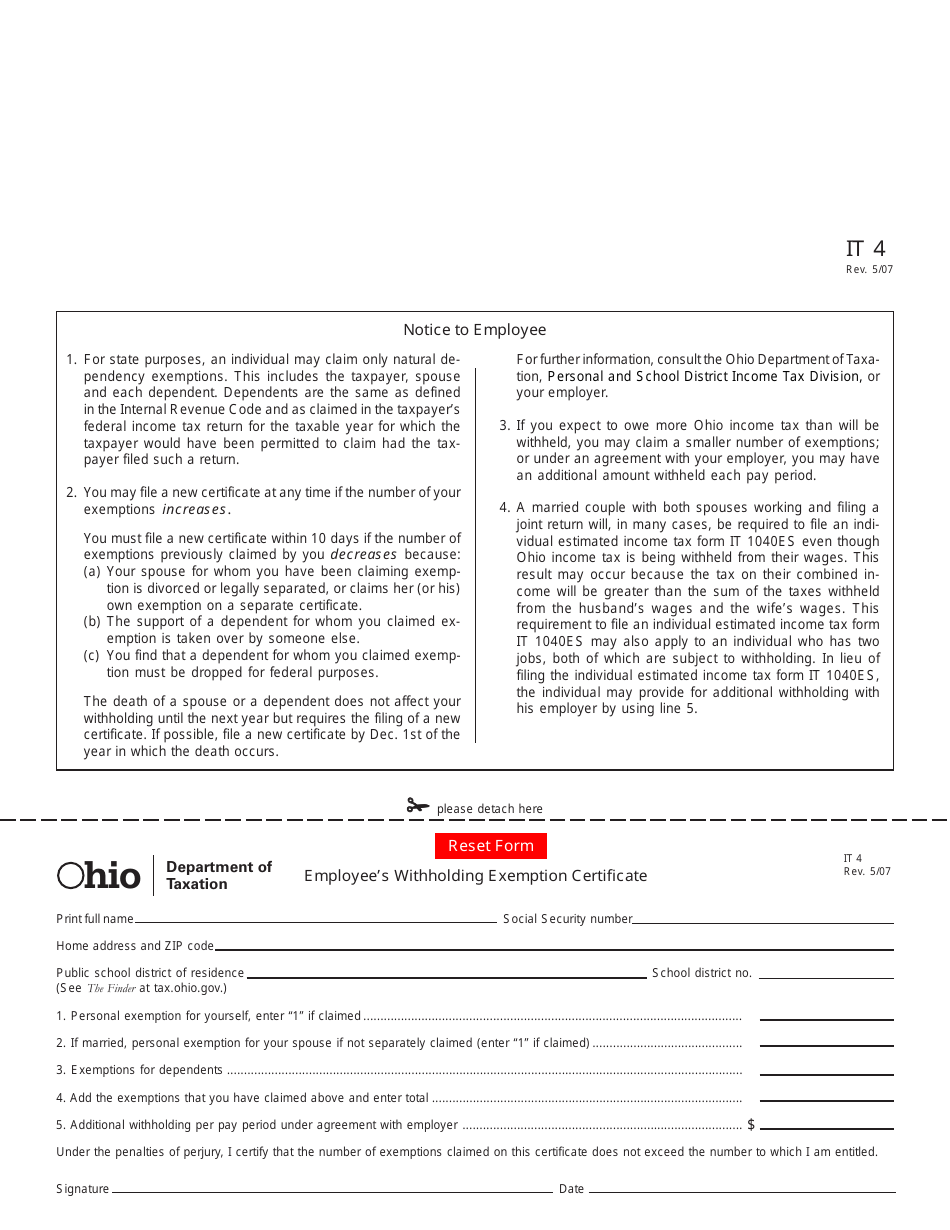

Form IT4

for the current year.

Form IT4 Employee's Withholding Exemption Certificate - Ohio

What Is Form IT4?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

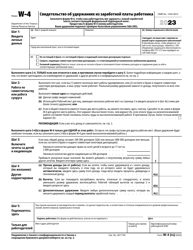

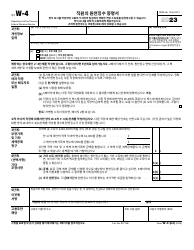

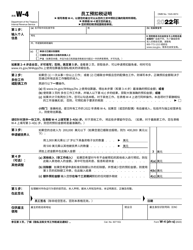

Q: What is Form IT4?

A: Form IT4 is the Employee's Withholding Exemption Certificate used in Ohio.

Q: Who needs to fill out Form IT4?

A: Employees in Ohio who want to claim exempt status from withholding taxes need to fill out Form IT4.

Q: What is the purpose of Form IT4?

A: Form IT4 is used to determine the amount of income tax that should be withheld from an employee's paycheck.

Q: Is Form IT4 specific to Ohio?

A: Yes, Form IT4 is specific to Ohio and is not used in other states.

Q: What information do I need to provide on Form IT4?

A: You will need to provide your personal information, including your name, Social Security number, and address. You will also need to indicate your filing status and any exemptions you are claiming.

Q: Can I claim exempt status on Form IT4?

A: Yes, if you meet certain criteria, you can claim exempt status on Form IT4 and have no income tax withheld from your paycheck.

Q: When do I need to submit Form IT4?

A: You should submit Form IT4 to your employer as soon as possible, preferably before you start working.

Q: Do I need to submit a new Form IT4 every year?

A: No, you do not need to submit a new Form IT4 every year. However, if your tax situation changes, you may need to update your Form IT4 and submit a new one to your employer.

Q: What happens if I don't submit Form IT4?

A: If you do not submit Form IT4, your employer will withhold taxes from your paycheck based on the default withholding rates.

Q: Can I change my withholding status after submitting Form IT4?

A: Yes, you can change your withholding status by submitting a new Form IT4 to your employer.

Q: Is there a deadline to submit Form IT4?

A: There is no specific deadline to submit Form IT4, but it is recommended to submit it as soon as possible.

Form Details:

- Released on May 1, 2007;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT4 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.