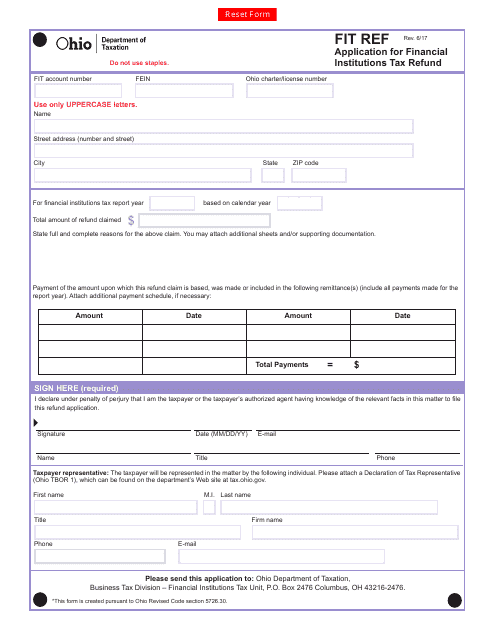

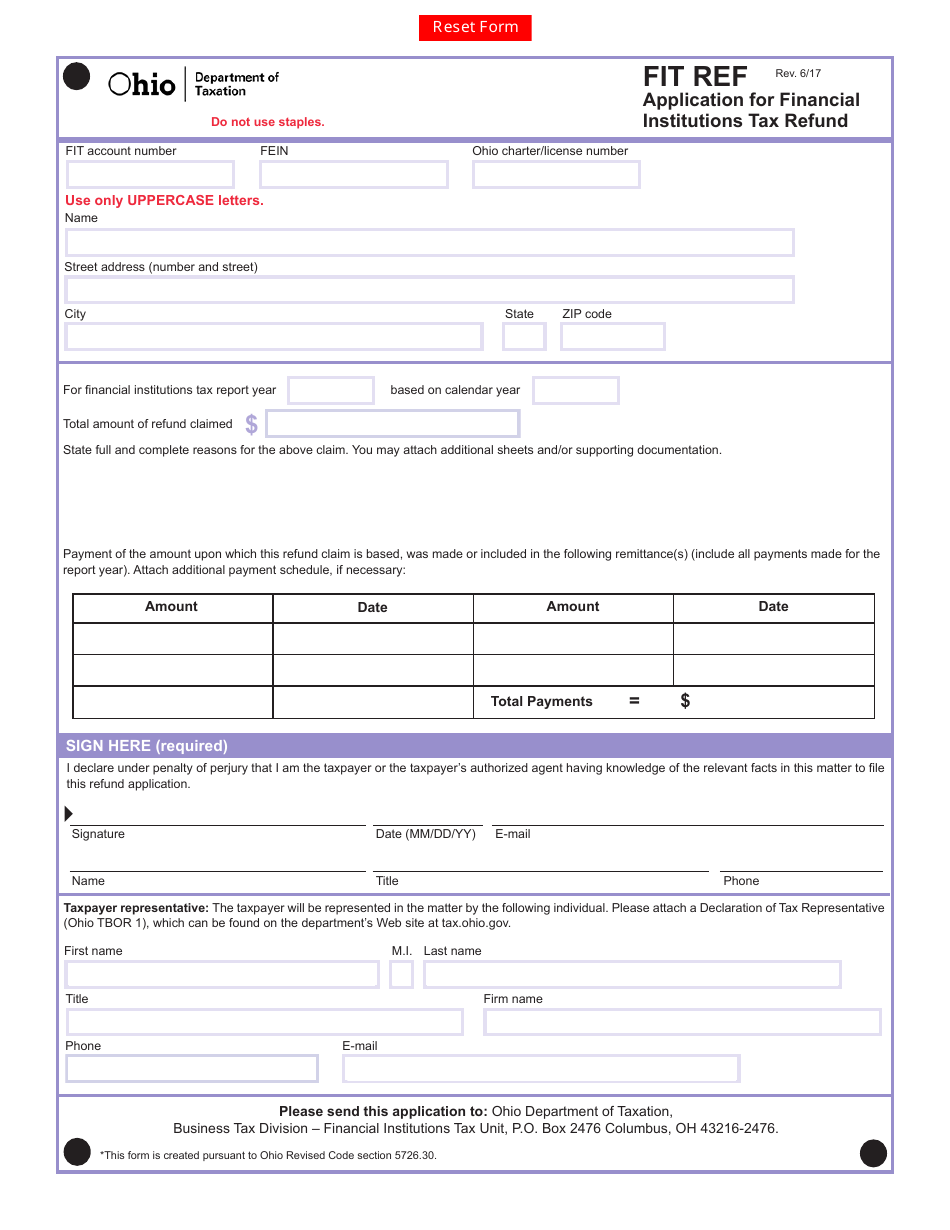

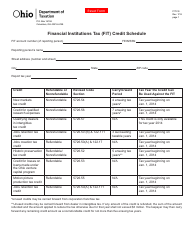

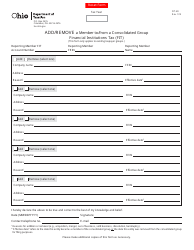

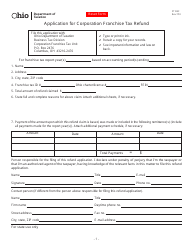

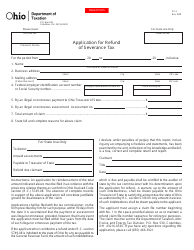

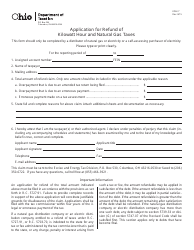

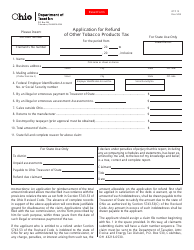

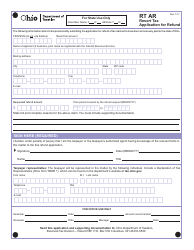

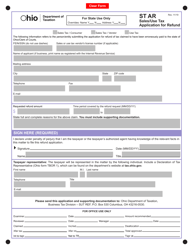

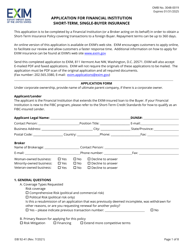

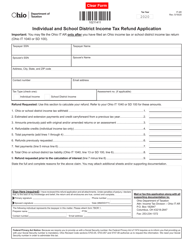

Form FIT REF Application for Financial Institutions Tax Refund - Ohio

What Is Form FIT REF?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form FIT REF?

A: The Form FIT REF is an application for Financial Institutions Tax Refund in Ohio.

Q: Who can apply for the Form FIT REF?

A: Financial institutions in Ohio can apply for the Form FIT REF.

Q: What is the purpose of the Form FIT REF?

A: The purpose of the Form FIT REF is to request a refund of taxes paid by financial institutions in Ohio.

Q: Is there a deadline for submitting the Form FIT REF?

A: Yes, the Form FIT REF must be submitted by the due date specified by the Ohio Department of Taxation.

Q: What documentation is required to accompany the Form FIT REF?

A: The specific documentation requirements are outlined in the instructions accompanying the Form FIT REF.

Q: How long does it take to process the Form FIT REF?

A: The processing time for the Form FIT REF can vary, but you can expect to receive a response within a few weeks.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIT REF by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.