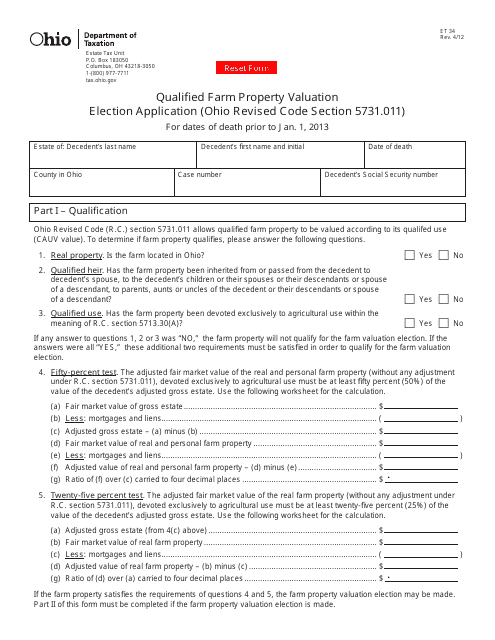

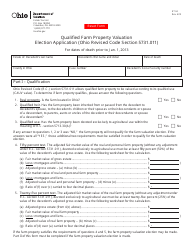

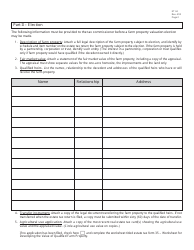

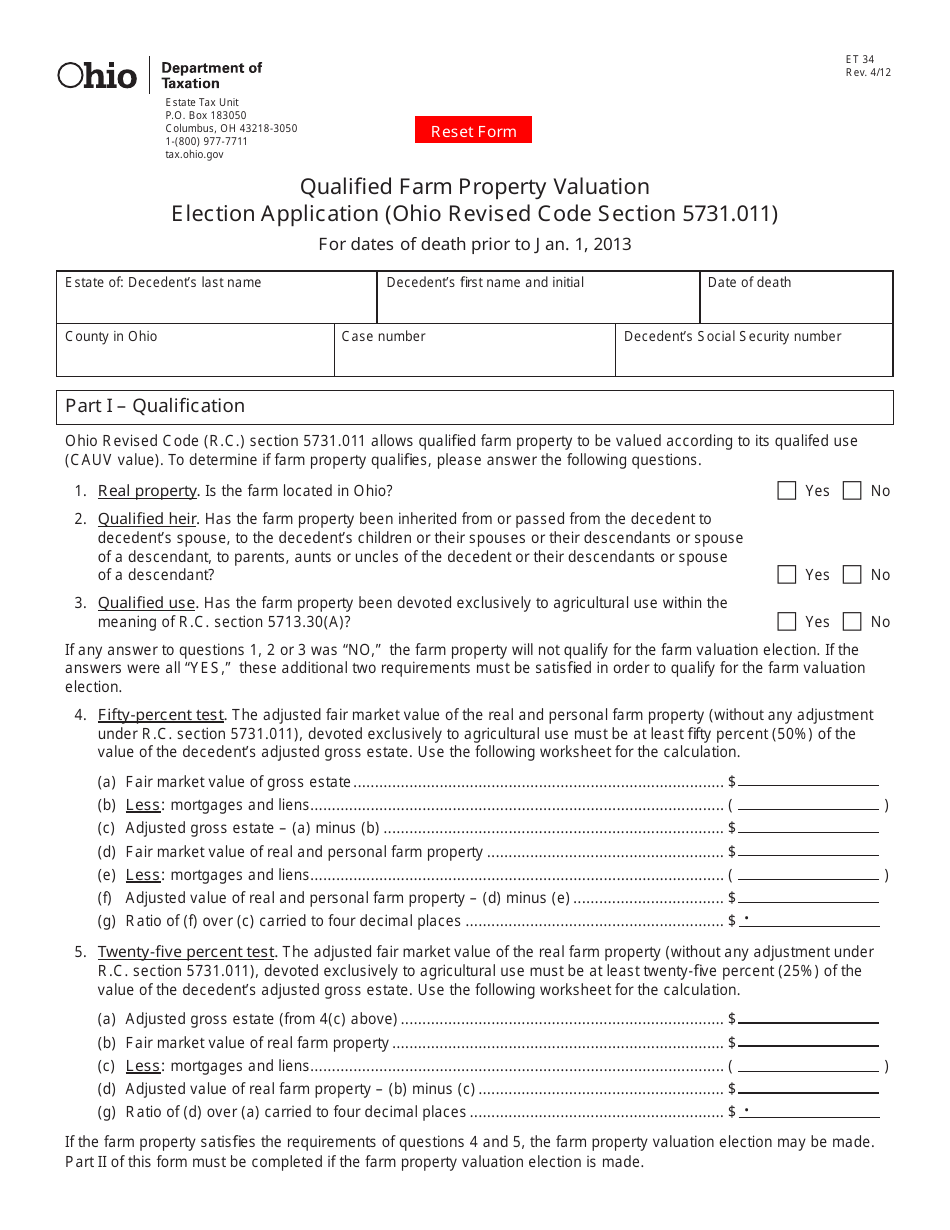

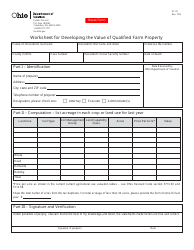

Form ET34 Qualified Farm Property Valuation Election Application - Ohio

What Is Form ET34?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET34?

A: Form ET34 is an application used in Ohio for making a Qualified Farm Property Valuation Election.

Q: What is a Qualified Farm Property Valuation Election?

A: A Qualified Farm Property Valuation Election allows qualifying agricultural property in Ohio to be assessed at a lower value for property tax purposes.

Q: Who is eligible to make a Qualified Farm Property Valuation Election?

A: Owners of agricultural property in Ohio that meets certain criteria are eligible to make this election.

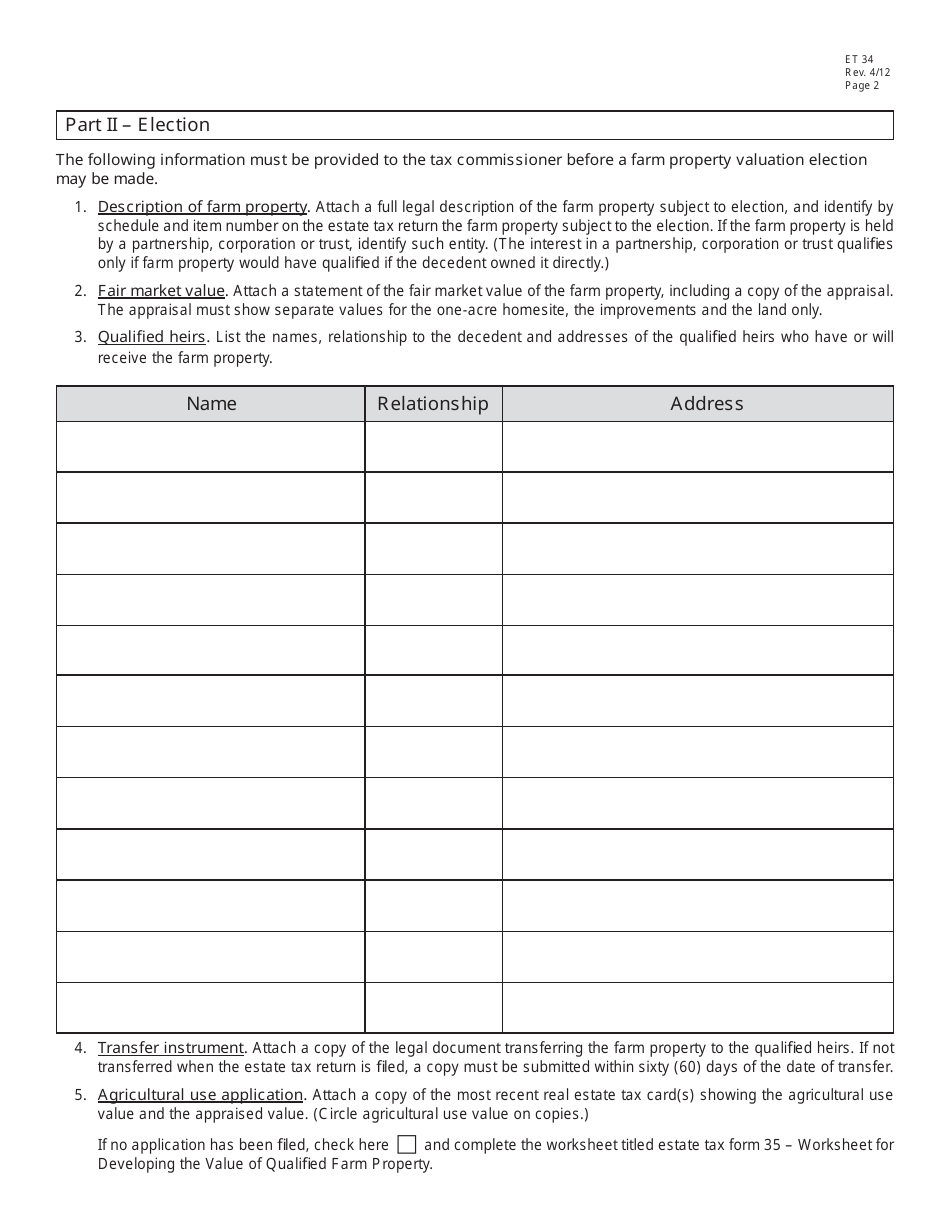

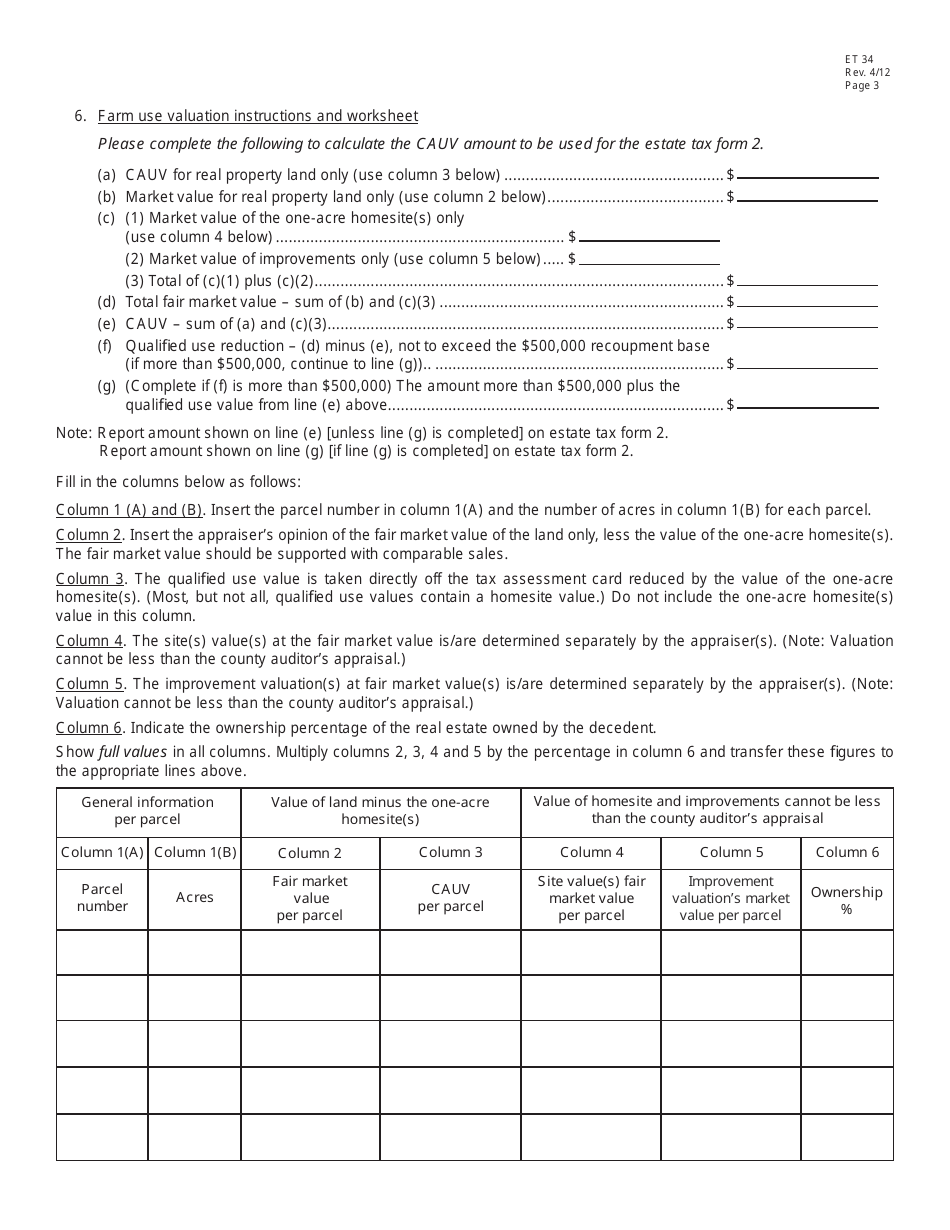

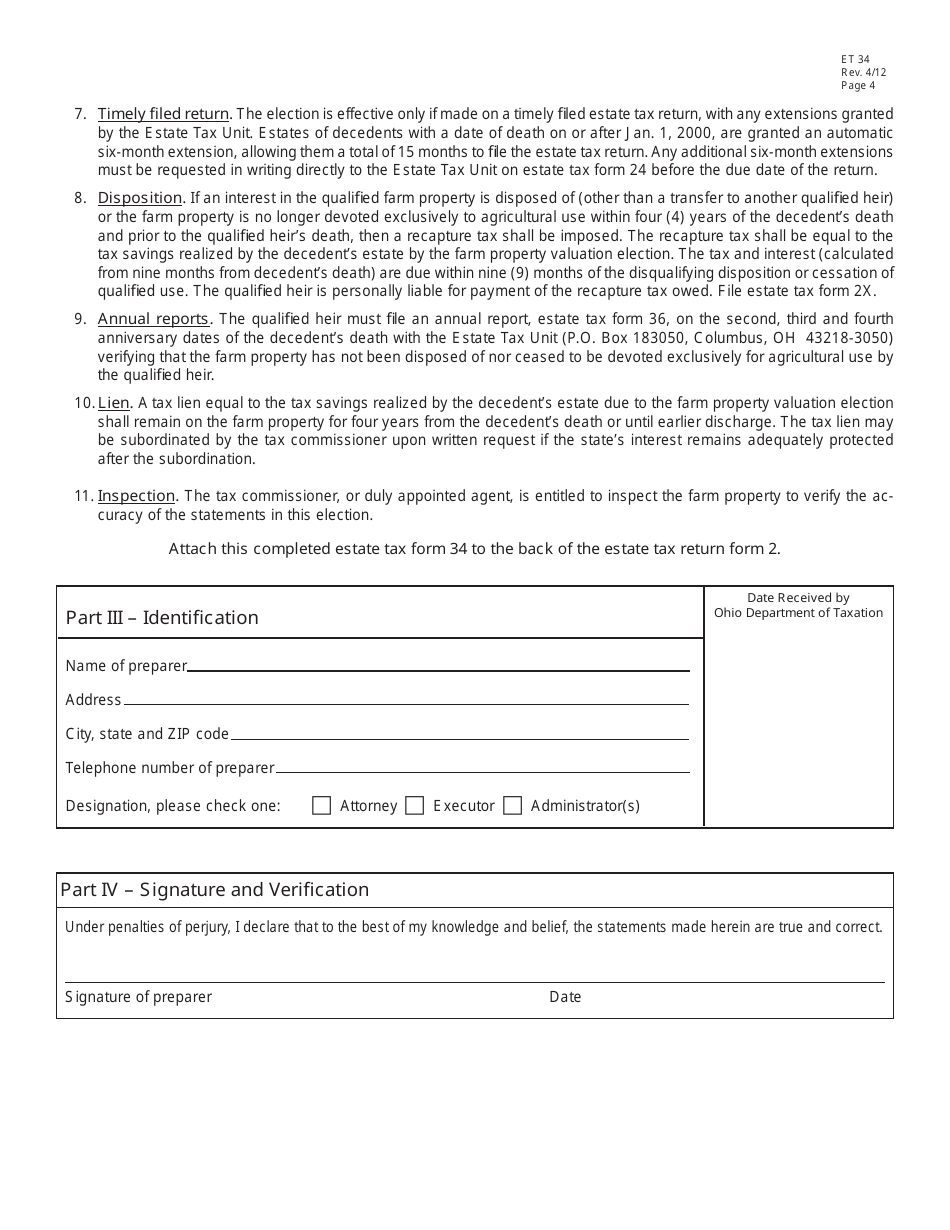

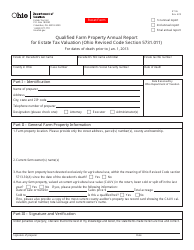

Q: What information is required on Form ET34?

A: Form ET34 requires information about the property, the farm operation, the owner, and other details to qualify for the election.

Q: When should Form ET34 be filed?

A: Form ET34 should be filed with the county auditor's office by the first Monday in March of the year for which the election is desired.

Q: Are there any fees for filing Form ET34?

A: Yes, there is a filing fee associated with Form ET34 that varies by county. Contact your local county auditor's office for the specific fee.

Q: What are the benefits of making a Qualified Farm Property Valuation Election?

A: The benefits include lower property taxes for qualifying agricultural property, which can help reduce the financial burden on farmers.

Form Details:

- Released on April 1, 2012;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET34 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.