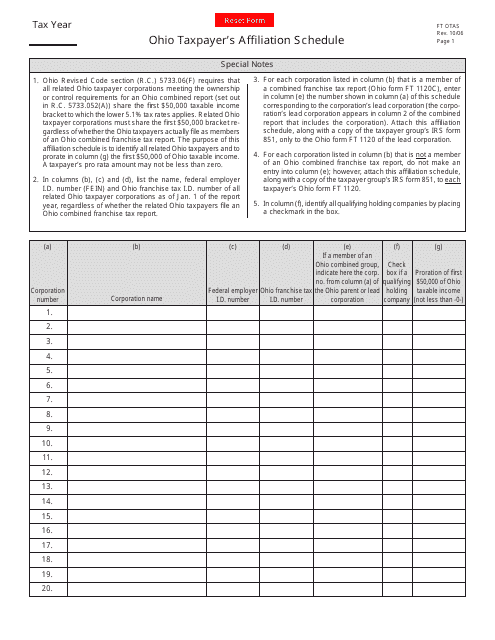

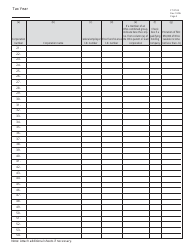

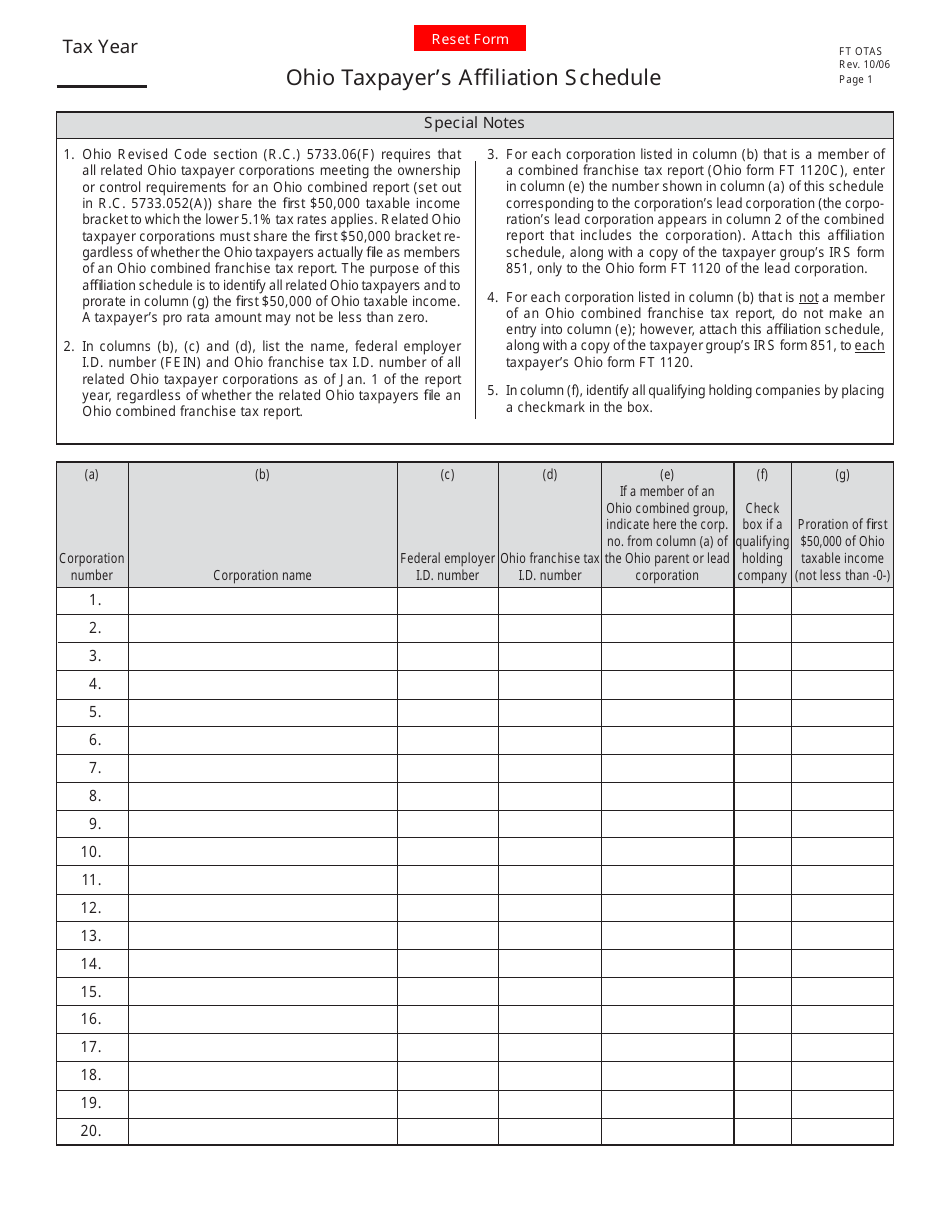

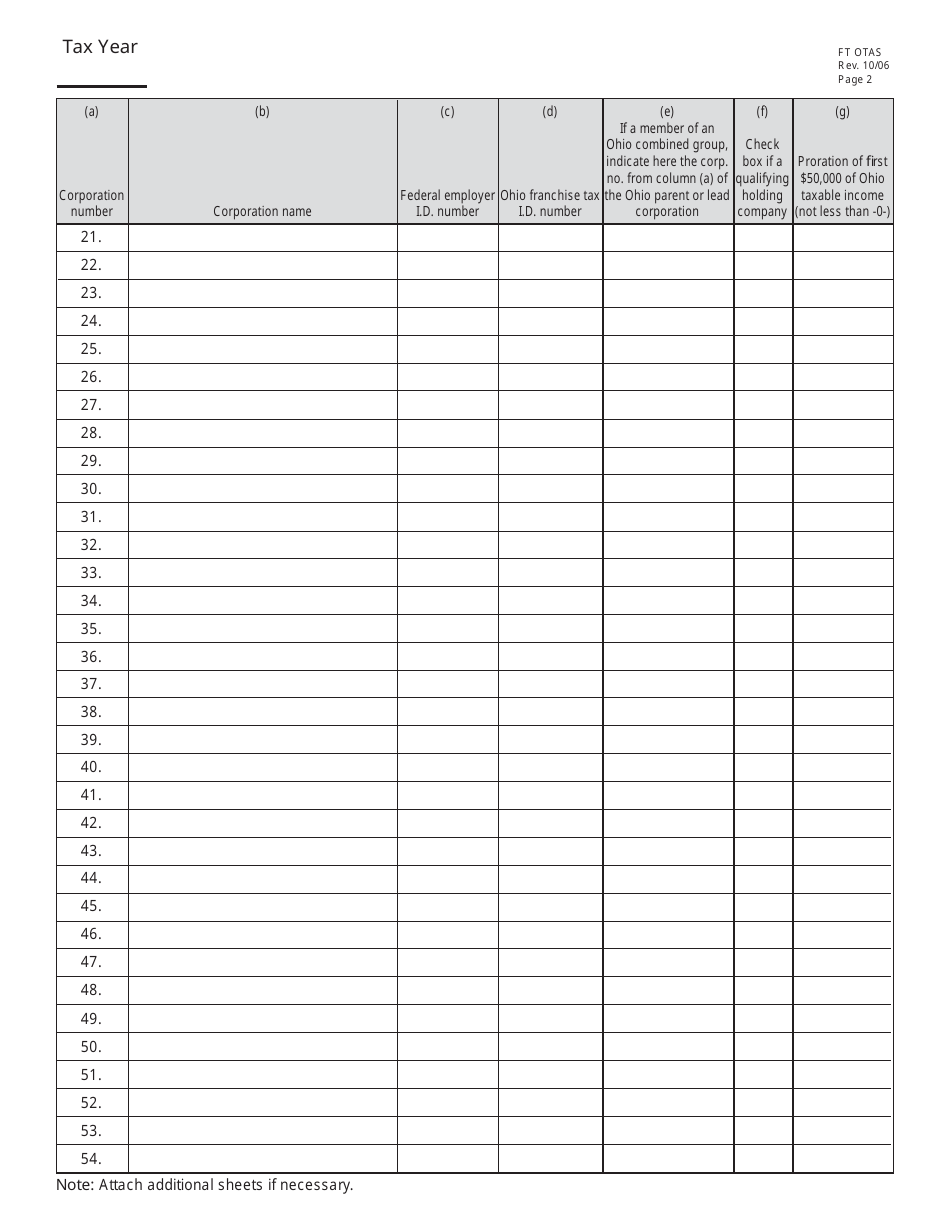

Form FT OTAS Ohio Taxpayer's Affiliation Schedule - Ohio

What Is Form FT OTAS?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the FT OTAS Ohio Taxpayer's Affiliation Schedule?

A: The FT OTAS Ohio Taxpayer's Affiliation Schedule is a form used by Ohio taxpayers to report their business affiliations.

Q: Who needs to file the FT OTAS Ohio Taxpayer's Affiliation Schedule?

A: Ohio taxpayers who have business affiliations that need to be reported must file this form.

Q: What information is required on the FT OTAS Ohio Taxpayer's Affiliation Schedule?

A: The form requires information about the taxpayer's business affiliations, including the name and address of the affiliate and the percentage of ownership.

Q: When is the deadline for filing the FT OTAS Ohio Taxpayer's Affiliation Schedule?

A: The deadline for filing the form is the same as the deadline for filing your Ohio income tax return, usually April 15th.

Q: What happens if I don't file the FT OTAS Ohio Taxpayer's Affiliation Schedule?

A: Failure to file the form or providing incomplete or inaccurate information may result in penalties and interest charges.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT OTAS by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.