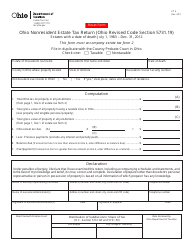

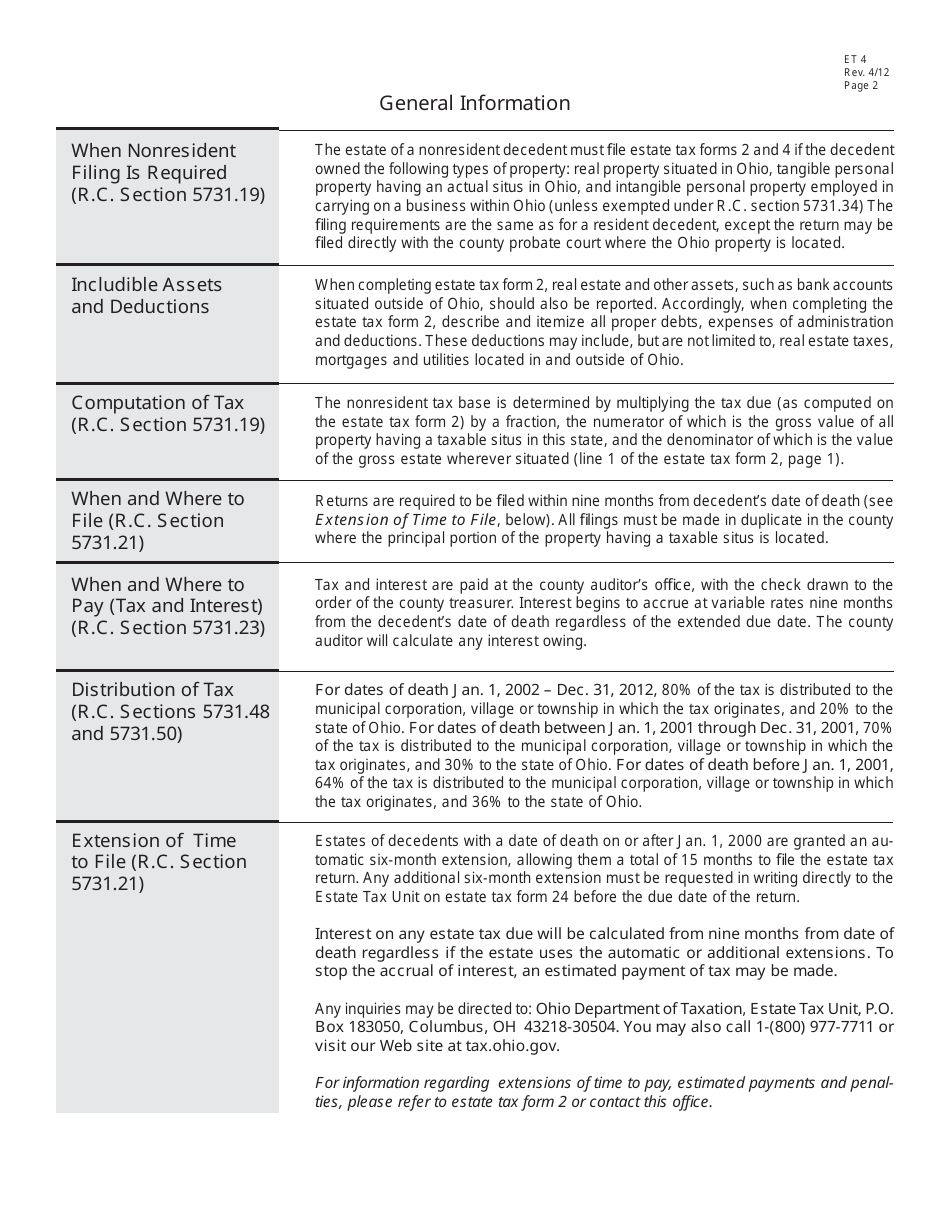

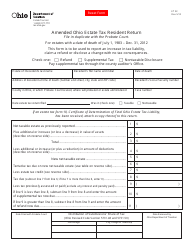

Form ET4 Ohio Nonresident Estate Tax Return - Estates With a Date of Death July 1, 1983 - Dec. 31, 2012 - Ohio

What Is Form ET4?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET4?

A: Form ET4 is the Ohio Nonresident Estate Tax Return.

Q: Which estates are eligible to file Form ET4?

A: Estates with a date of death ranging from July 1, 1983, to December 31, 2012, in Ohio.

Q: What is the purpose of Form ET4?

A: The purpose of Form ET4 is to report and pay the Ohio estate tax for nonresident estates with the specified date of death.

Q: What is the filing period for Form ET4?

A: The filing period for Form ET4 is for estates with a date of death between July 1, 1983, and December 31, 2012.

Form Details:

- Released on April 1, 2012;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET4 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.