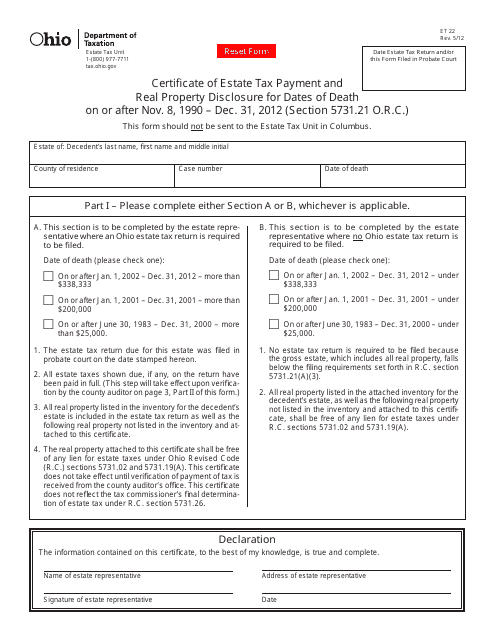

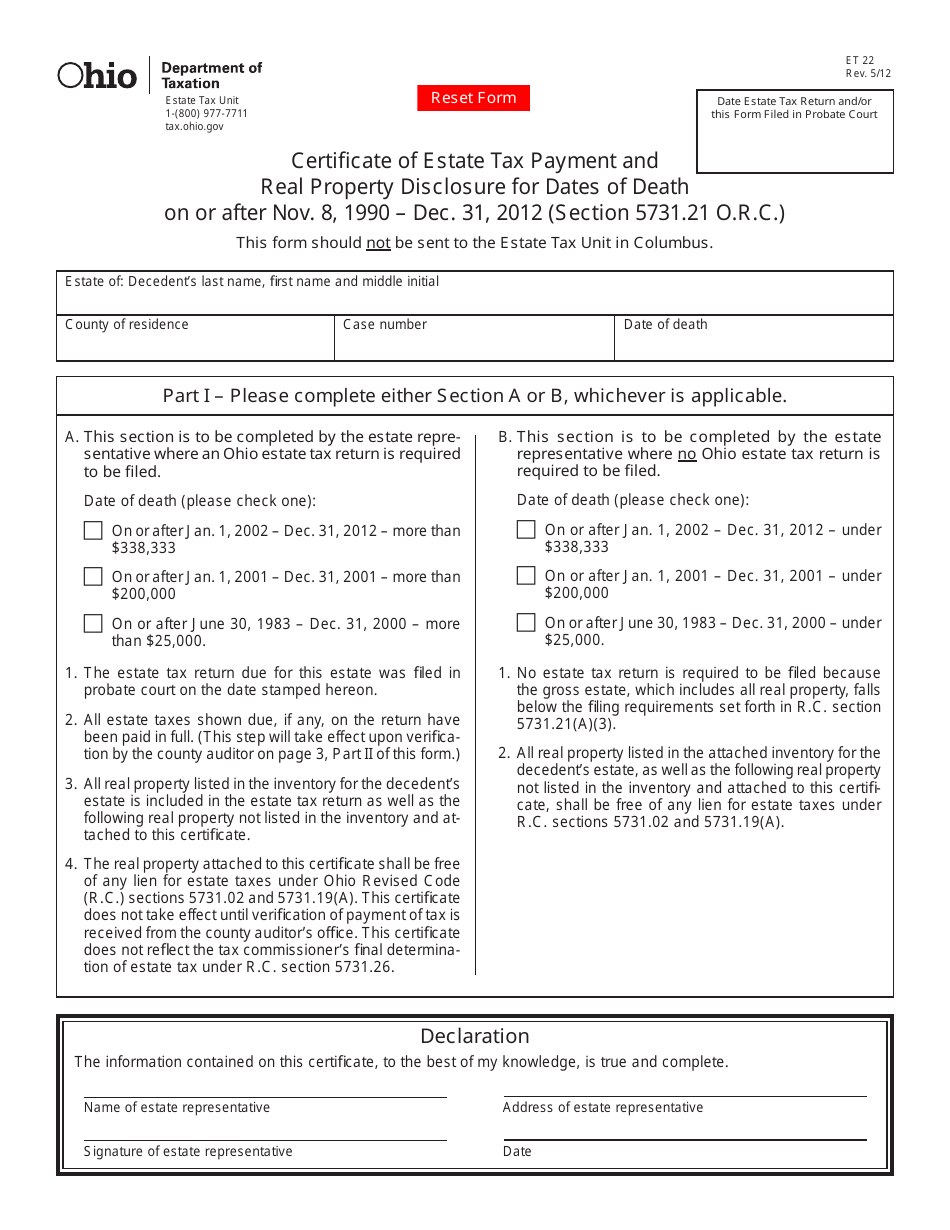

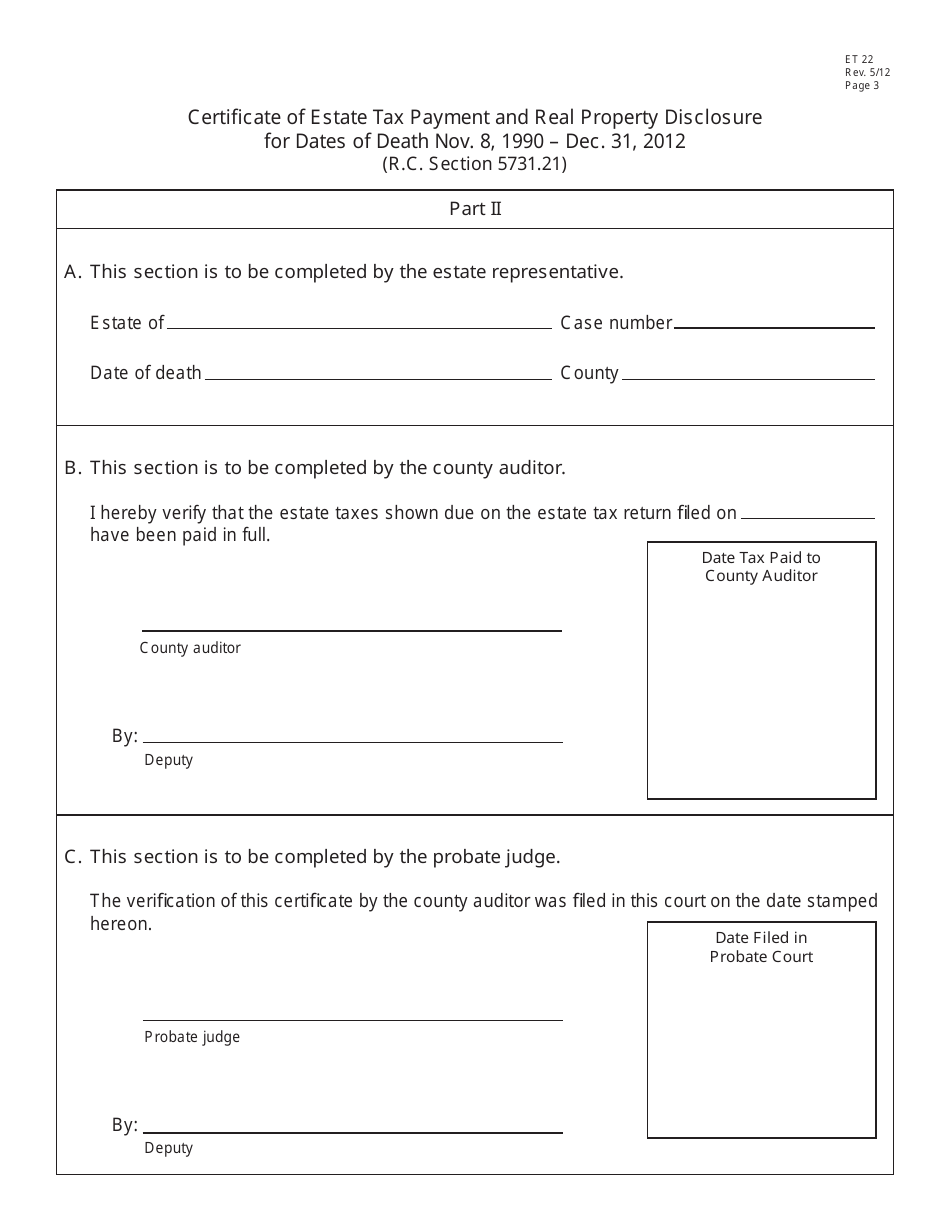

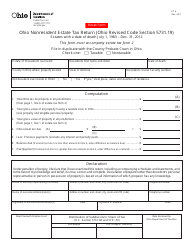

Form ET22 Certificate of Estate Tax Payment and Real Property Disclosure for Dates of Death on or After Nov. 8, 1990 - Ohio

What Is Form ET22?

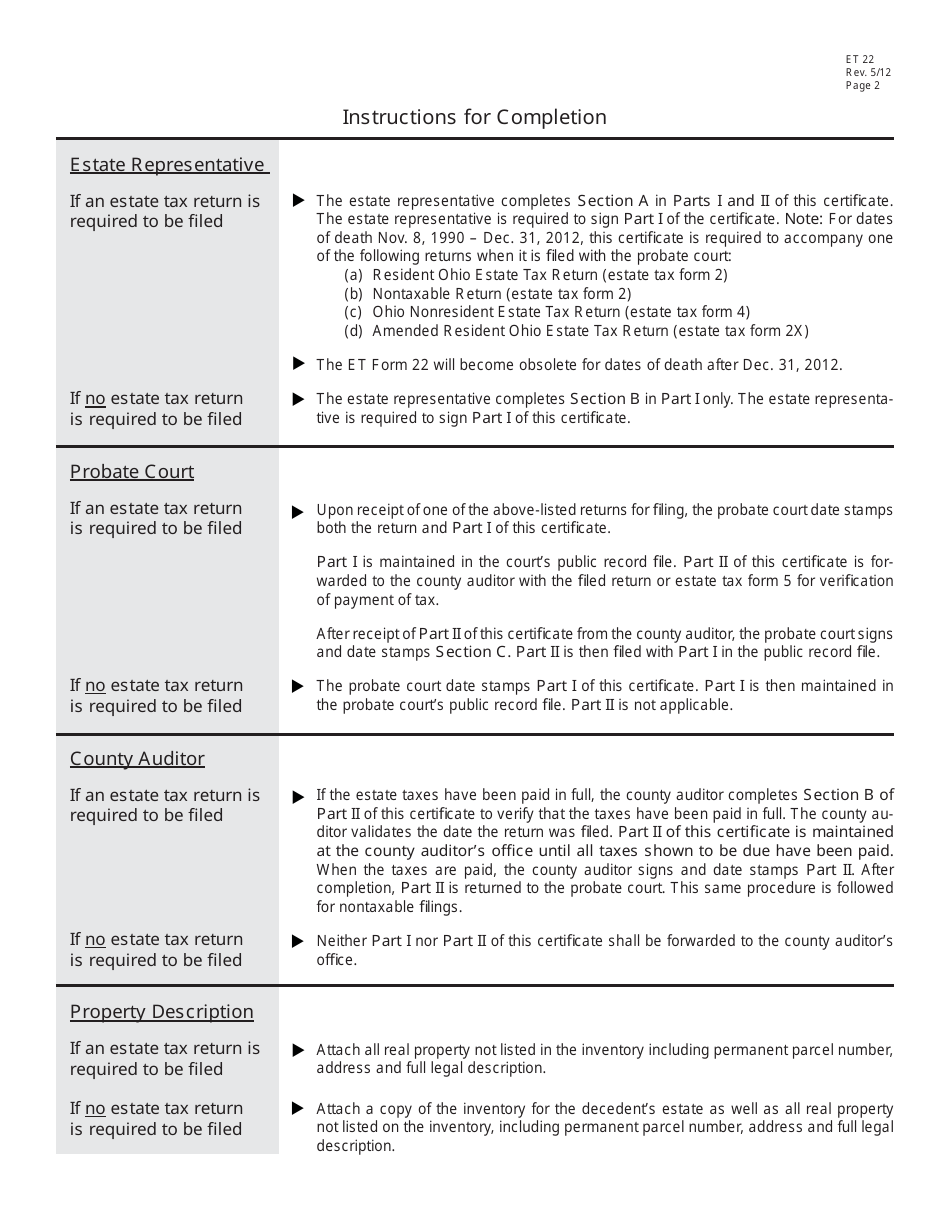

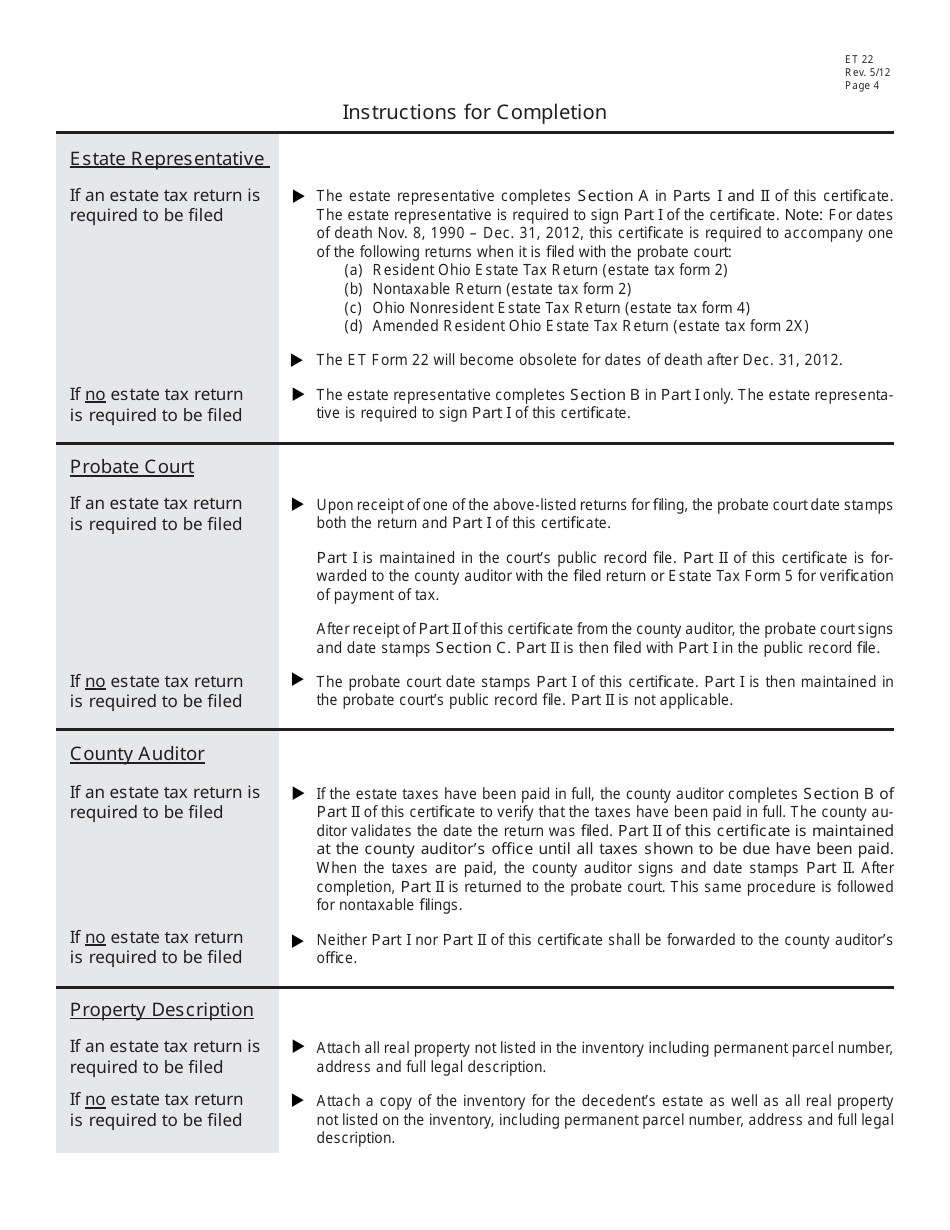

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET22?

A: Form ET22 is the Certificate of Estate Tax Payment and Real Property Disclosure form for Dates of Death on or After Nov. 8, 1990 in Ohio.

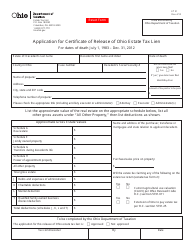

Q: When is Form ET22 used?

A: Form ET22 is used when reporting the payment of estate taxes and disclosing real property information for individuals who passed away on or after November 8, 1990 in Ohio.

Q: What information is required on Form ET22?

A: Form ET22 requires information about the deceased individual, the estate tax payment, and details about real property owned by the decedent in Ohio.

Q: Are there any deadlines for filing Form ET22?

A: Yes, Form ET22 must be filed within nine months of the individual's date of death or the due date of the estate tax return, whichever is later.

Form Details:

- Released on May 1, 2012;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET22 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.