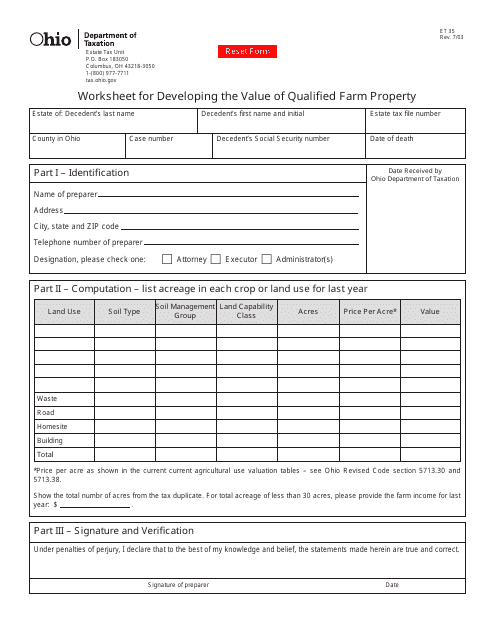

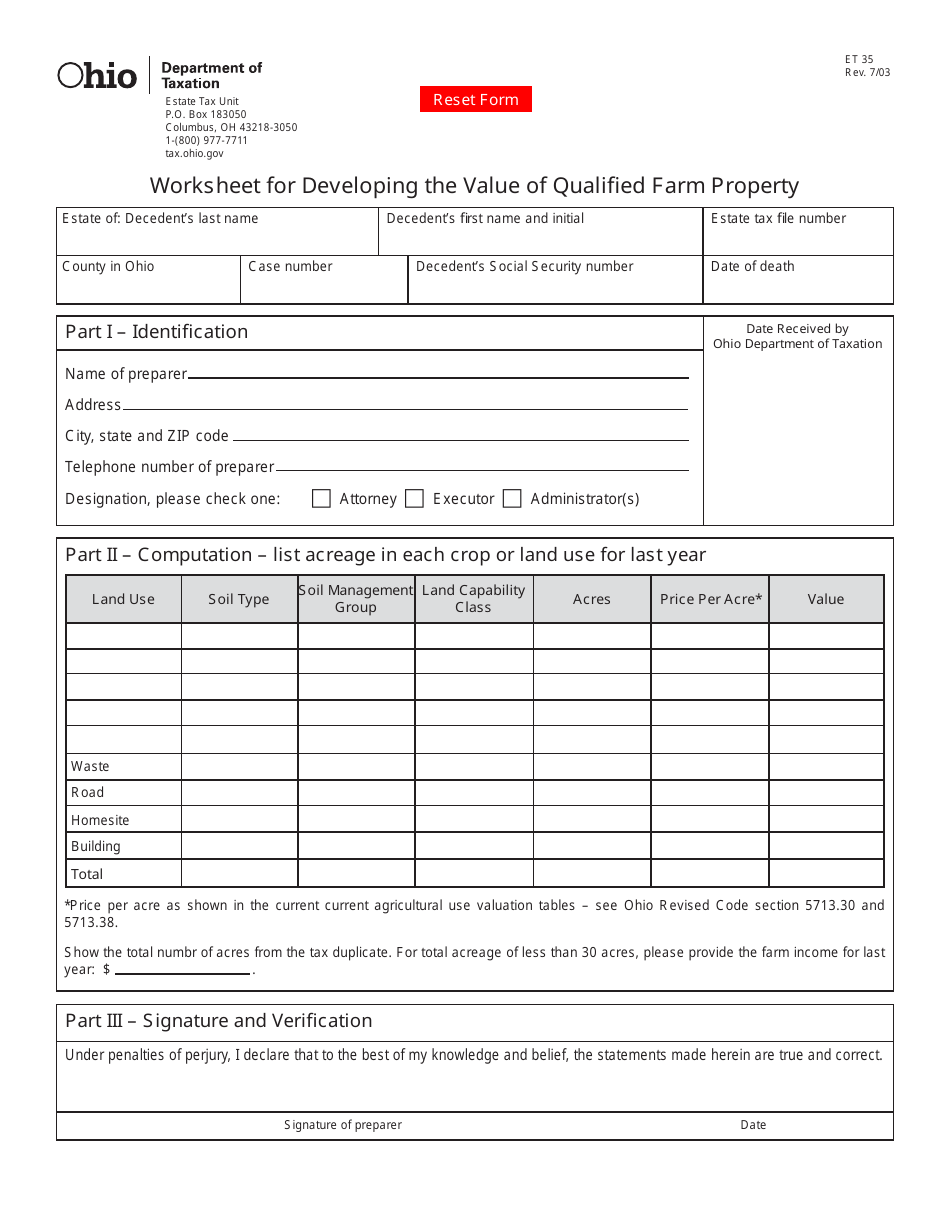

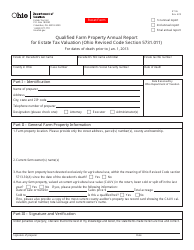

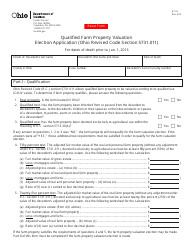

Form ET35 Worksheet for Developing the Value of Qualified Farm Property - Ohio

What Is Form ET35?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET35?

A: Form ET35 is a worksheet used for developing the value of qualified farm property in Ohio.

Q: What is qualified farm property?

A: Qualified farm property refers to agricultural lands, farm structures, and equipment used for farming activities.

Q: Who should use Form ET35?

A: Farm owners in Ohio who want to assess the value of their qualified farm property should use Form ET35.

Q: What is the purpose of Form ET35?

A: The purpose of Form ET35 is to calculate the value of qualified farm property for property tax assessment purposes.

Form Details:

- Released on July 1, 2003;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET35 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.