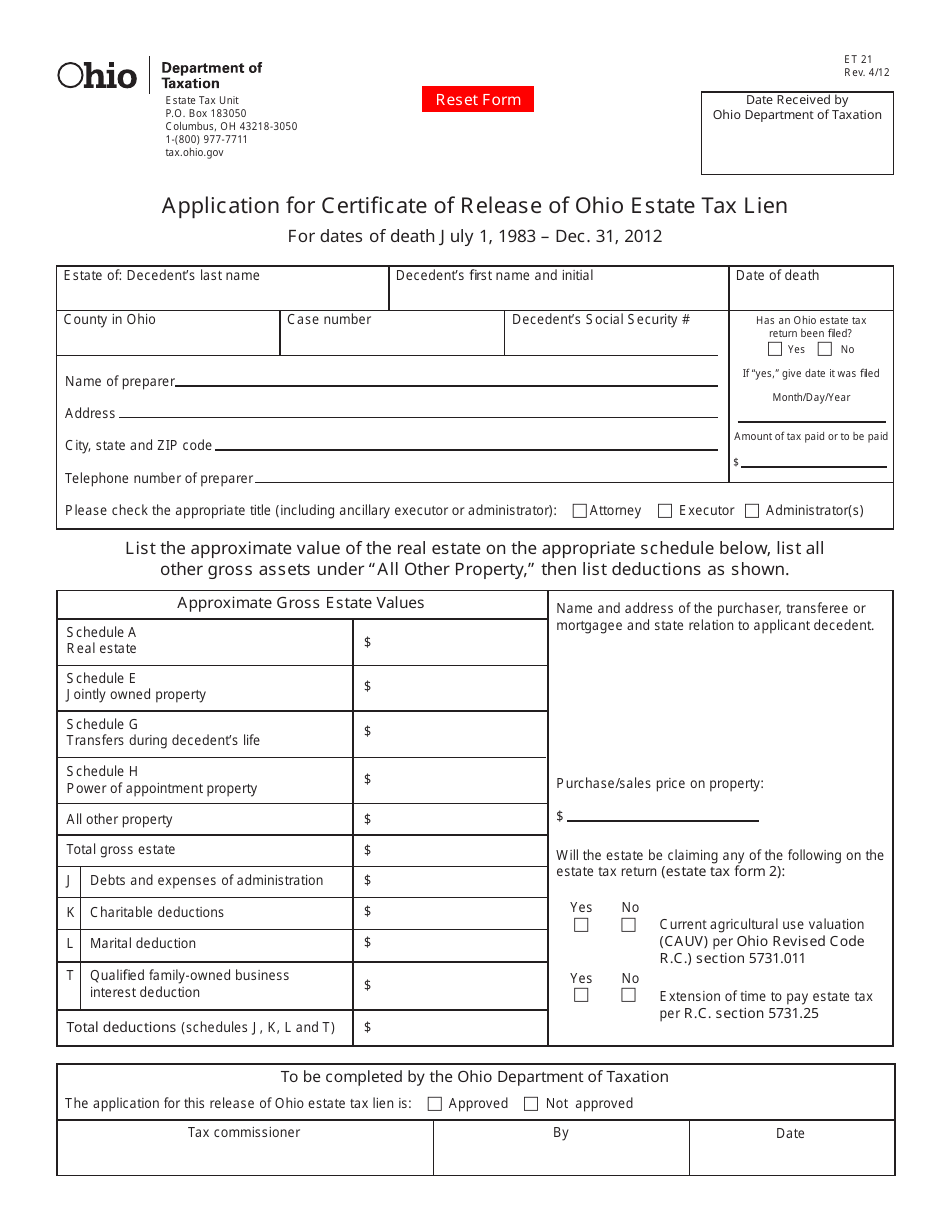

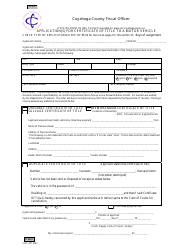

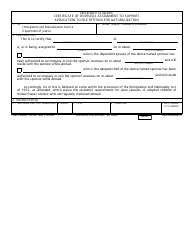

Form ET21 Application for Certificate of Release of Ohio Estate Tax Lien - Ohio

What Is Form ET21?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET21?

A: Form ET21 is the application for Certificate of Release of Ohio Estate Tax Lien in Ohio.

Q: What is the purpose of Form ET21?

A: The purpose of Form ET21 is to apply for the release of a lien on an estate for Ohio Estate Tax.

Q: Who needs to fill out Form ET21?

A: Form ET21 needs to be filled out by the executor or administrator of an estate that has a tax lien in Ohio.

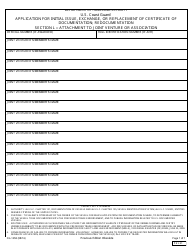

Q: What information is required on Form ET21?

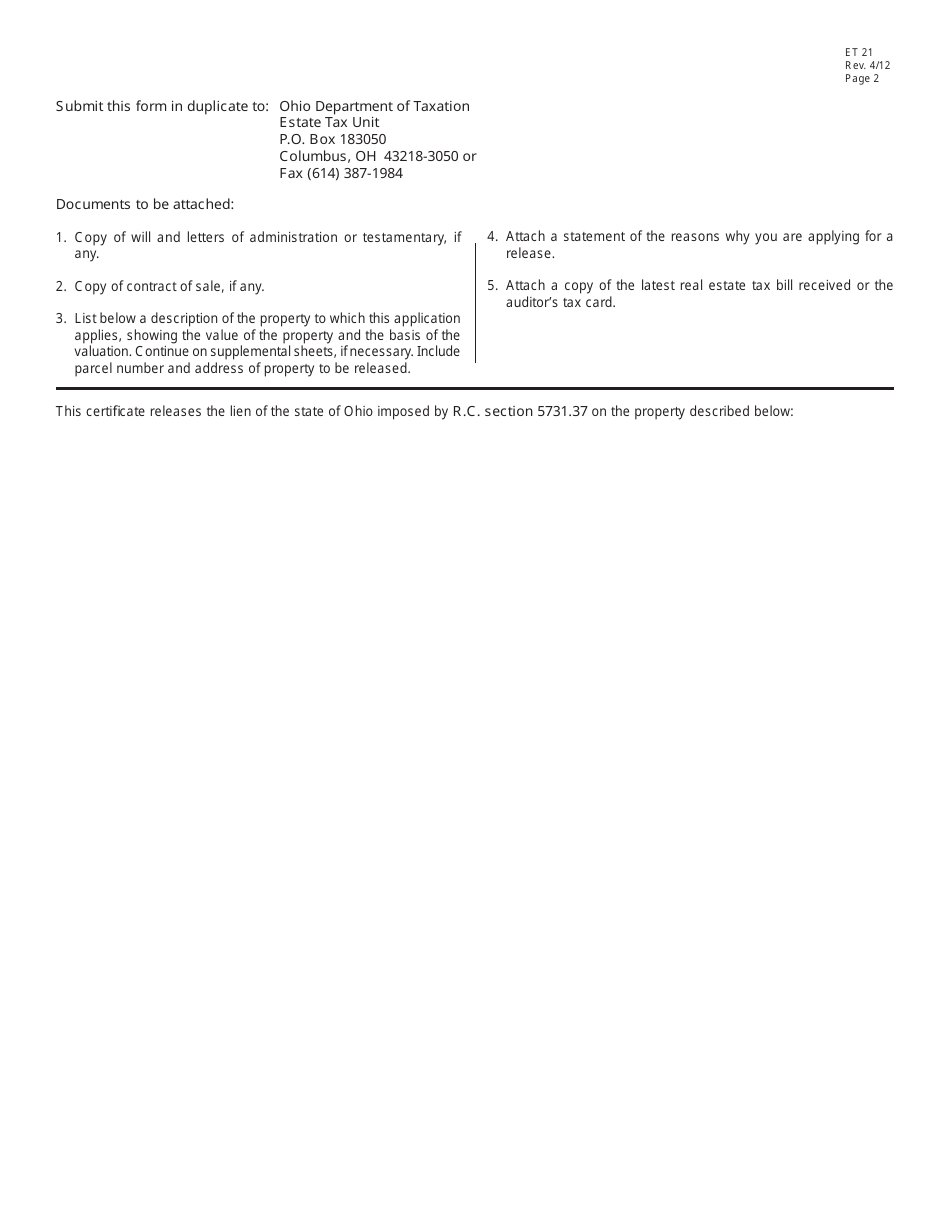

A: Form ET21 requires information about the estate, the lien, and the applicant.

Q: What happens after I submit Form ET21?

A: After submitting Form ET21, the Ohio Department of Taxation will review the application and release the lien if all requirements are met.

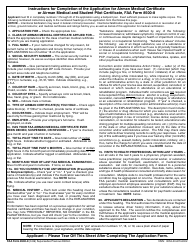

Q: Is there a deadline for filing Form ET21?

A: Yes, Form ET21 should be filed within three years from the date of the estate tax return or the date of payment, whichever is later.

Q: Can I file Form ET21 electronically?

A: No, Form ET21 cannot be filed electronically and must be submitted by mail.

Form Details:

- Released on April 1, 2012;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET21 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.