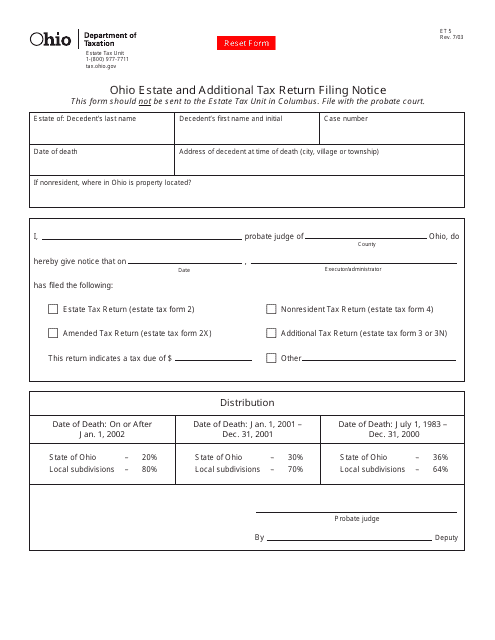

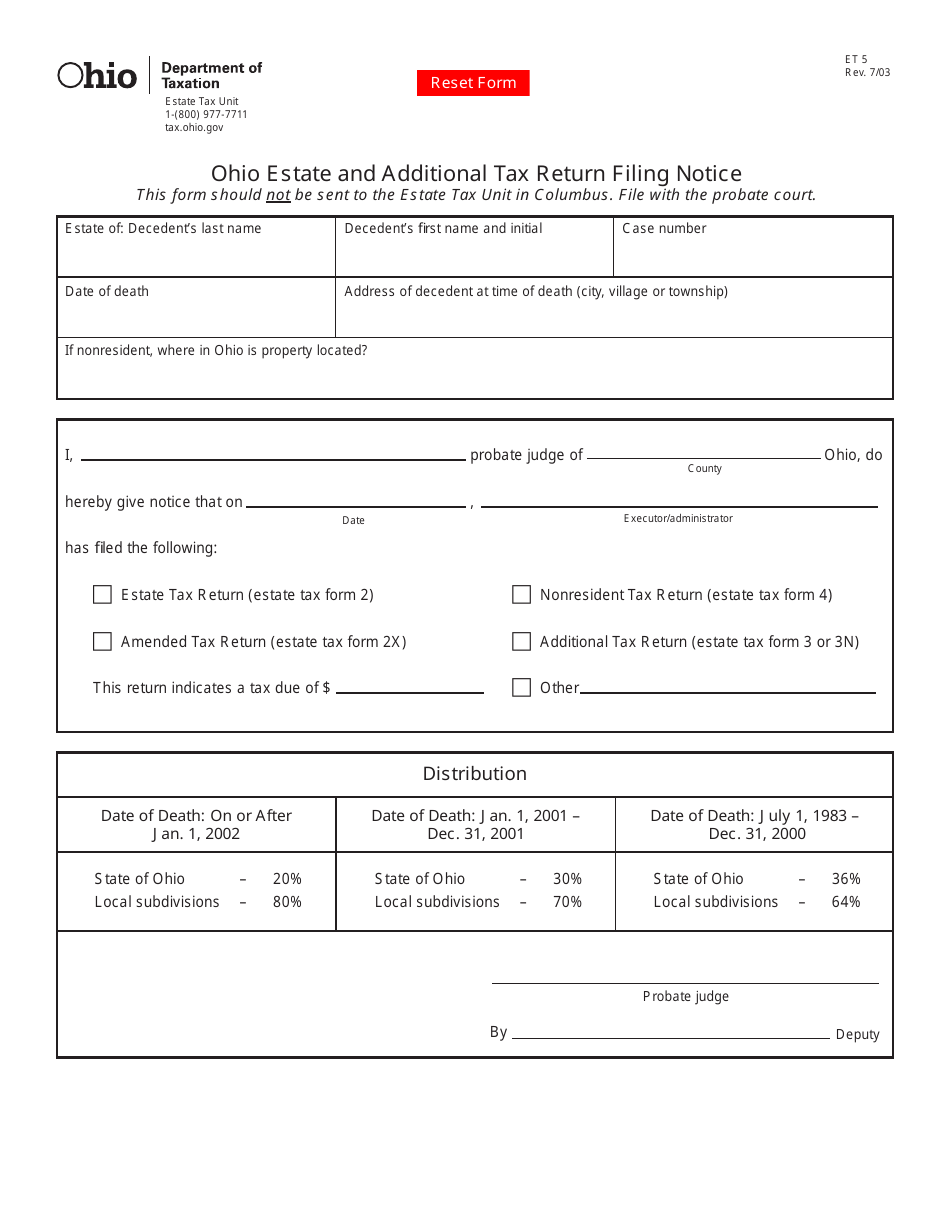

Form ET5 Ohio Estate and Additional Tax Return Filing Notice - Ohio

What Is Form ET5?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET5?

A: Form ET5 is the Ohio Estate and Additional Tax Return Filing Notice.

Q: Who needs to file Form ET5?

A: Form ET5 needs to be filed by individuals who are required to pay Ohio estate and additional taxes.

Q: What is the purpose of Form ET5?

A: The purpose of Form ET5 is to report and pay estate and additional taxes to the state of Ohio.

Q: When is Form ET5 due?

A: Form ET5 is due on the 15th day of the fourth month after the decedent's death.

Q: What information is required to complete Form ET5?

A: Information such as the decedent's personal details, estate assets and liabilities, and calculations of tax owed must be provided on Form ET5.

Q: Are there any exemptions or deductions available on Form ET5?

A: Yes, there are exemptions and deductions available on Form ET5. It is recommended to consult the instructions or a tax professional for guidance on these.

Q: Can Form ET5 be filed electronically?

A: Yes, Form ET5 can be filed electronically through the Ohio Business Gateway.

Q: What should I do if I need additional time to file Form ET5?

A: If you need additional time to file Form ET5, you may request an extension by submitting Form IT-10 to the Ohio Department of Taxation.

Form Details:

- Released on July 1, 2003;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET5 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.