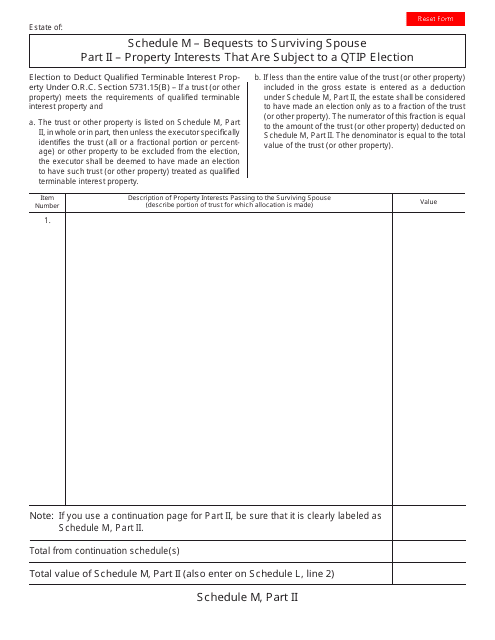

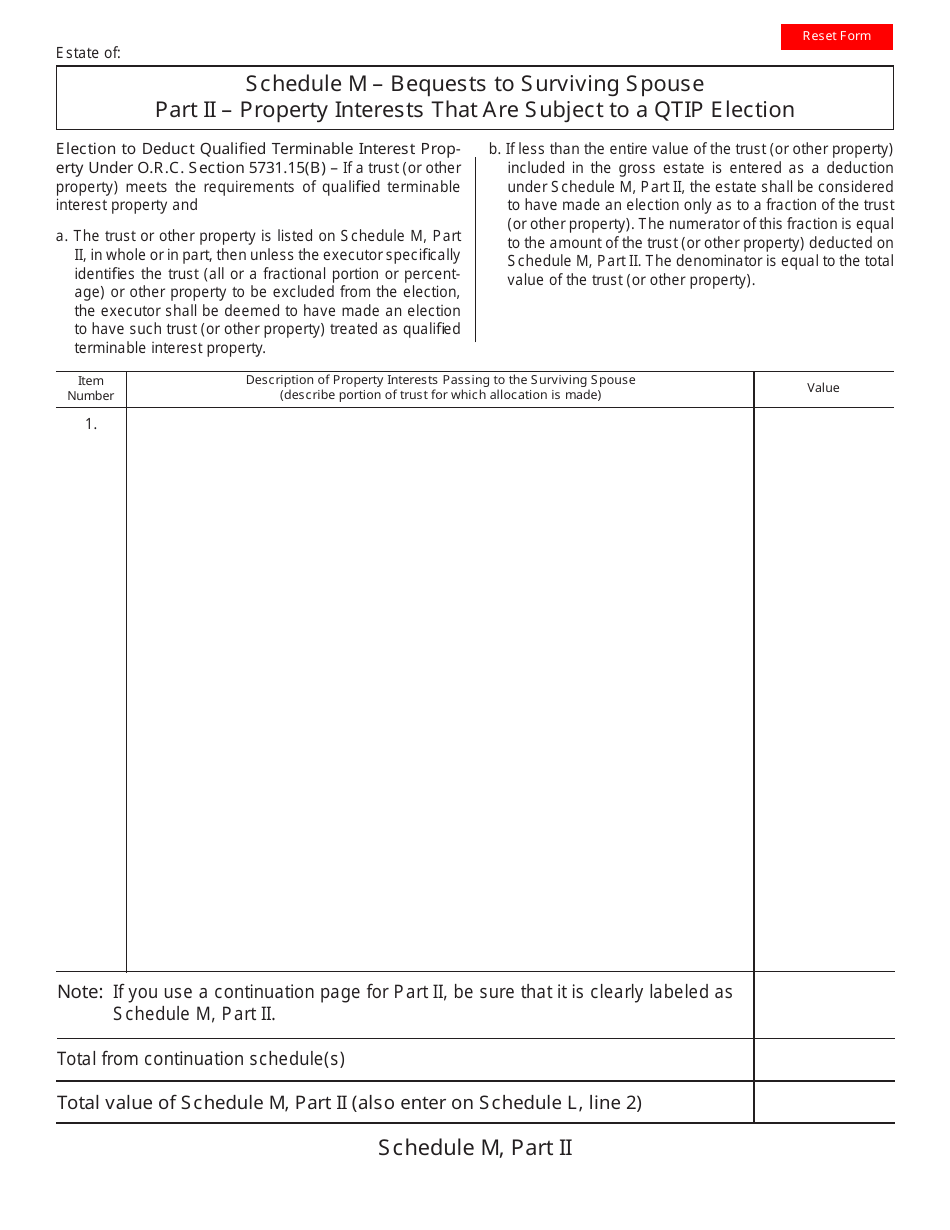

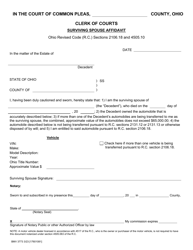

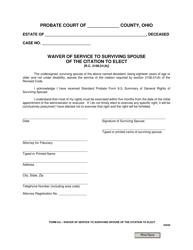

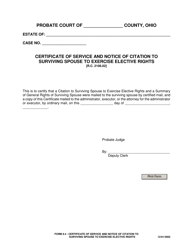

Schedule M Part II - Bequests to Surviving Spouse - Ohio

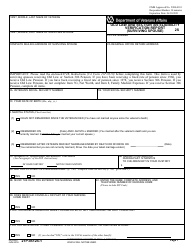

What Is Schedule M?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule M Part II?

A: Schedule M Part II is a section of the Ohio estate tax return form.

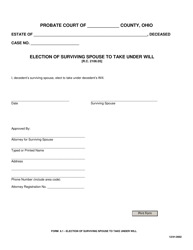

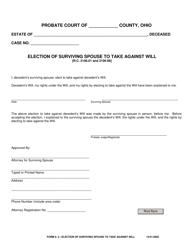

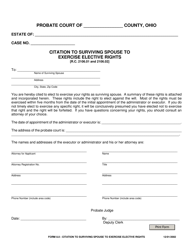

Q: What does Schedule M Part II cover?

A: Schedule M Part II covers bequests to a surviving spouse in the state of Ohio.

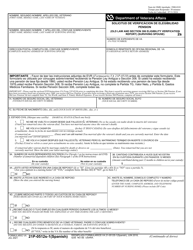

Q: Who needs to complete Schedule M Part II?

A: Individuals who are filing an Ohio estate tax return and have made bequests to their surviving spouse need to complete Schedule M Part II.

Q: What information is required in Schedule M Part II?

A: Schedule M Part II requires information about the bequests made to the surviving spouse, such as the value of the bequests and the date of the bequests.

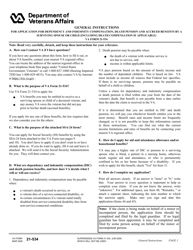

Q: Is Schedule M Part II specific to Ohio?

A: Yes, Schedule M Part II is specific to the state of Ohio and is used for reporting bequests to a surviving spouse on the Ohio estate tax return.

Form Details:

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

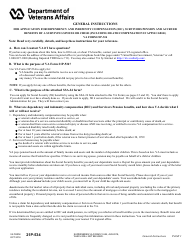

Download a fillable version of Schedule M by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.