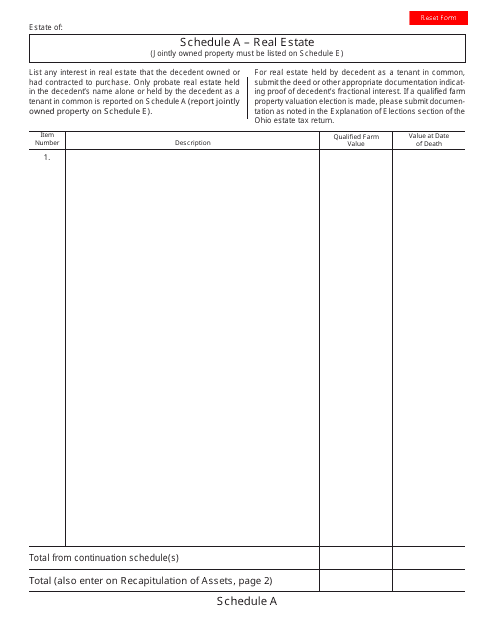

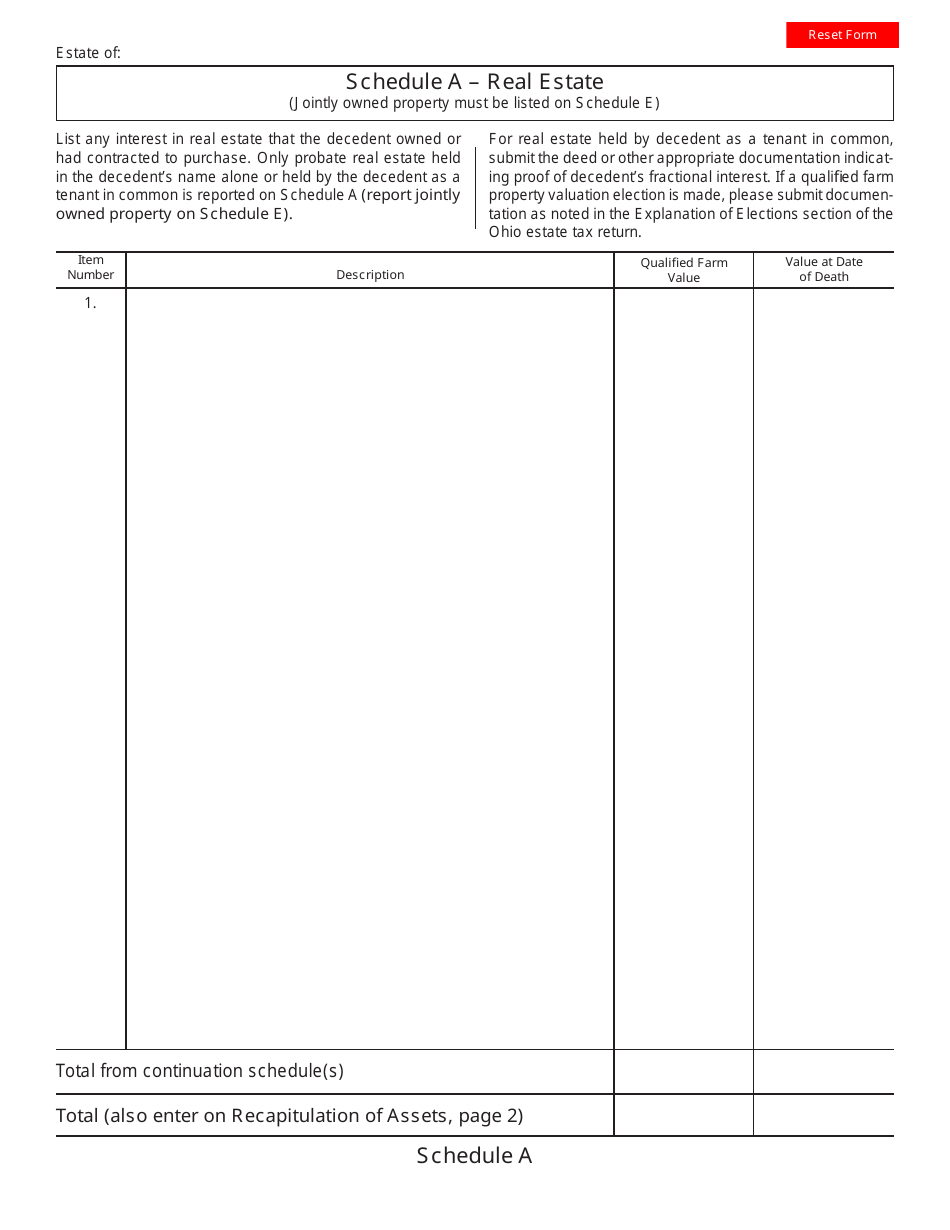

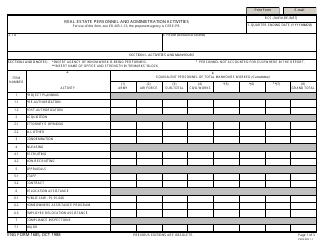

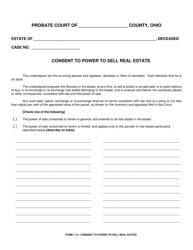

Form ET2 Schedule A Real Estate - Ohio

What Is Form ET2 Schedule A?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET2 Schedule A Real Estate?

A: Form ET2 Schedule A Real Estate is a document used in Ohio to report the value of real estate property for tax purposes.

Q: Who needs to file Form ET2 Schedule A Real Estate?

A: Property owners in Ohio who own real estate need to file Form ET2 Schedule A Real Estate to report the value of their property.

Q: When is Form ET2 Schedule A Real Estate due?

A: Form ET2 Schedule A Real Estate is typically due on or before the first Monday in March each year.

Q: What information do I need to complete Form ET2 Schedule A Real Estate?

A: You will need the property's legal description, total acreage, improvement information, market value, and other property details to complete Form ET2 Schedule A Real Estate.

Q: Are there any penalties for not filing Form ET2 Schedule A Real Estate?

A: Yes, failure to file Form ET2 Schedule A Real Estate may result in penalties, such as a loss of tax benefits or fines.

Form Details:

- Released on January 1, 2004;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET2 Schedule A by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.