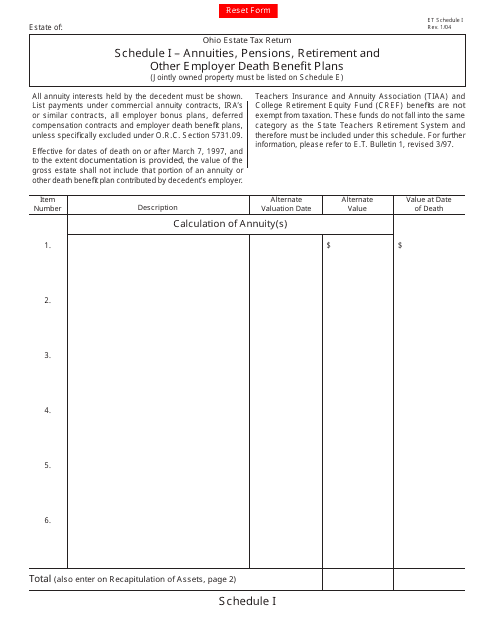

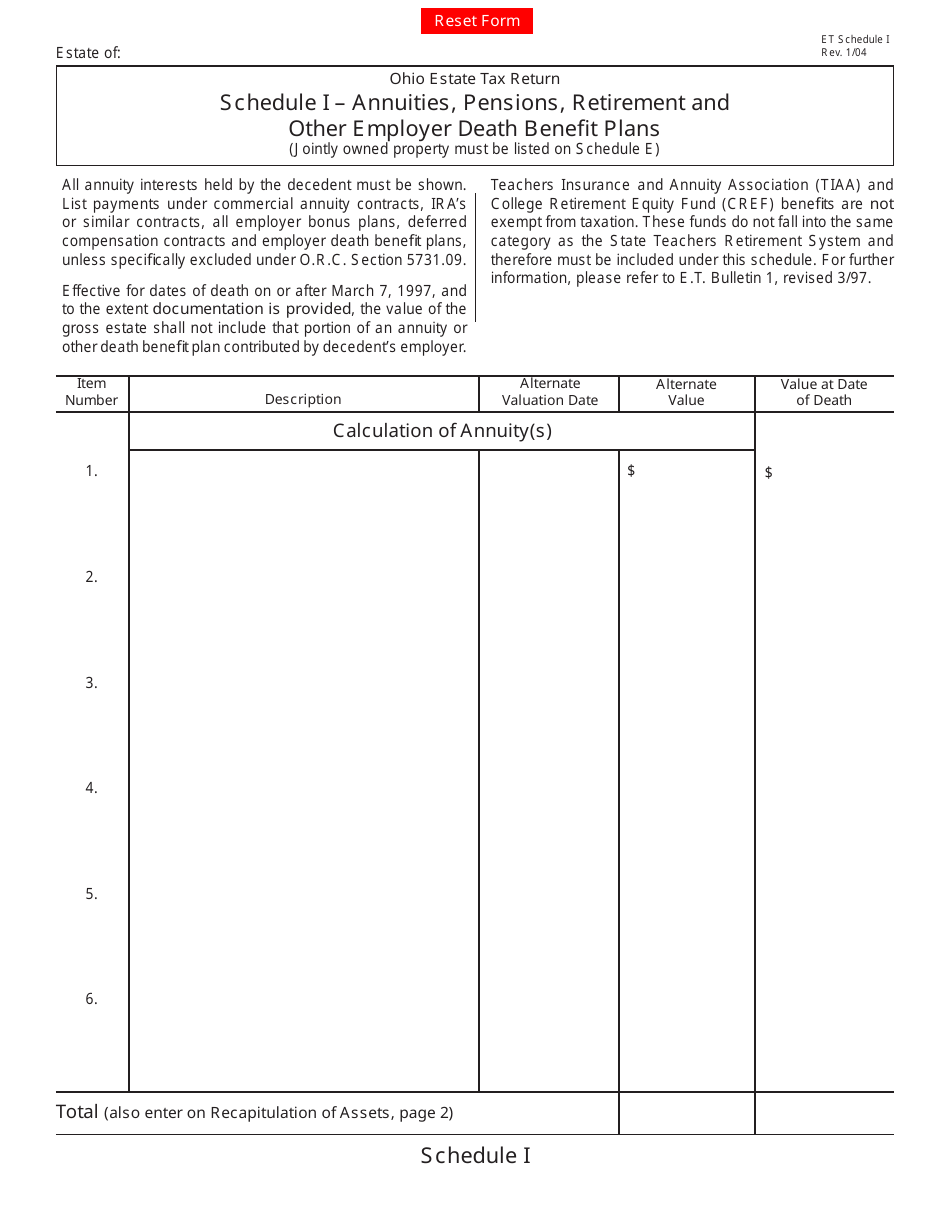

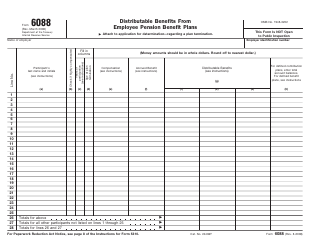

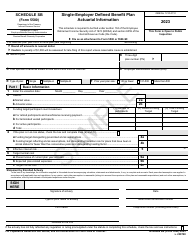

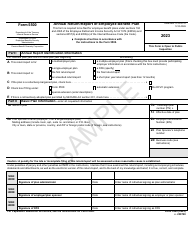

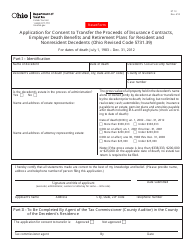

Form ET2 Schedule I Annuities, Pensions, Retirement and Other Employer Death Benefit Plans - Ohio

What Is Form ET2 Schedule I?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET2 Schedule I?

A: Form ET2 Schedule I is a form used in Ohio to report annuities, pensions, retirement accounts, and other employer death benefit plans.

Q: Who needs to fill out Form ET2 Schedule I?

A: Individuals who are Ohio residents and have annuities, pensions, retirement accounts, or other employer death benefit plans need to fill out Form ET2 Schedule I.

Q: What information is required on Form ET2 Schedule I?

A: Form ET2 Schedule I requires information such as the type of plan, the amount received, and any taxes withheld.

Q: When is Form ET2 Schedule I due?

A: Form ET2 Schedule I is typically due on or before April 15th of each year, along with your state income tax return.

Form Details:

- Released on January 1, 2004;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET2 Schedule I by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.