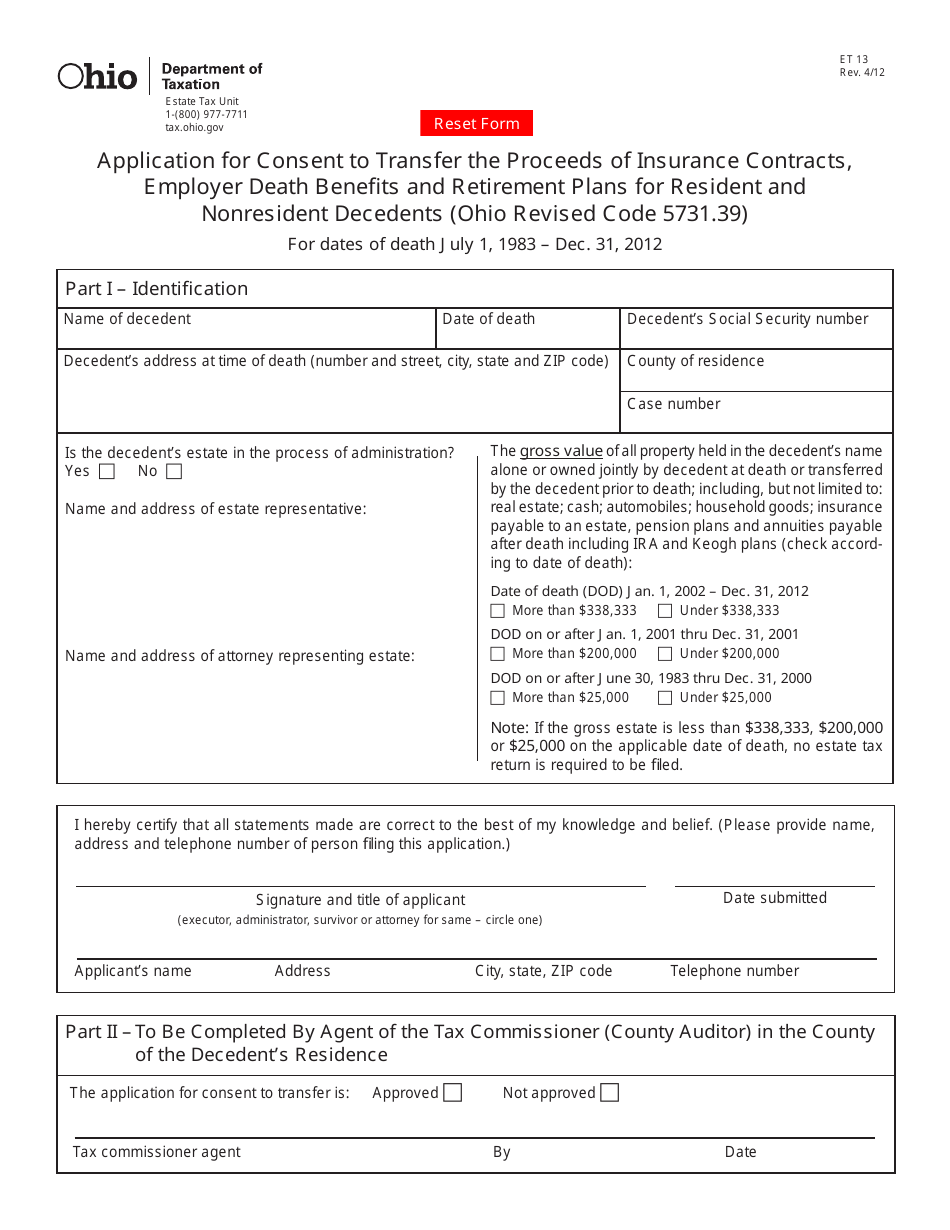

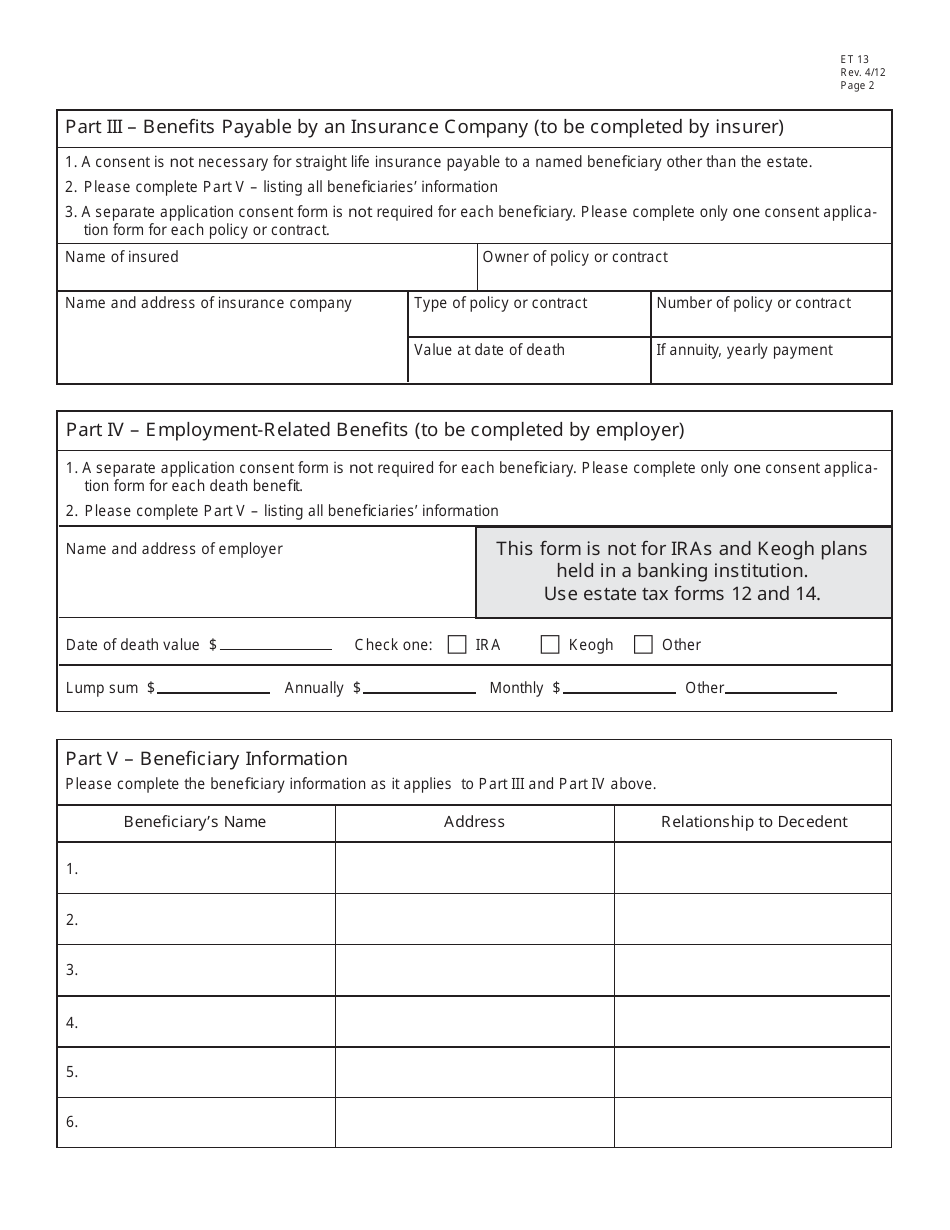

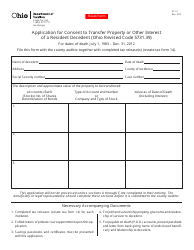

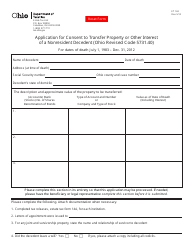

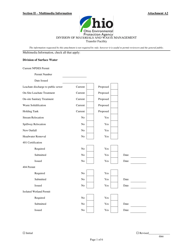

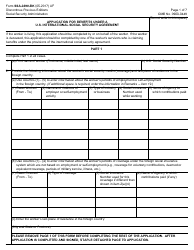

Form ET13 Application for Consent to Transfer the Proceeds of Insurance Contracts, Employer Death Benefits and Retirement Plans for Resident and Nonresident Decedents - Ohio

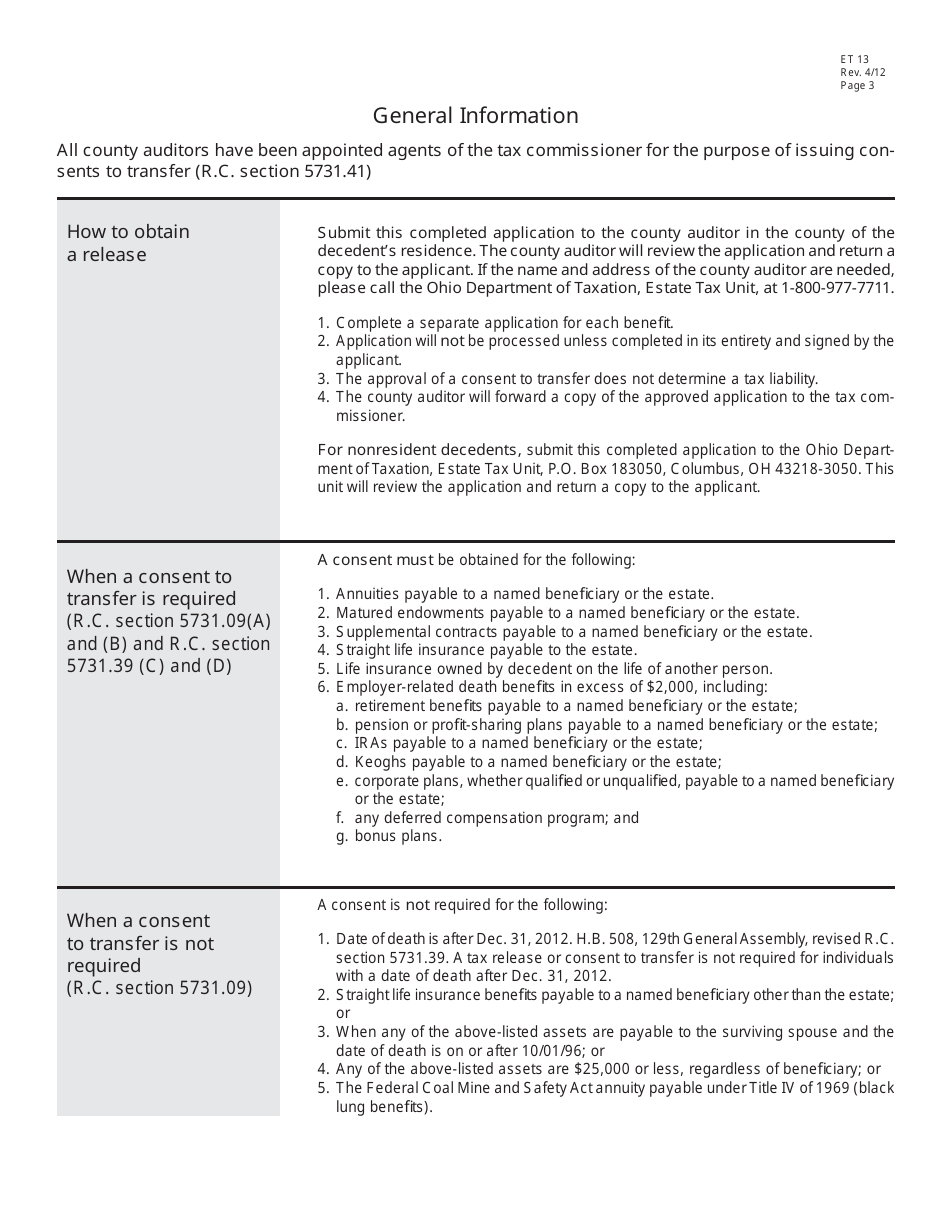

What Is Form ET13?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET13?

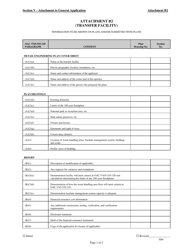

A: Form ET13 is an application for consent to transfer the proceeds of insurance contracts, employer death benefits, and retirement plans for resident and nonresident decedents in Ohio.

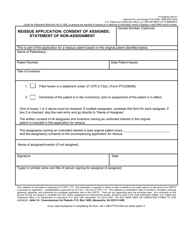

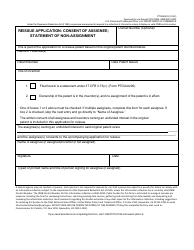

Q: Who needs to file Form ET13?

A: Anyone who needs to transfer the proceeds of insurance contracts, employer death benefits, and retirement plans for a deceased person in Ohio.

Q: What is the purpose of Form ET13?

A: The purpose of Form ET13 is to obtain consent from the Ohio Department of Taxation for the transfer of these proceeds.

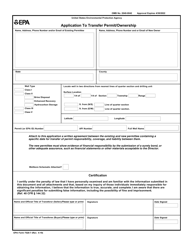

Q: Are there any fees associated with filing Form ET13?

A: Yes, there may be fees associated with filing Form ET13. You should consult the instructions or contact the Ohio Department of Taxation for more information.

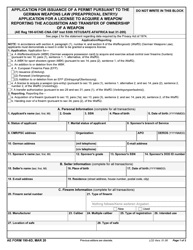

Q: What supporting documents are required with Form ET13?

A: The specific supporting documents required may vary depending on the situation. You should refer to the instructions provided with Form ET13 or contact the Ohio Department of Taxation for guidance.

Q: What is the deadline for filing Form ET13?

A: The deadline for filing Form ET13 may vary depending on the circumstances. You should consult the instructions or contact the Ohio Department of Taxation for specific deadlines.

Form Details:

- Released on April 1, 2012;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET13 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.