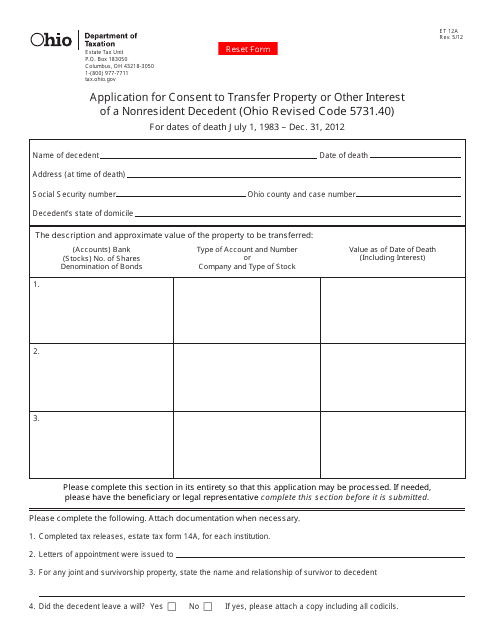

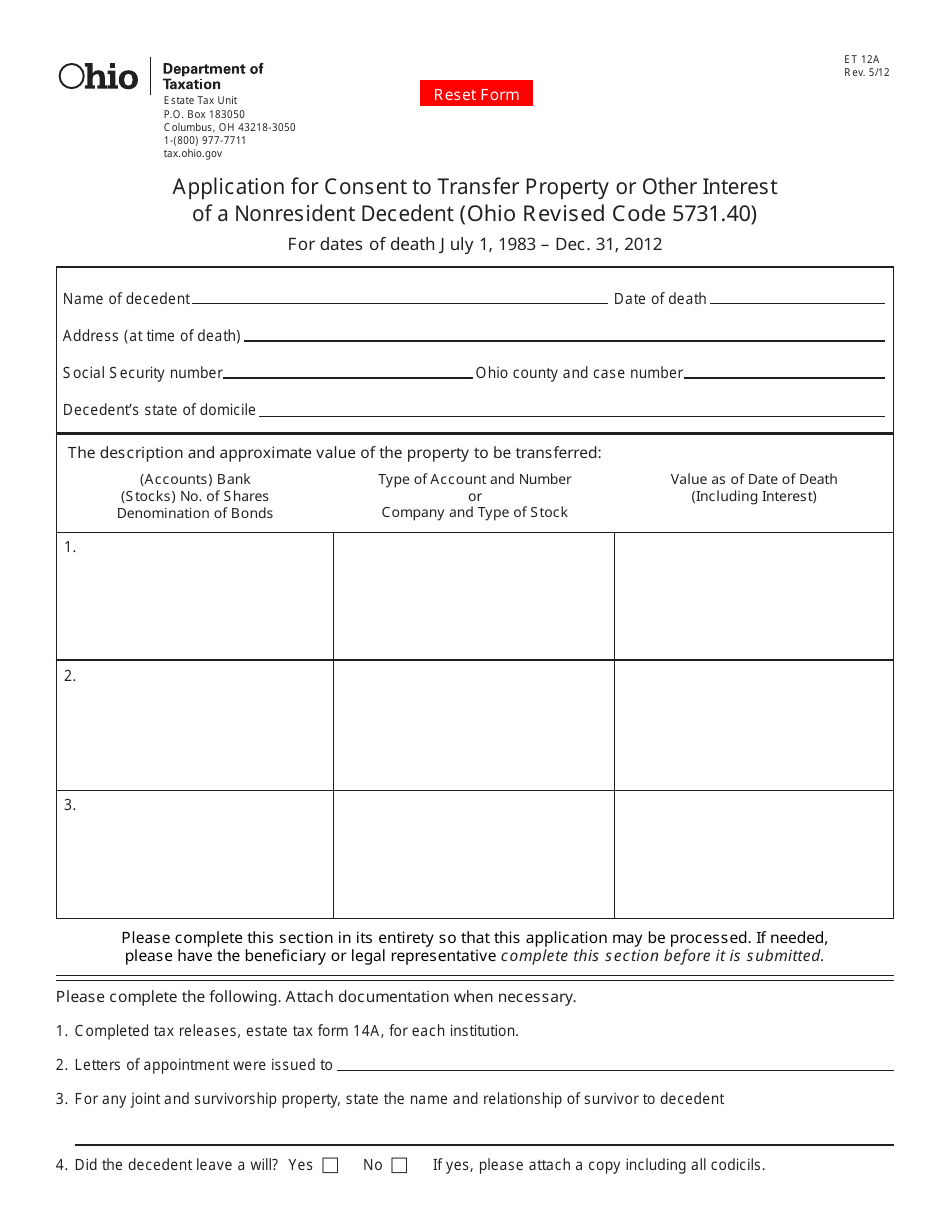

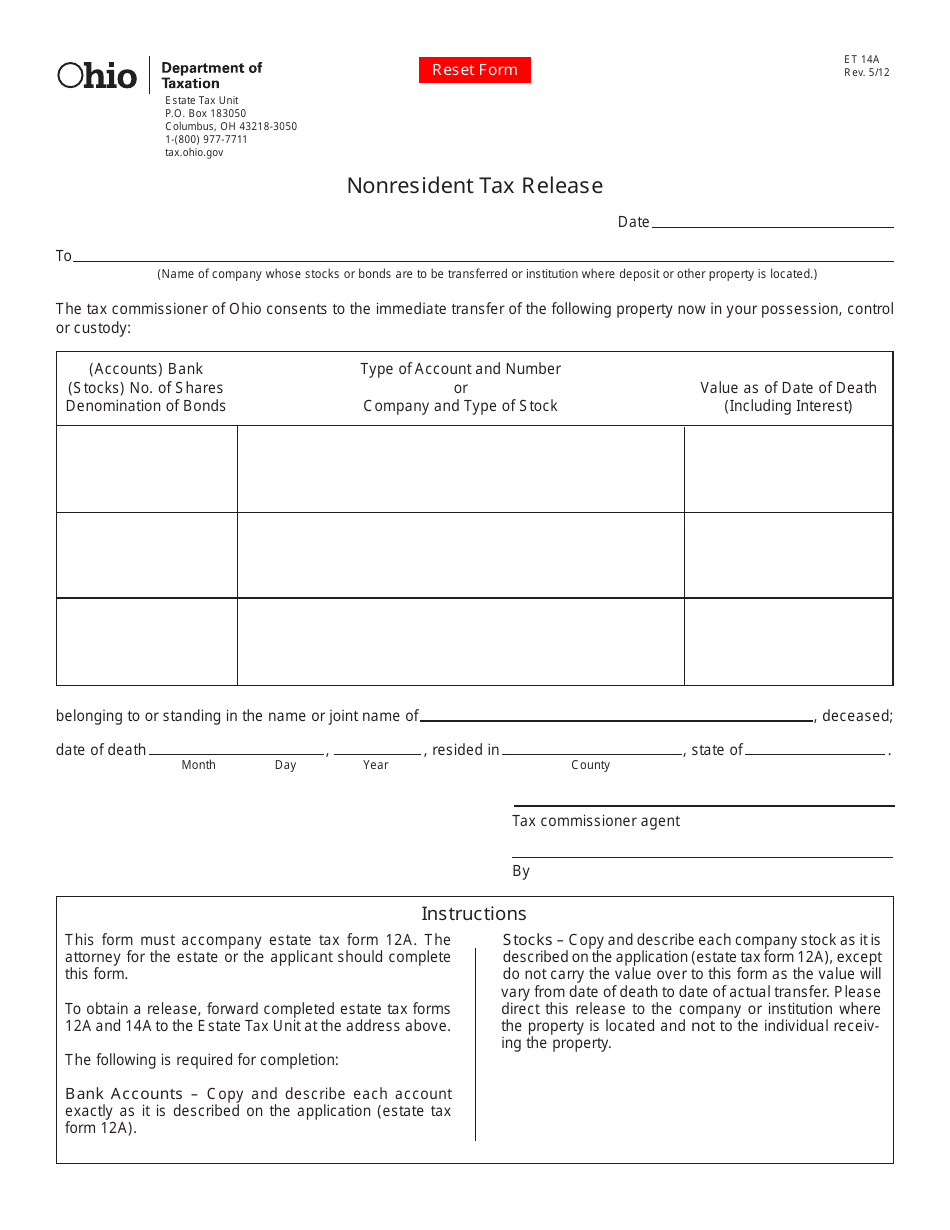

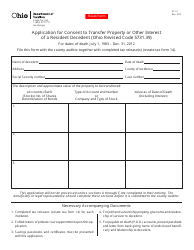

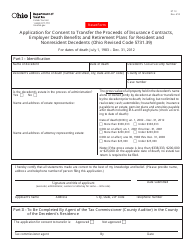

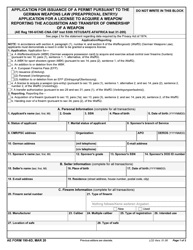

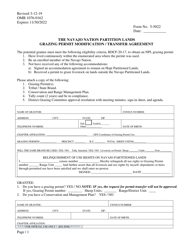

Form ET12a Application for Consent to Transfer Property or Other Interest of a Nonresident Decedent - Ohio

What Is Form ET12a?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET12a?

A: Form ET12a is the Application for Consent to Transfer Property or Other Interest of a Nonresident Decedent in Ohio.

Q: Who needs to file Form ET12a?

A: Form ET12a needs to be filed by individuals who need consent to transfer the property or other interest of a nonresident decedent in Ohio.

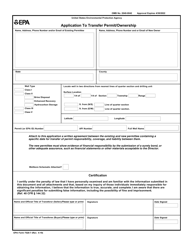

Q: What is the purpose of Form ET12a?

A: The purpose of Form ET12a is to request consent from the Ohio Department of Taxation for the transfer of property or other interest of a nonresident decedent.

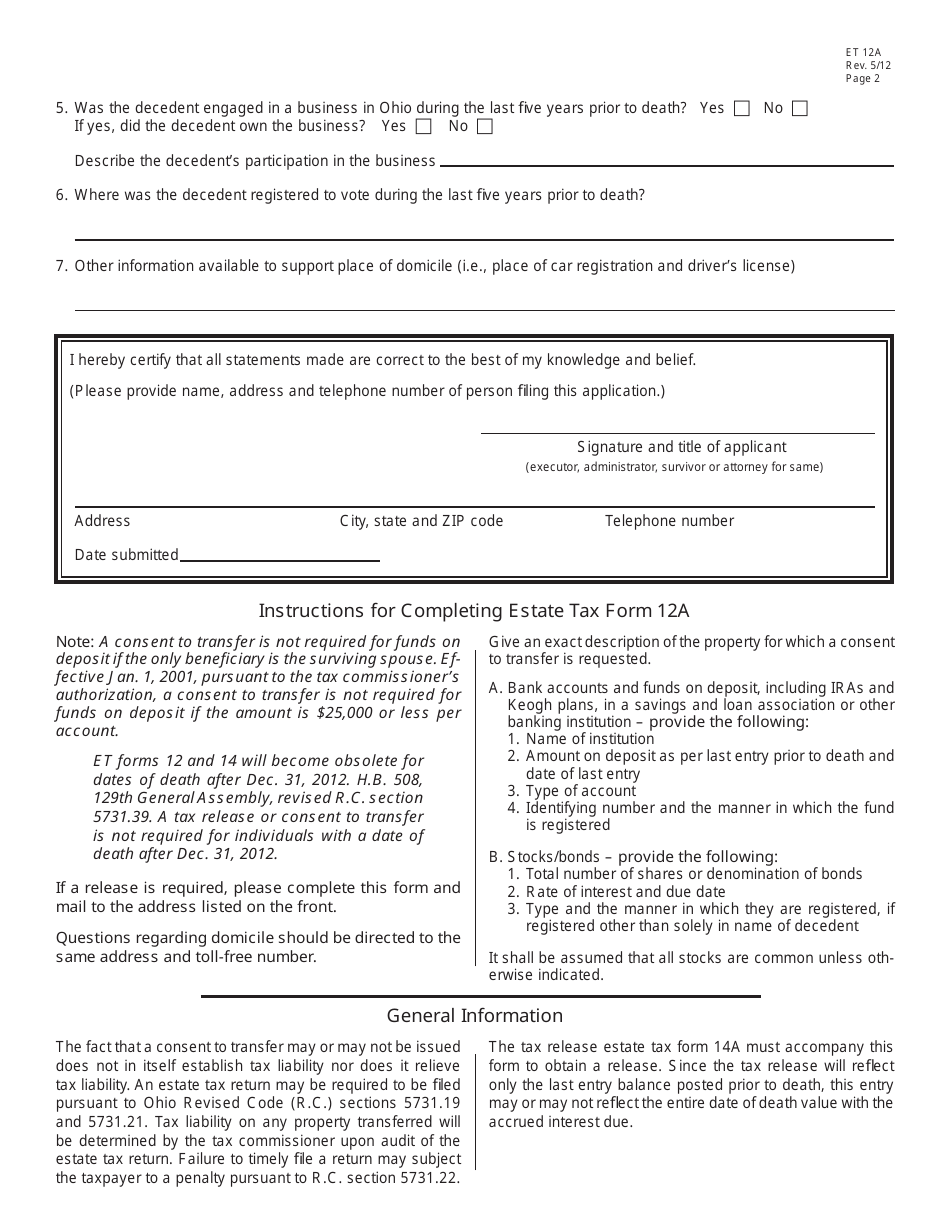

Q: How do I fill out Form ET12a?

A: Form ET12a must be filled out with the necessary information, including details about the nonresident decedent, the property or interest being transferred, and the individuals involved in the transfer.

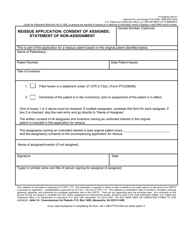

Q: Are there any fees associated with filing Form ET12a?

A: Yes, there may be fees associated with filing Form ET12a. Please refer to the instructions on the form or contact the Ohio Department of Taxation for more information.

Q: Is there a deadline for filing Form ET12a?

A: Yes, Form ET12a must be filed within nine months from the date of the nonresident decedent's death or within any extension period granted by the Ohio Department of Taxation.

Q: What happens after I file Form ET12a?

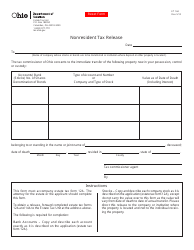

A: After filing Form ET12a, the Ohio Department of Taxation will review the application and issue a consent if all requirements are met. The consent will allow for the transfer of the property or other interest of the nonresident decedent.

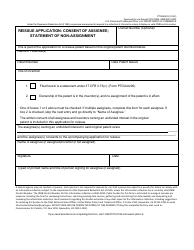

Q: What should I do if I have more questions about Form ET12a?

A: If you have more questions about Form ET12a, you can contact the Ohio Department of Taxation for further assistance.

Form Details:

- Released on May 1, 2012;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET12a by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.