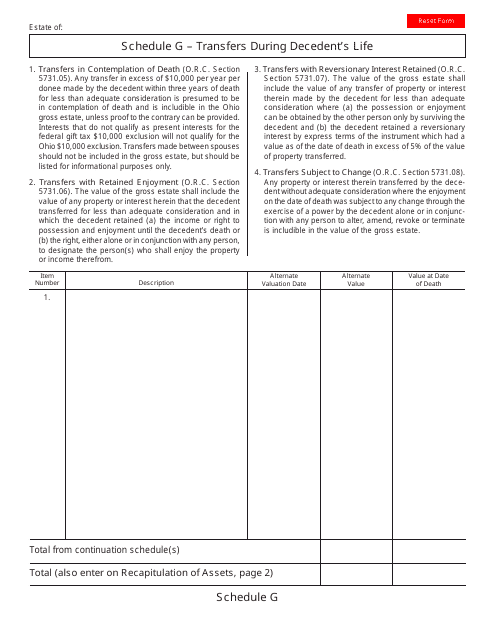

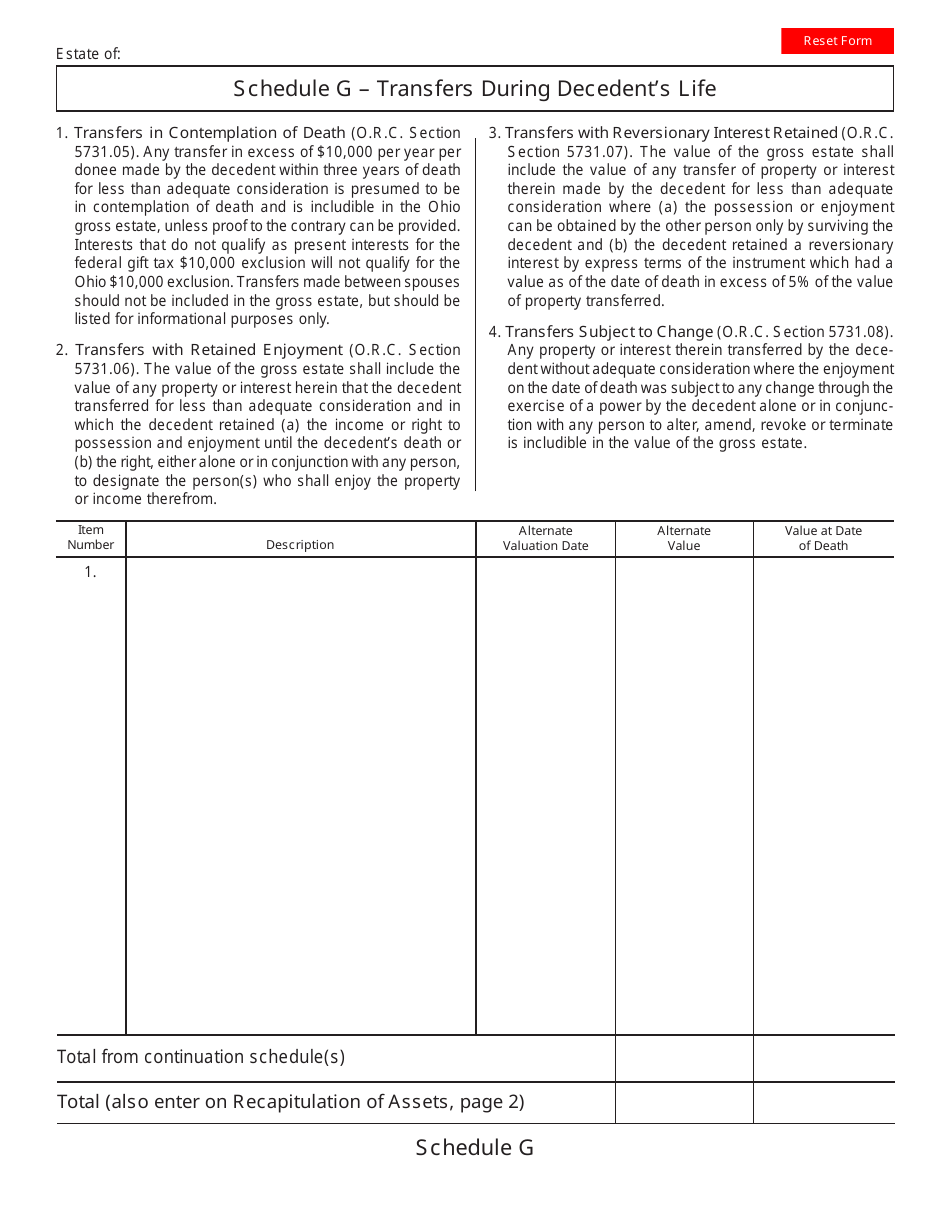

Schedule G Transfers During Decedent's Life - Ohio

What Is Schedule G?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule G?

A: Schedule G is a form used in Ohio to report transfers of property made by a decedent during their lifetime.

Q: When is Schedule G required?

A: Schedule G is required if the decedent made any transfers of property during their lifetime.

Q: What information is included in Schedule G?

A: Schedule G includes details about the transfers of property, including the description of the property, the date of the transfer, and the fair market value of the property at the time of the transfer.

Q: Do I need to file Schedule G if there were no transfers of property?

A: No, if there were no transfers of property made by the decedent during their lifetime, you do not need to file Schedule G.

Form Details:

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule G by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.