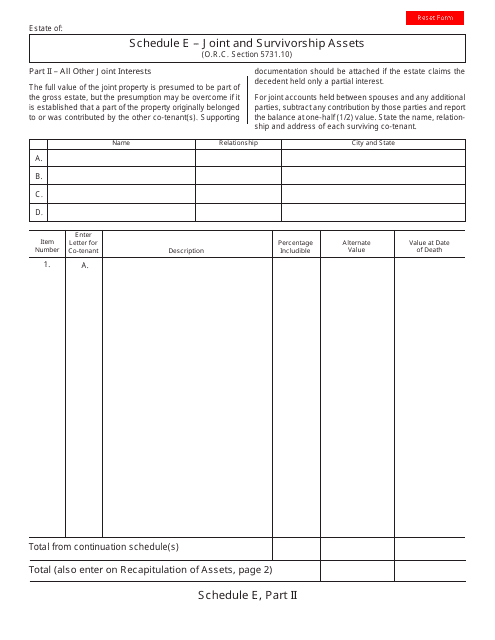

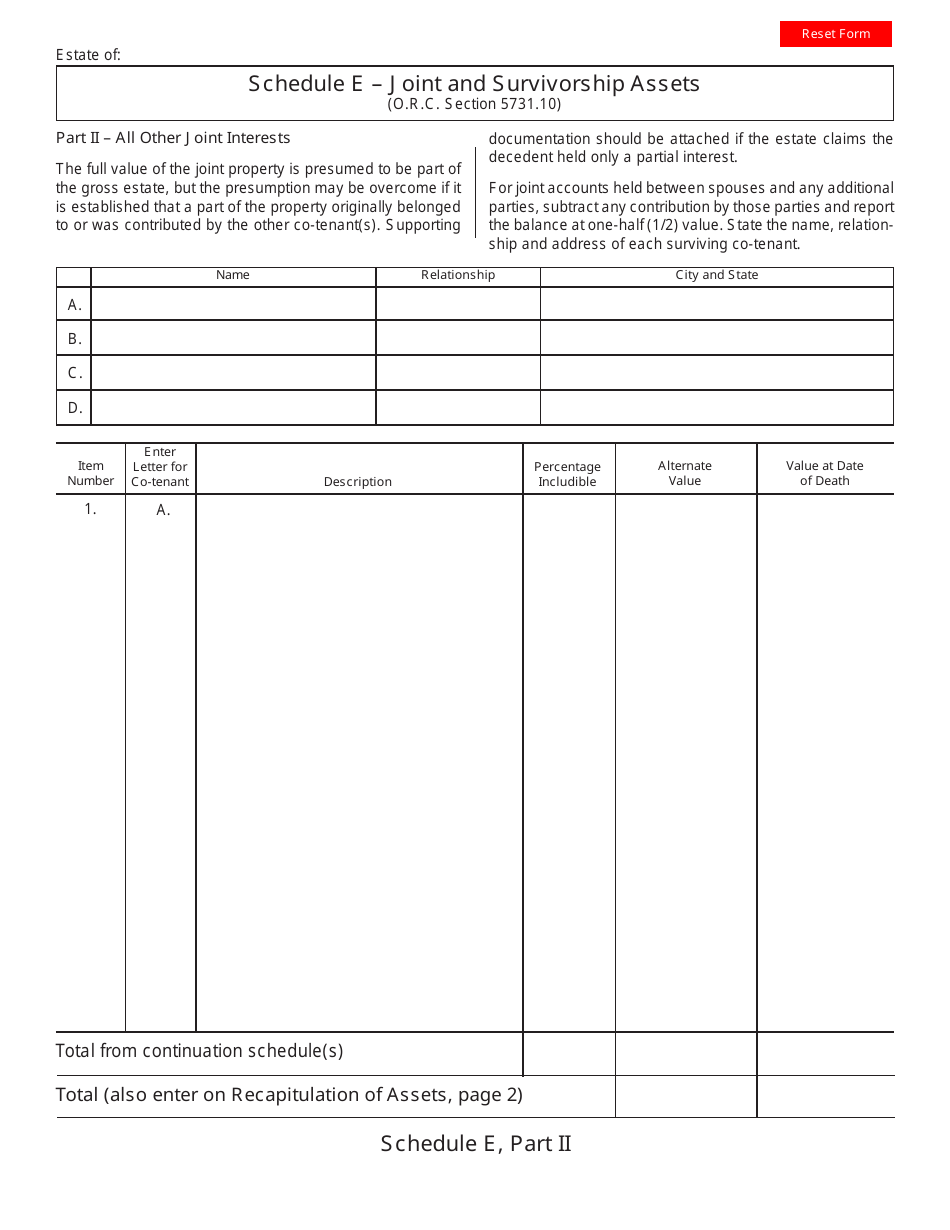

Form ET2 Schedule E Part II - Joint and Survivorship Assets - Ohio

What Is Form ET2 Schedule E?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET2 Schedule E?

A: Form ET2 Schedule E is a tax form used in Ohio to report joint and survivorship assets.

Q: What is Part II of Form ET2 Schedule E?

A: Part II of Form ET2 Schedule E is specific to joint and survivorship assets.

Q: What are joint and survivorship assets?

A: Joint and survivorship assets refer to property or investments that are owned jointly by two or more people with rights of survivorship.

Q: Why do I need to report joint and survivorship assets on Form ET2 Schedule E?

A: Reporting joint and survivorship assets on Form ET2 Schedule E ensures that the correct tax treatment is applied.

Q: Is Form ET2 Schedule E required for all Ohio residents?

A: No, Form ET2 Schedule E is only required if you have joint and survivorship assets to report.

Form Details:

- Released on January 1, 2004;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET2 Schedule E by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.