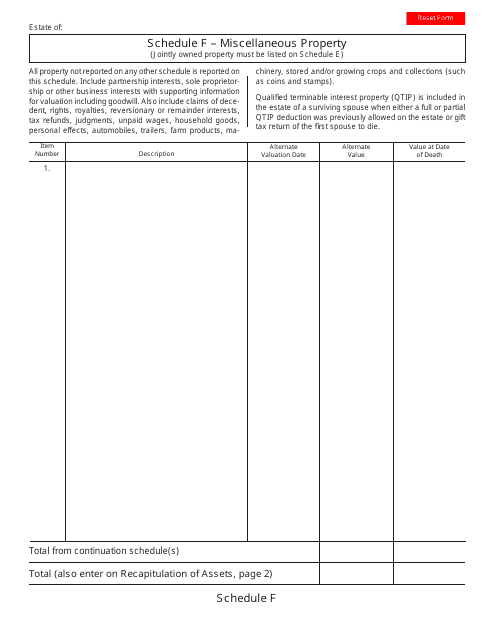

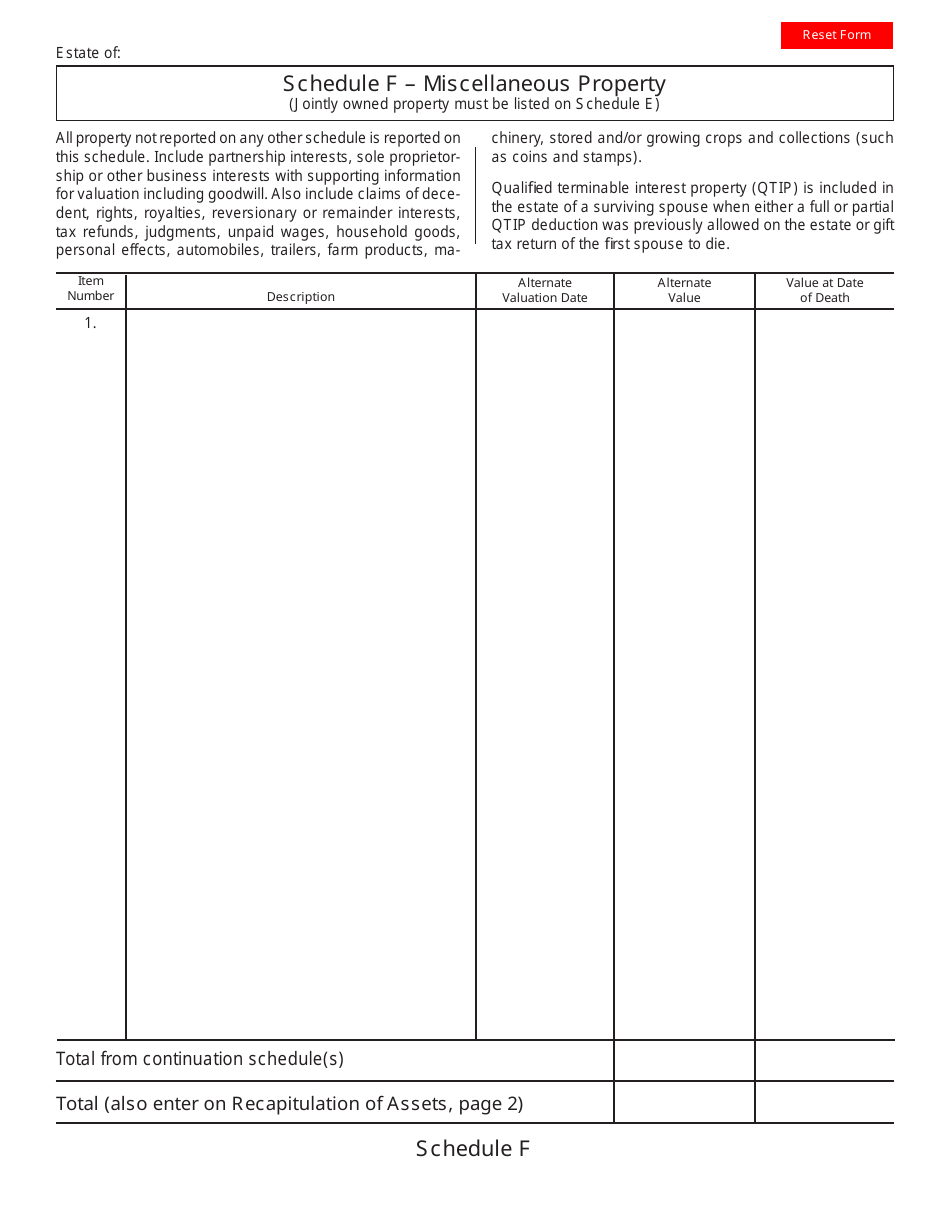

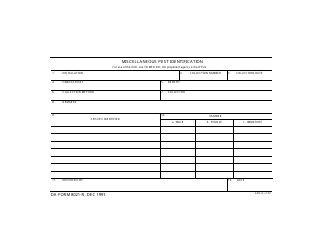

Schedule F Miscellaneous Property - Ohio

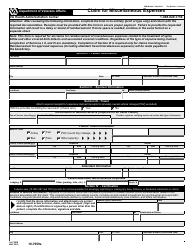

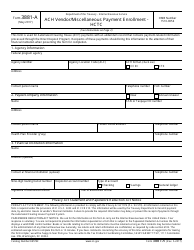

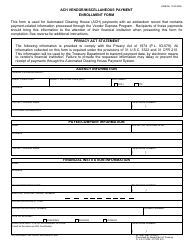

What Is Schedule F?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule F Miscellaneous Property in Ohio?

A: Schedule F Miscellaneous Property is a declaration form used in Ohio to report owned miscellaneous property that is not subject to property tax.

Q: What type of property should be reported on Schedule F Miscellaneous Property?

A: Any property that is not otherwise taxable or exempt should be reported on Schedule F.

Q: When is the deadline to file Schedule F Miscellaneous Property in Ohio?

A: The deadline to file Schedule F Miscellaneous Property in Ohio is generally on or before the first Monday in March each year.

Q: Are there any exemptions from filing Schedule F Miscellaneous Property?

A: Yes, certain types of property, such as household goods and personal effects, are exempt from filing Schedule F.

Form Details:

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule F by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.