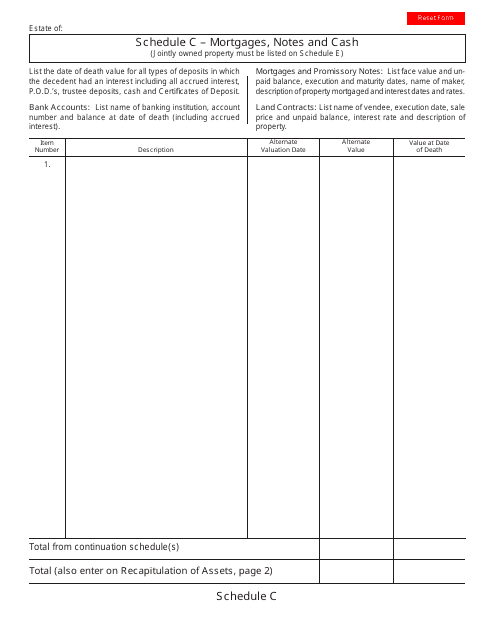

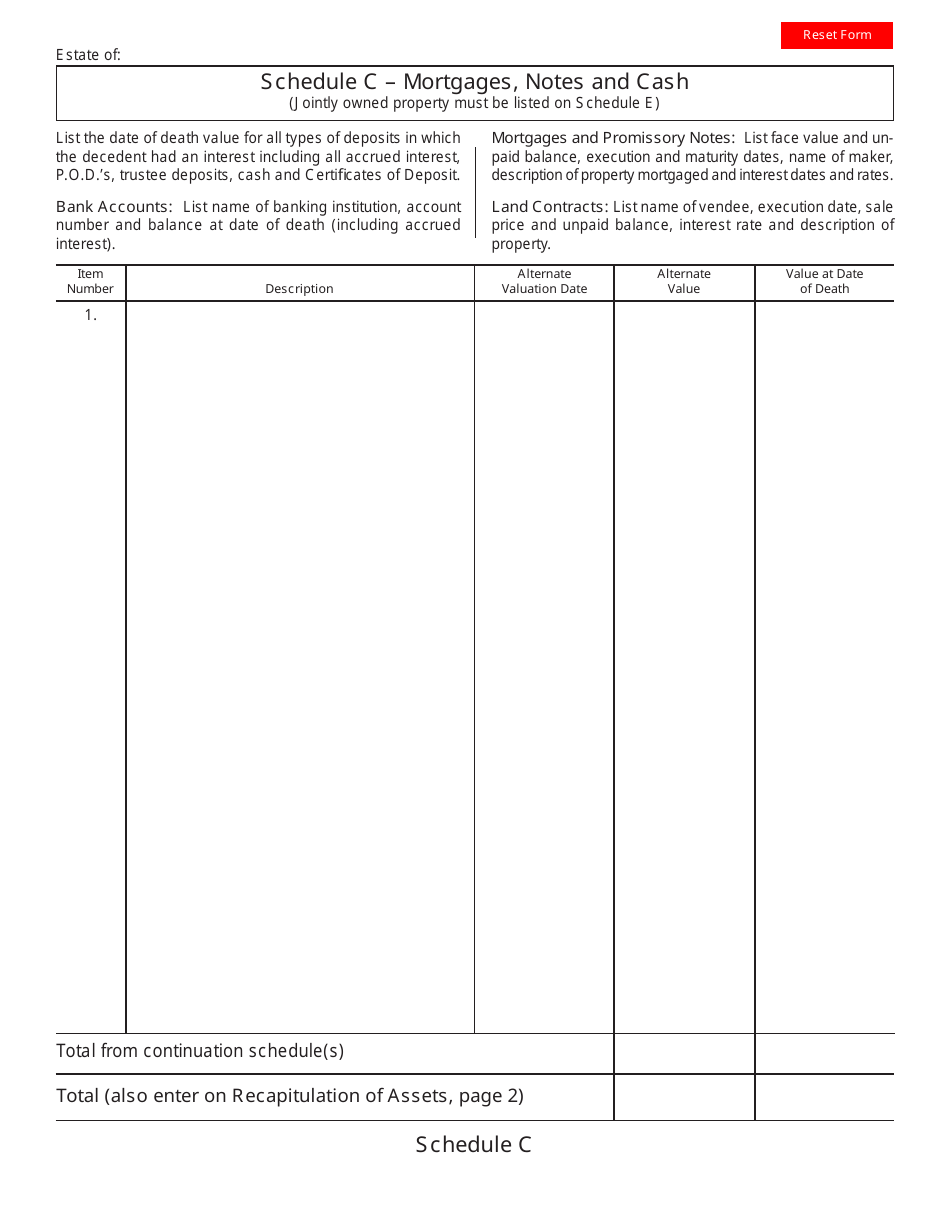

Schedule C Mortgages, Notes and Cash - Ohio

What Is Schedule C?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule C?

A: Schedule C is a form used to report various types of income or losses from a business you operated or a profession you practiced as a sole proprietor.

Q: What are Schedule C mortgages?

A: Schedule C mortgages refer to the loans or mortgages that are taken out to finance business-related properties or assets used in your business operations.

Q: What are Schedule C notes?

A: Schedule C notes refer to promissory notes or loans that are made or received in the course of operating your business as a sole proprietor.

Q: What is Schedule C cash?

A: Schedule C cash refers to the cash and cash equivalents held or received in the course of running your business as a sole proprietor.

Q: How do I report Schedule C mortgages, notes, and cash in Ohio?

A: In Ohio, you would report Schedule C mortgages, notes, and cash on your state income tax return if they are related to your business activities in the state. Be sure to follow the instructions provided by the Ohio Department of Taxation for reporting these items accurately.

Form Details:

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule C by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.