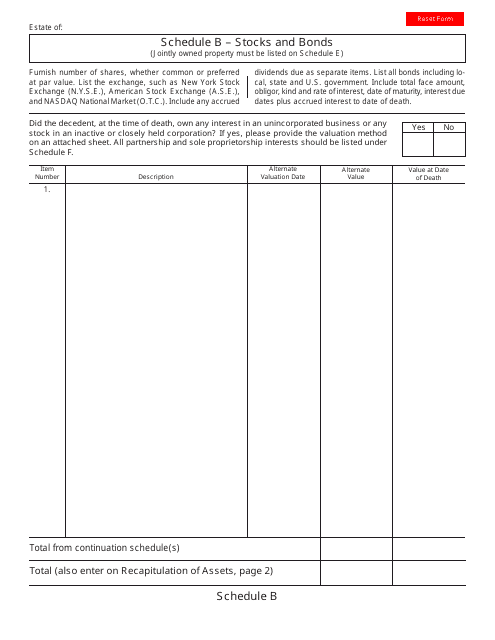

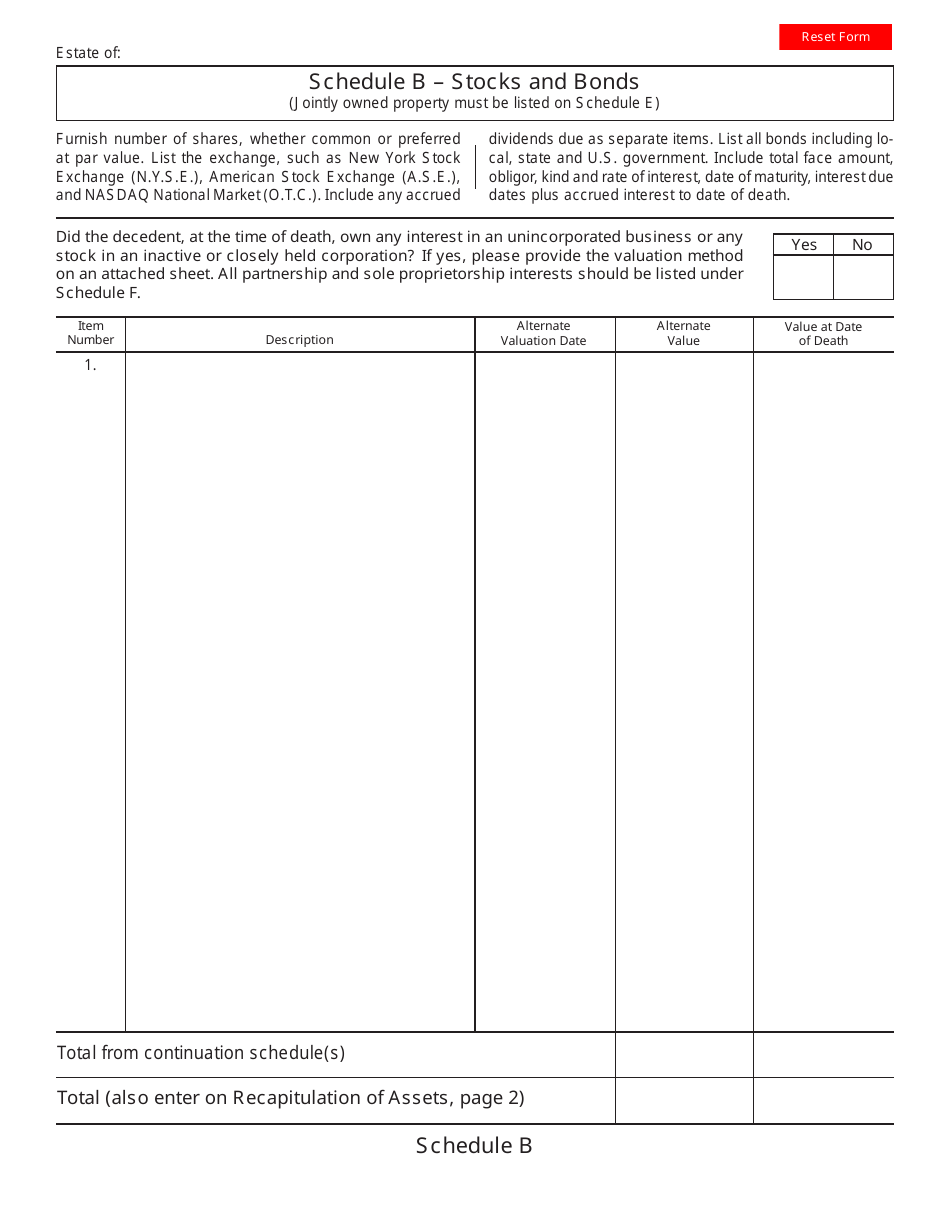

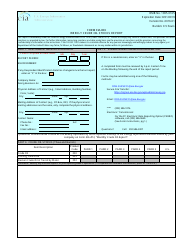

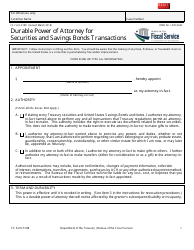

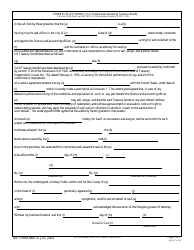

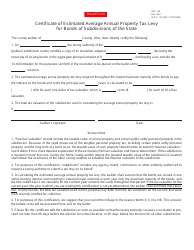

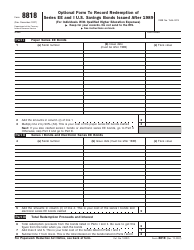

Schedule B Stocks and Bonds - Ohio

What Is Schedule B?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule B?

A: Schedule B is a form used to report holdings of stocks and bonds.

Q: What are stocks?

A: Stocks represent ownership in a company. When you buy stocks, you become a shareholder.

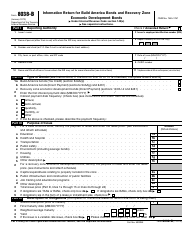

Q: What are bonds?

A: Bonds are debt securities issued by companies, municipalities, or the government.

Q: Why do I need to report stocks and bonds on Schedule B?

A: Reporting stocks and bonds on Schedule B helps the government track your investment holdings.

Q: Who needs to fill out Schedule B?

A: You need to fill out Schedule B if you have stocks and bonds with a total value exceeding a certain threshold.

Q: What information do I need to provide on Schedule B?

A: You need to provide details about the stocks and bonds you own, including the issuer, type, and value.

Q: Is Schedule B required for tax purposes?

A: Yes, Schedule B is required for tax purposes to accurately report your investment holdings.

Q: When is Schedule B due?

A: Schedule B is typically due along with your annual tax return, which is usually April 15th.

Q: What happens if I don't report my stocks and bonds on Schedule B?

A: Failure to report stocks and bonds on Schedule B could result in penalties or audits by the IRS.

Form Details:

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule B by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.