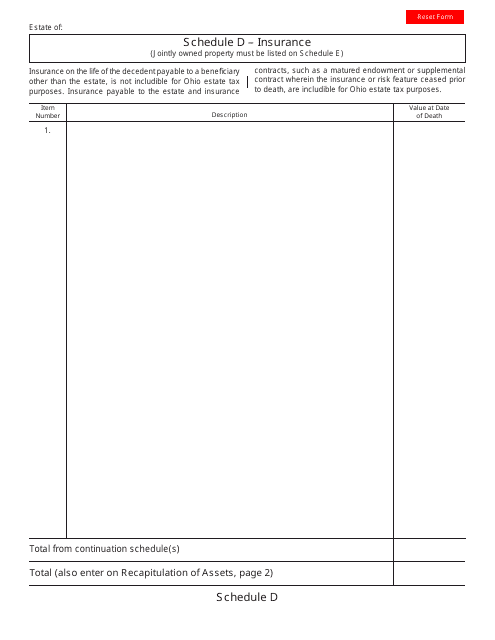

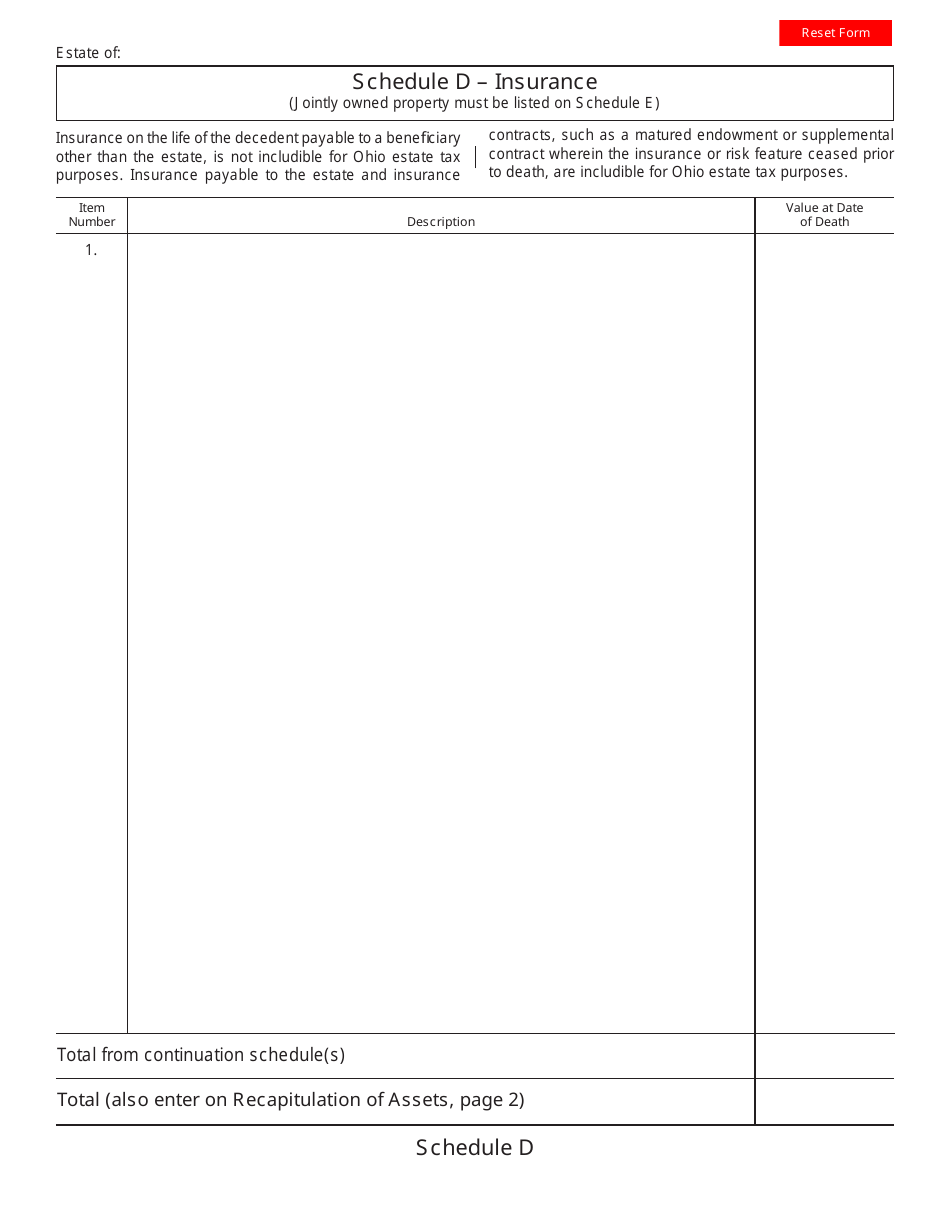

Form ET2 Schedule D Insurance - Ohio

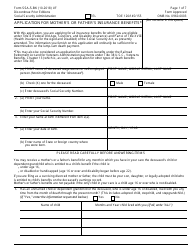

What Is Form ET2 Schedule D?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET2 Schedule D Insurance?

A: Form ET2 Schedule D Insurance is a specific form used in the state of Ohio for reporting insurance information.

Q: Who needs to file Form ET2 Schedule D Insurance?

A: Insurance companies operating in Ohio are required to file Form ET2 Schedule D Insurance.

Q: What information does Form ET2 Schedule D Insurance require?

A: Form ET2 Schedule D Insurance requires insurance companies to report details about premiums received, losses paid, and other related information.

Q: When is the deadline to file Form ET2 Schedule D Insurance?

A: The deadline for filing Form ET2 Schedule D Insurance in Ohio is typically in March of each year.

Q: Are there any penalties for not filing Form ET2 Schedule D Insurance?

A: Yes, insurance companies may face penalties if they fail to file Form ET2 Schedule D Insurance or if they file it late.

Q: Is Form ET2 Schedule D Insurance the only form required for insurance companies in Ohio?

A: No, insurance companies in Ohio are also required to file other forms and reports, depending on the nature of their operations.

Form Details:

- Released on January 1, 2004;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET2 Schedule D by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.