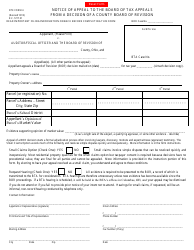

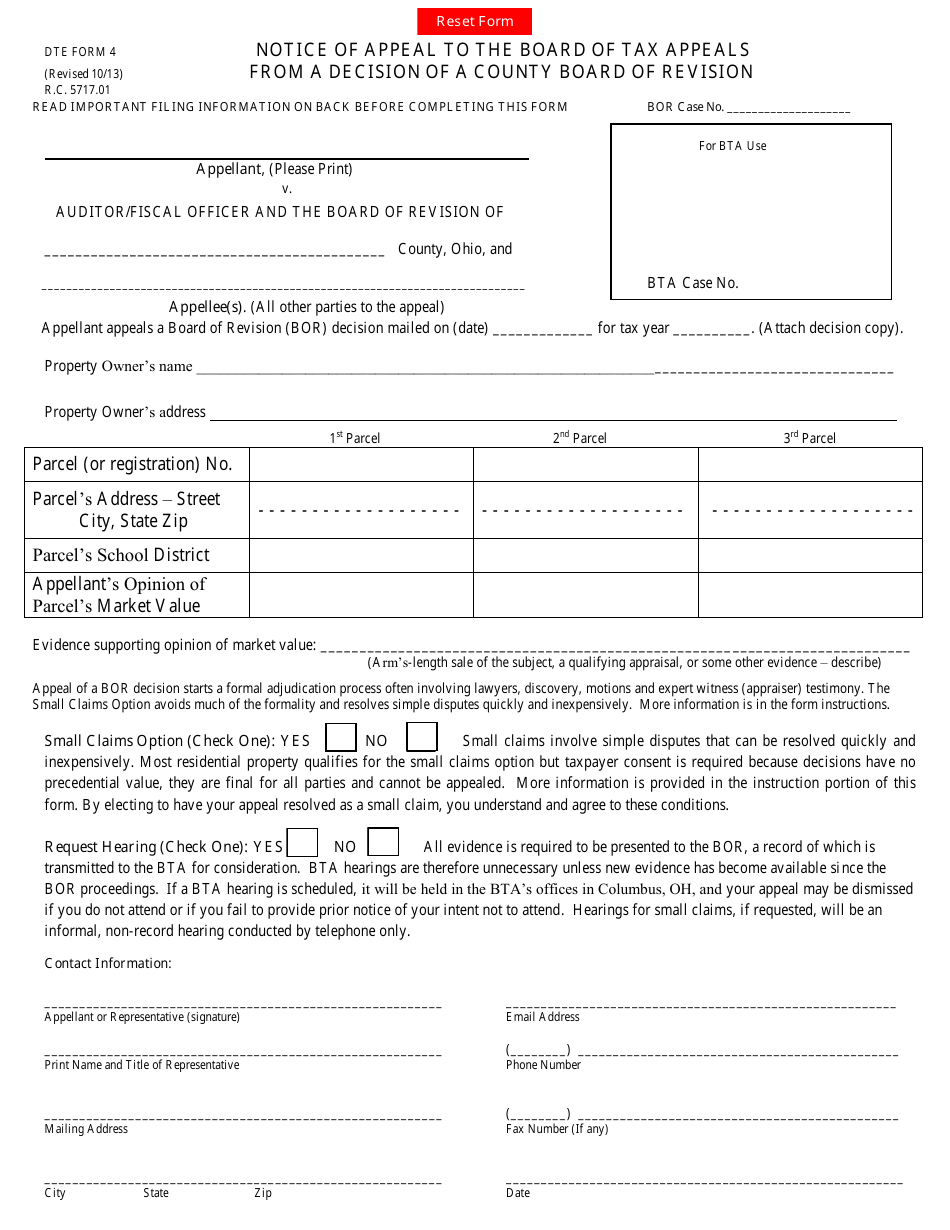

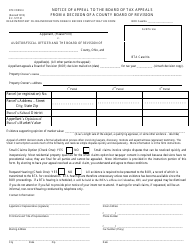

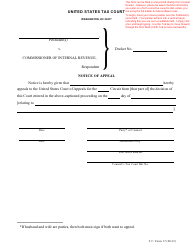

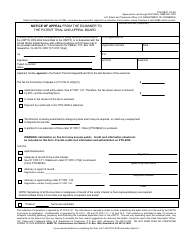

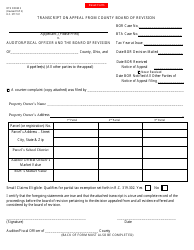

Form DTE4 Notice of Appeal to the Board of Tax Appeals From a Decision of a County Board of Revision - Ohio

What Is Form DTE4?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE4?

A: Form DTE4 is a Notice of Appeal to the Board of Tax Appeals From a Decision of a County Board of Revision in Ohio.

Q: When is Form DTE4 used?

A: Form DTE4 is used when a person wants to appeal a decision made by a County Board of Revision regarding their property taxes in Ohio.

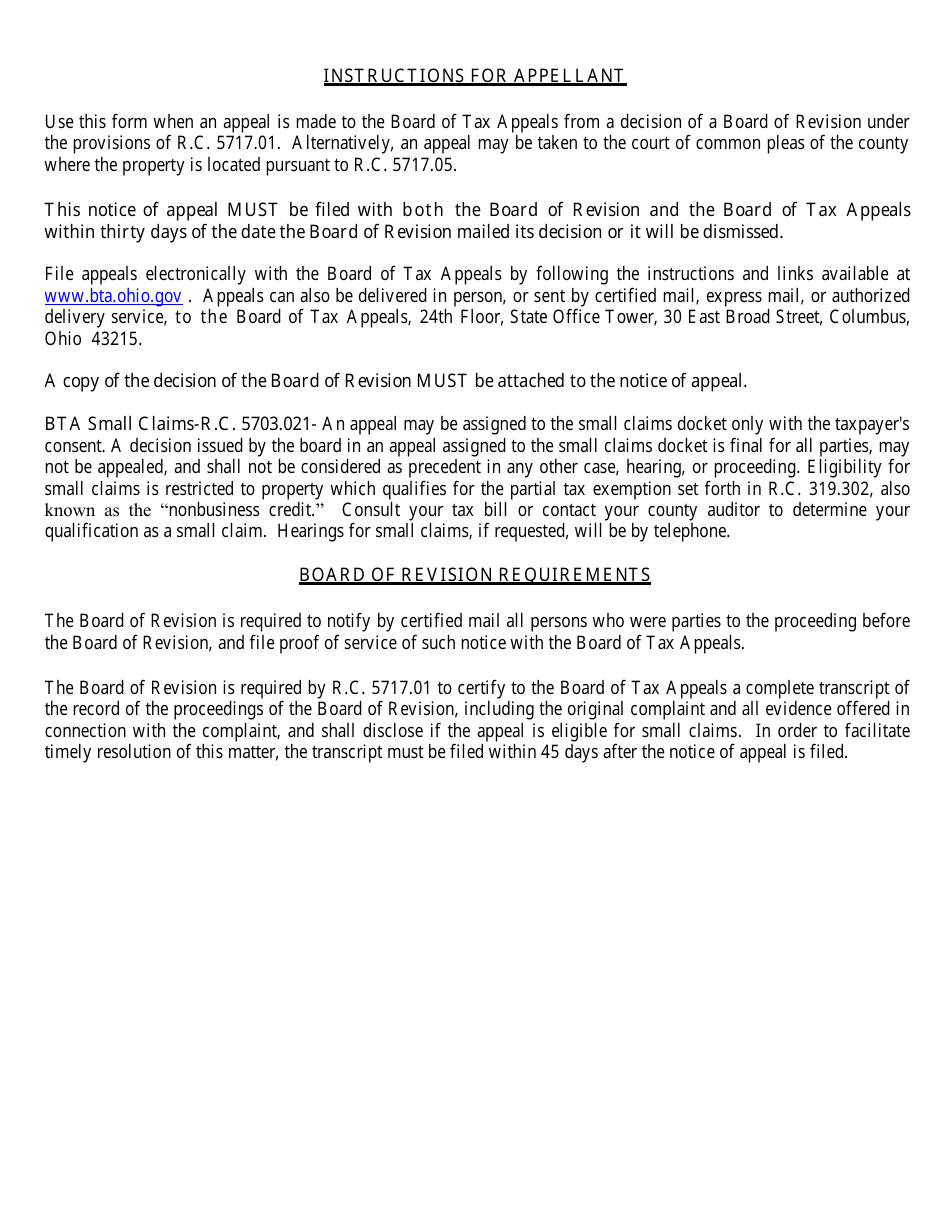

Q: Is there a deadline for filing Form DTE4?

A: Yes, there is a deadline for filing Form DTE4. It must be filed within 30 days from the date of the certified mail receipt of the decision being appealed.

Q: What information is required on Form DTE4?

A: Form DTE4 requires information about the appellant, the property in question, the County Board of Revision decision being appealed, and the reasons for the appeal.

Form Details:

- Released on October 1, 2013;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE4 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.