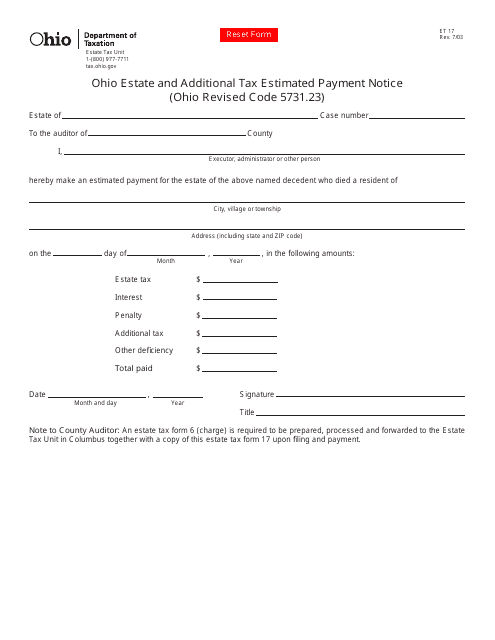

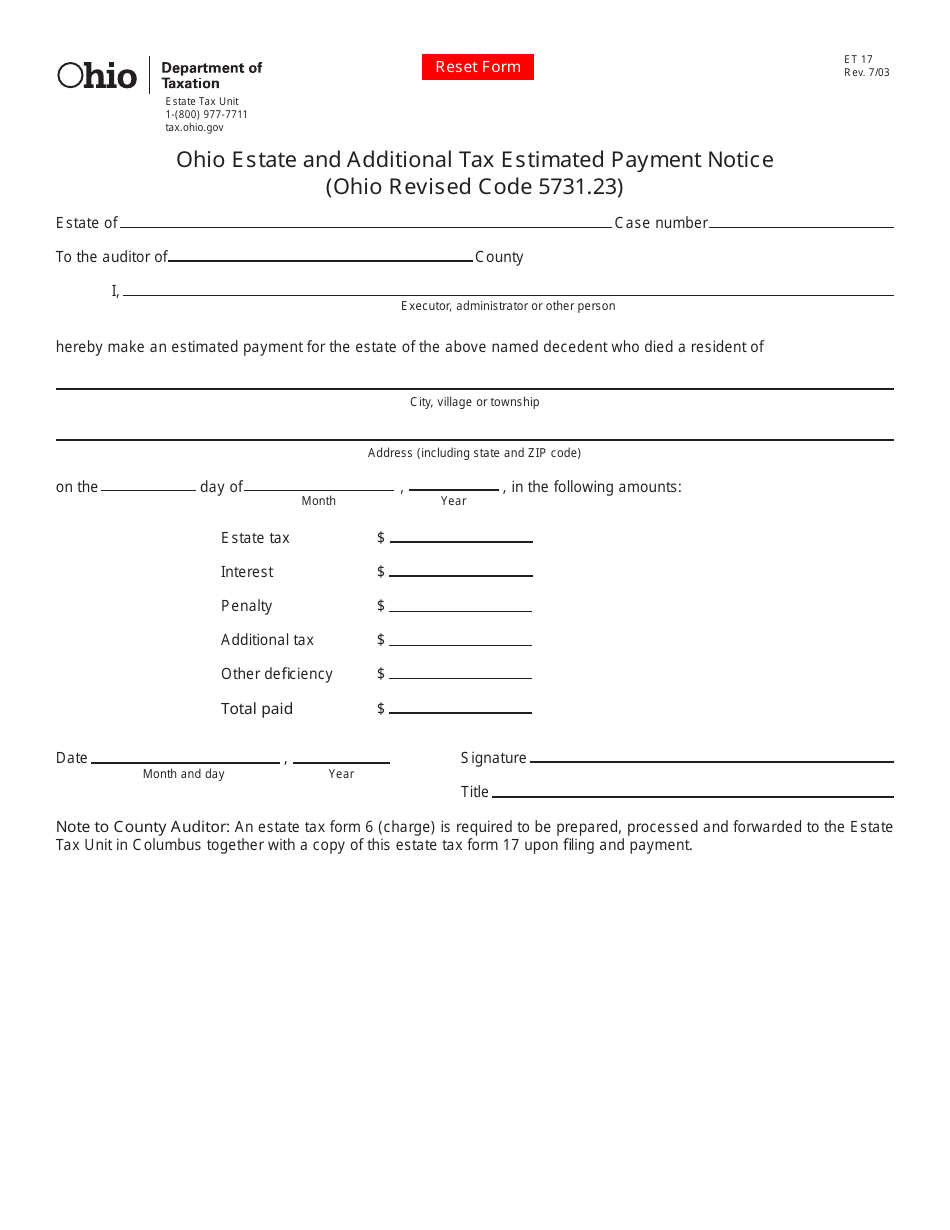

Form ET17 Ohio Estate and Additional Tax Estimated Payment Notice - Ohio

What Is Form ET17?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET17?

A: Form ET17 is the Ohio Estate and Additional Tax Estimated Payment Notice.

Q: What is the purpose of Form ET17?

A: The purpose of Form ET17 is to report and remit estimated payments of estate and additional taxes owed to the state of Ohio.

Q: Who needs to file Form ET17?

A: Executors or administrators of estates and any person liable for additional taxes in Ohio must file Form ET17.

Q: When should Form ET17 be filed?

A: Form ET17 should be filed on a quarterly basis, with the due dates falling on April 15, July 15, October 15, and January 15.

Q: Is there a penalty for late filing of Form ET17?

A: Yes, there is a penalty for late filing of Form ET17. The penalty is based on a percentage of the unpaid tax.

Q: Are there any exceptions or special circumstances for filing Form ET17?

A: There may be exceptions or special circumstances that apply to your specific situation. It is advisable to consult with a tax professional or contact the Ohio Department of Taxation for guidance.

Form Details:

- Released on July 1, 2003;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET17 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.