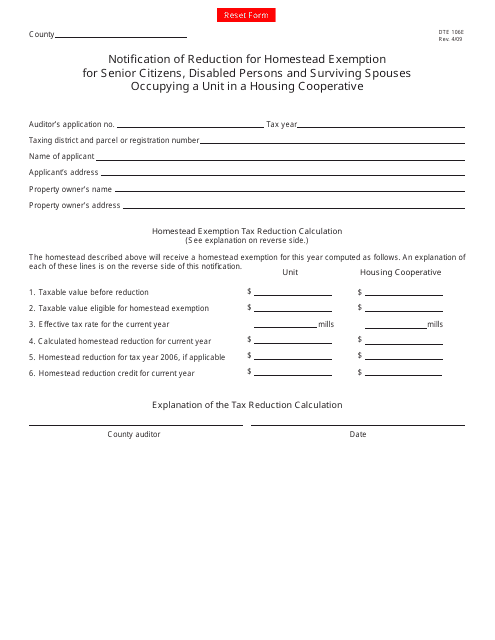

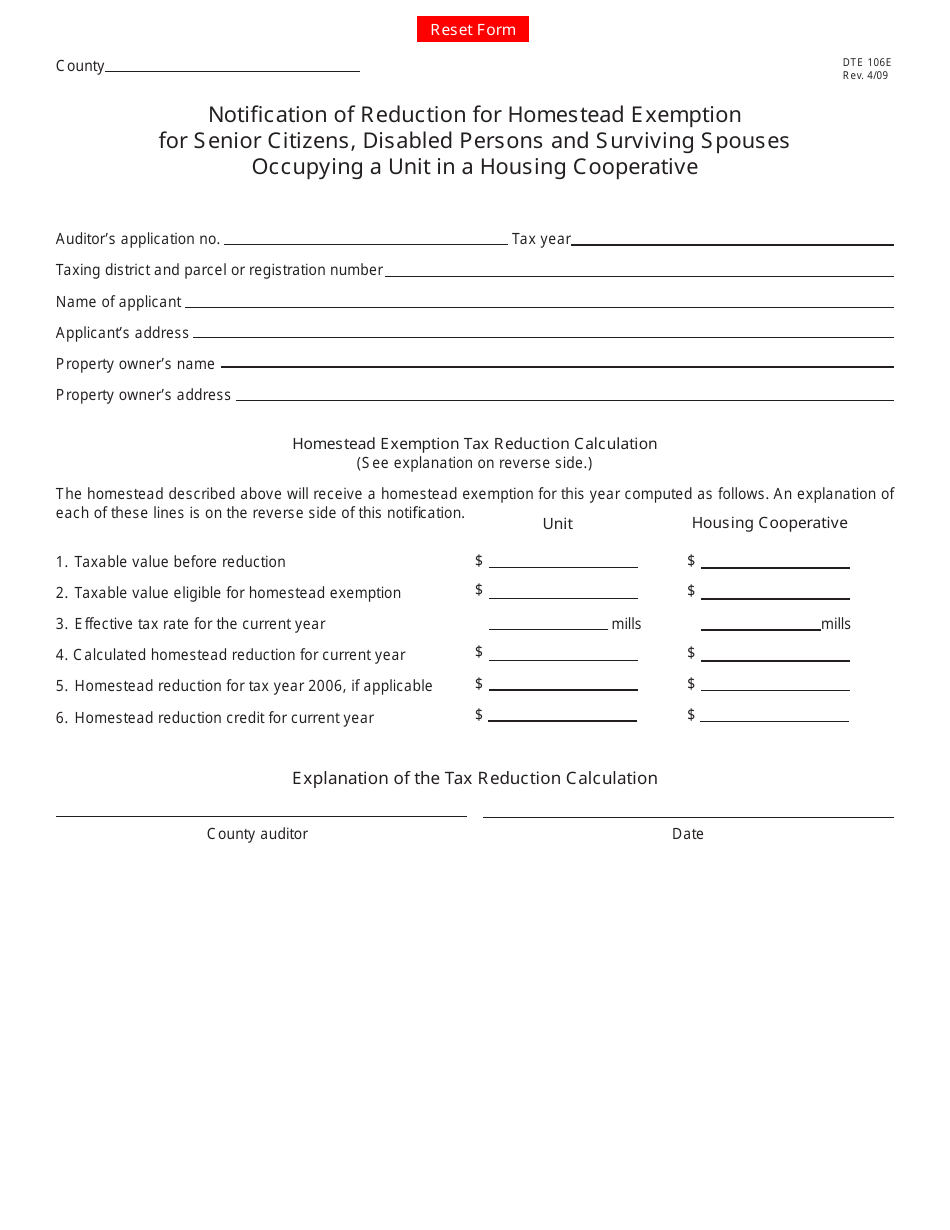

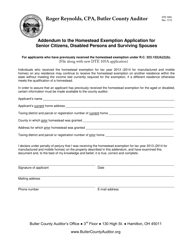

Form DTE106E Notification of Reduction for Homestead Exemption for Senior Citizens, Disabled Persons and Surviving Spouses Occupying a Unit in a Housing Cooperative - Ohio

What Is Form DTE106E?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE106E?

A: Form DTE106E is a notification form for reduction of Homestead Exemption in Ohio.

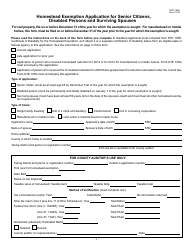

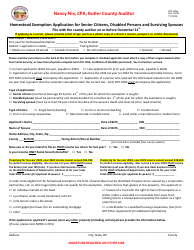

Q: Who is eligible for Homestead Exemption?

A: Senior citizens, disabled persons, and surviving spouses occupying a unit in a housing cooperative are eligible for Homestead Exemption.

Q: What is the purpose of Form DTE106E?

A: The purpose of Form DTE106E is to notify the county auditor about the reduction in Homestead Exemption.

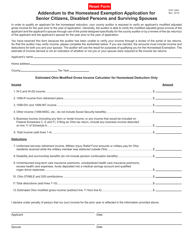

Q: What information is required on Form DTE106E?

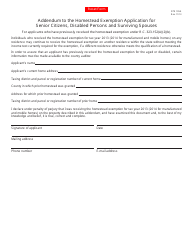

A: Form DTE106E requires information such as the applicant's name, address, date of birth, and documentation of eligibility.

Q: What is the deadline to submit Form DTE106E?

A: The deadline to submit Form DTE106E is the first Monday in June for new applications, and the first Monday in December for renewal applications.

Q: What happens after submitting Form DTE106E?

A: After submitting Form DTE106E, the county auditor will review the application and determine the eligibility for reduction in Homestead Exemption.

Q: Are there any income requirements for Homestead Exemption?

A: Yes, there are income requirements for Homestead Exemption. The applicant's income must be below a certain threshold to qualify.

Q: Can I appeal if my application for Homestead Exemption is denied?

A: Yes, if your application for Homestead Exemption is denied, you have the right to appeal the decision.

Form Details:

- Released on April 1, 2009;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE106E by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.