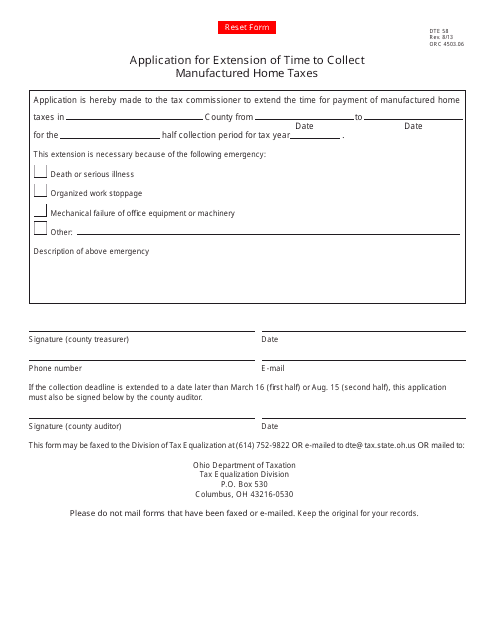

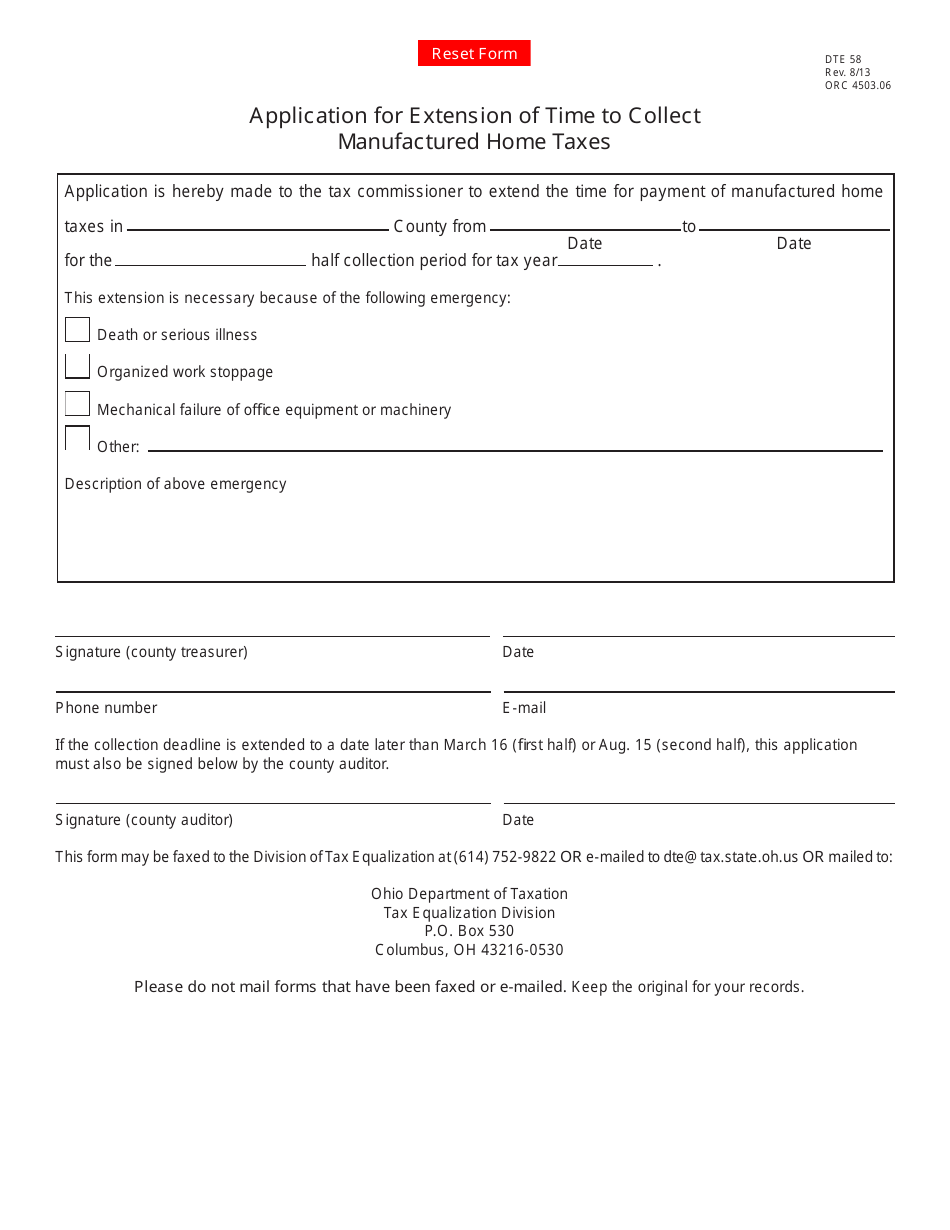

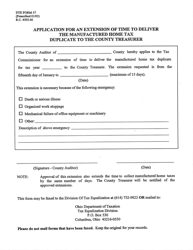

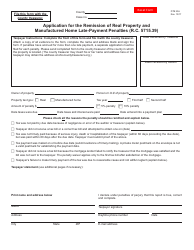

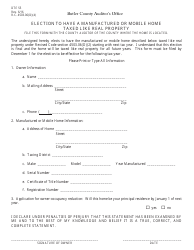

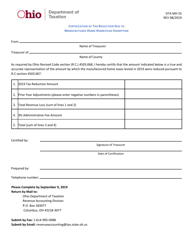

Form DTE58 Application for Extension of Time to Collect Manufactured Home Taxes - Ohio

What Is Form DTE58?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

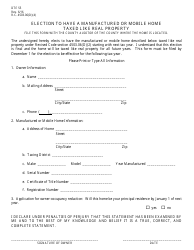

Q: What is Form DTE58?

A: Form DTE58 is the Application for Extension of Time to Collect Manufactured Home Taxes in Ohio.

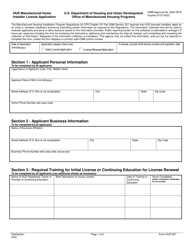

Q: Who should use Form DTE58?

A: Manufactured home owners or dealers who need additional time to collect and remit taxes should use Form DTE58.

Q: What is the purpose of Form DTE58?

A: The purpose of Form DTE58 is to request an extension of time to collect manufactured home taxes in Ohio.

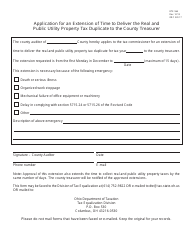

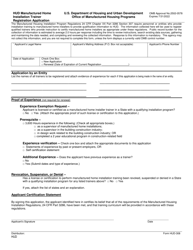

Q: When is the deadline to file Form DTE58?

A: The deadline to file Form DTE58 is 30 days before the expiration of the current registration period.

Q: Is there a fee to file Form DTE58?

A: No, there is no fee to file Form DTE58.

Q: What happens if I don't file Form DTE58?

A: If you fail to file Form DTE58 by the deadline, you may be subject to penalties and interest on the unpaid taxes.

Q: Can I file Form DTE58 electronically?

A: No, Form DTE58 must be filed by mail or in person.

Q: How long does it take to process Form DTE58?

A: It typically takes 4 to 6 weeks to process Form DTE58.

Form Details:

- Released on August 1, 2013;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE58 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.