This version of the form is not currently in use and is provided for reference only. Download this version of

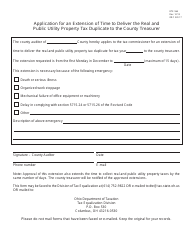

Form DTE26

for the current year.

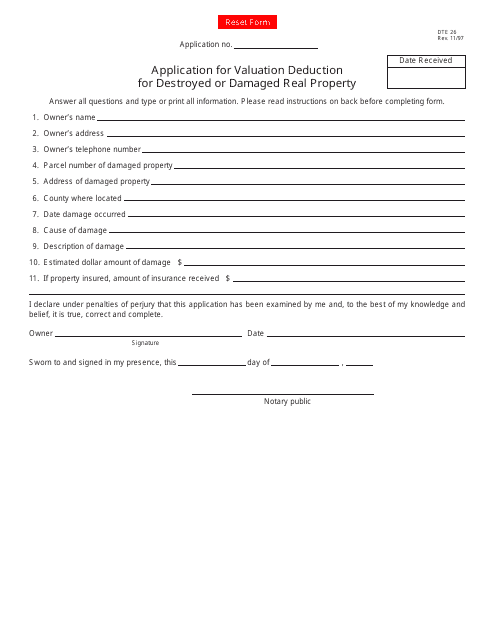

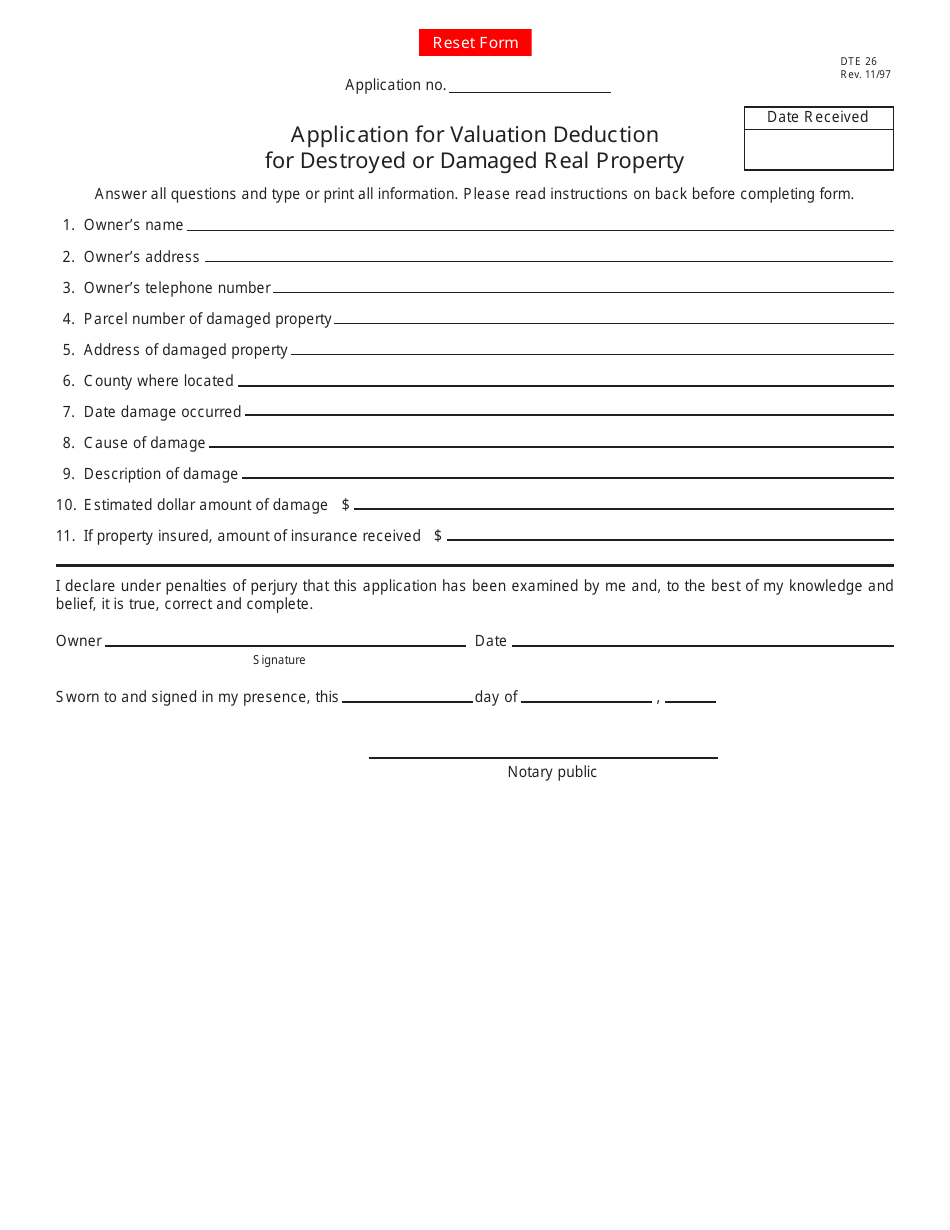

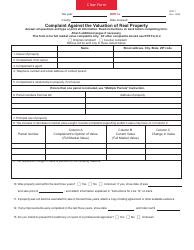

Form DTE26 Application for Valuation Deduction for Destroyed or Damaged Real Property - Ohio

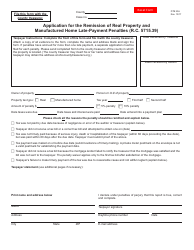

What Is Form DTE26?

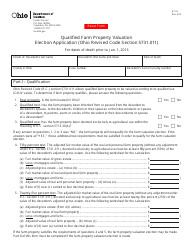

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

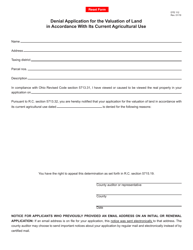

Q: What is Form DTE26?

A: Form DTE26 is the Application for Valuation Deduction for Destroyed or Damaged Real Property in Ohio.

Q: What is the purpose of Form DTE26?

A: The purpose of Form DTE26 is to apply for a deduction in property value for real property that has been destroyed or damaged in Ohio.

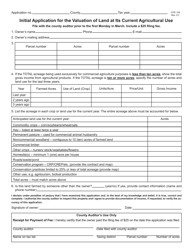

Q: Who can use Form DTE26?

A: Property owners in Ohio who have real property that has been destroyed or damaged can use Form DTE26.

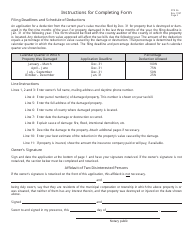

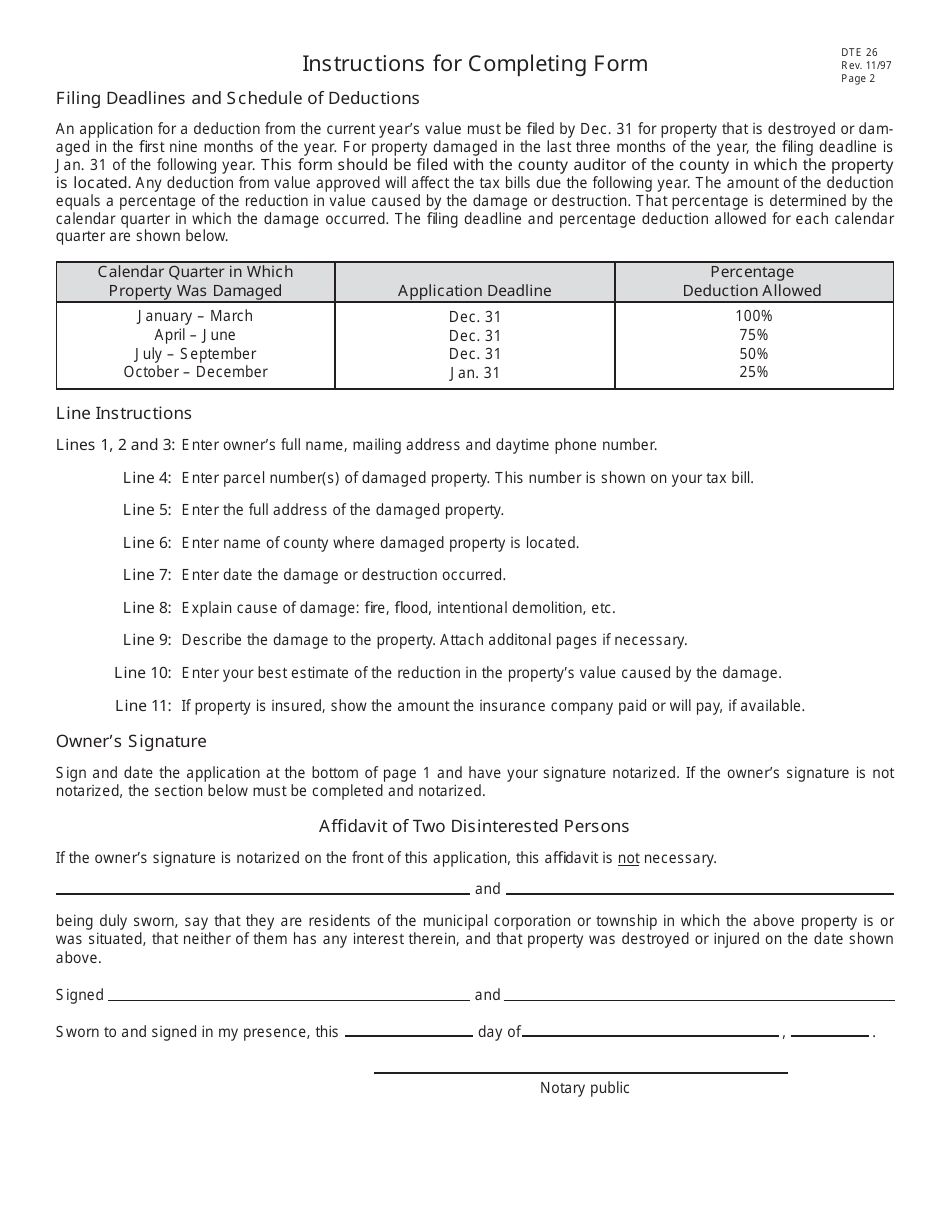

Q: How do I complete Form DTE26?

A: To complete Form DTE26, you will need to provide information about the property, the nature of the damage, and supporting documentation.

Q: Is there a deadline for filing Form DTE26?

A: Yes, Form DTE26 must be filed with the county auditor's office within 60 days of the date of the damage.

Q: Will filing Form DTE26 result in a decrease in property taxes?

A: Filing Form DTE26 may result in a decrease in the taxable value of the damaged property, which could potentially lower property taxes.

Q: Are there any fees associated with filing Form DTE26?

A: There are no fees associated with filing Form DTE26.

Q: What supporting documentation is required for Form DTE26?

A: Supporting documentation may include photographs, insurance claim forms, estimates for repair or replacement costs, and other relevant paperwork.

Q: Can I appeal the decision if my application is denied?

A: Yes, if your application is denied, you have the right to appeal the decision by filing a complaint with the county board of revision.

Form Details:

- Released on November 1, 1997;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE26 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.