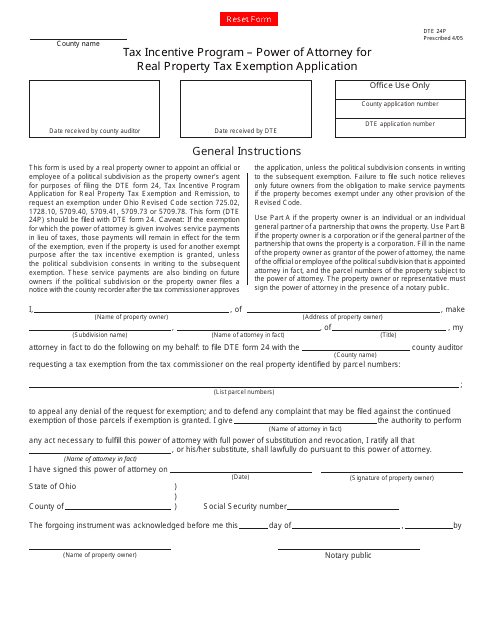

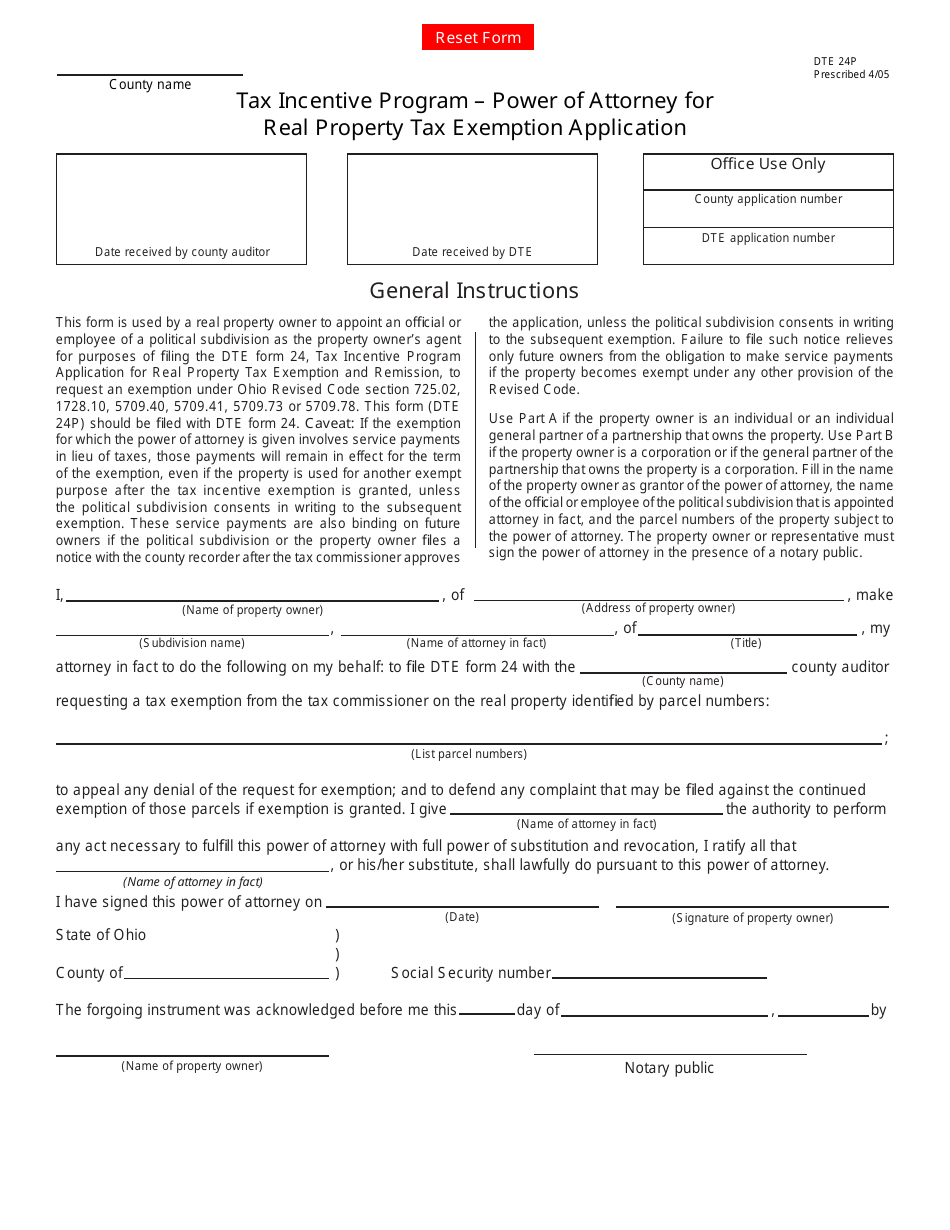

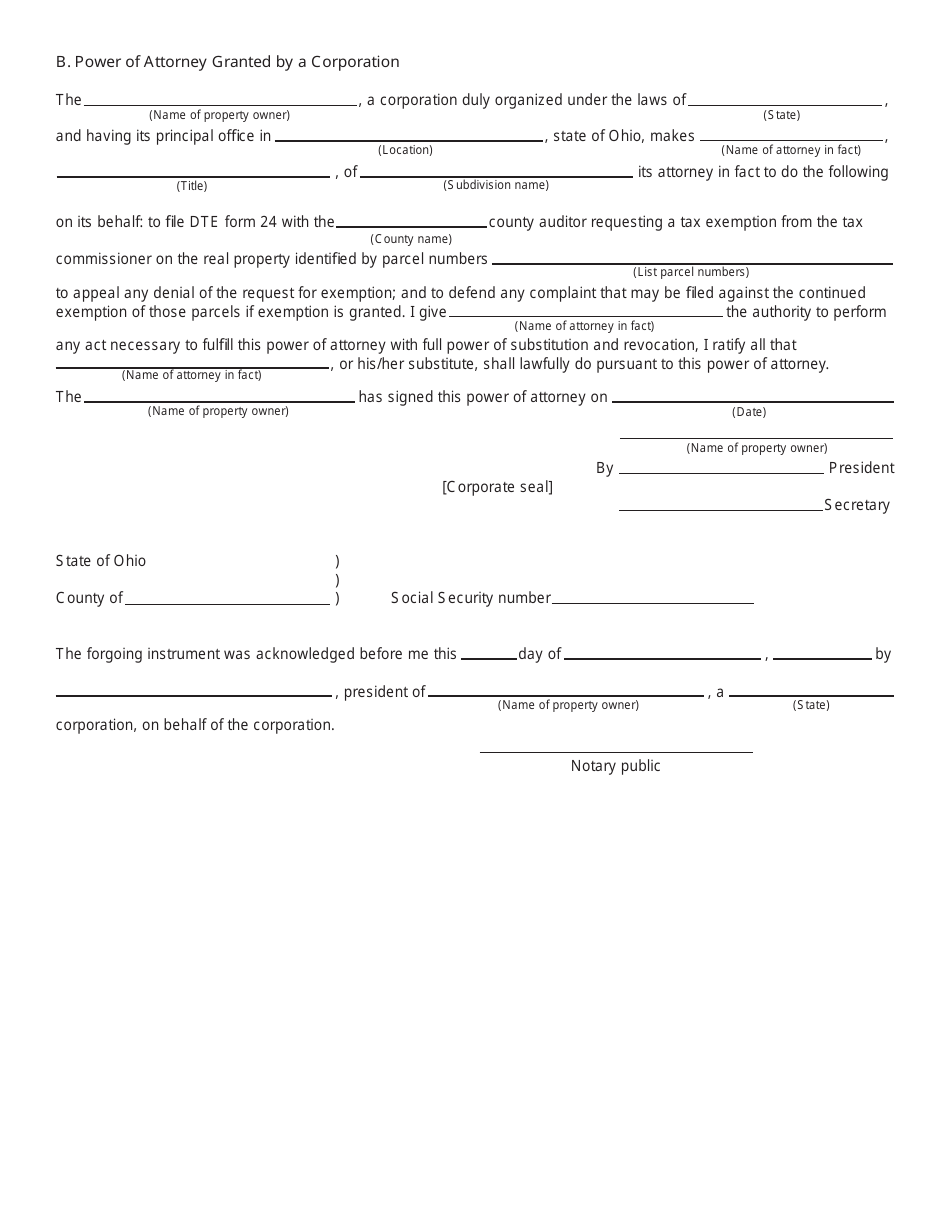

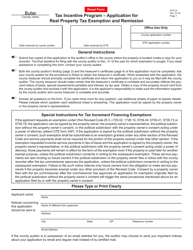

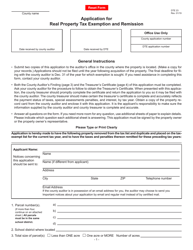

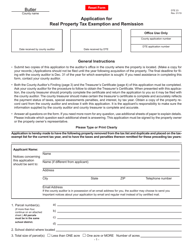

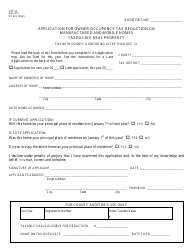

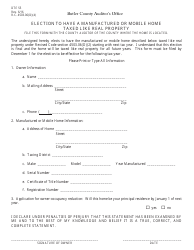

Form DTE24P Power of Attorney for Real Property Tax Exemption Application - Tax Incentive Program - Ohio

What Is Form DTE24P?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE24P?

A: Form DTE24P is the Power of Attorney for Real Property Tax Exemption Application for the Tax Incentive Program in Ohio.

Q: What is the purpose of Form DTE24P?

A: The purpose of Form DTE24P is to authorize another person or entity to act on your behalf in applying for a real property tax exemption under the Tax Incentive Program in Ohio.

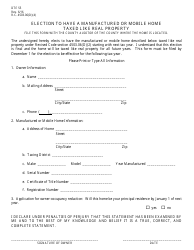

Q: Who can use Form DTE24P?

A: Any individual or entity who wants to apply for a real property tax exemption under the Tax Incentive Program in Ohio can use Form DTE24P.

Q: How do I fill out Form DTE24P?

A: To fill out Form DTE24P., you must provide your personal information, the property information, and details of the person or entity you are authorizing as your power of attorney.

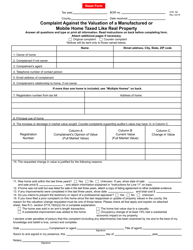

Q: Is there a fee for submitting Form DTE24P?

A: No, there is no fee for submitting Form DTE24P.

Q: What happens after I submit Form DTE24P?

A: After you submit Form DTE24P, the county auditor's office will review your application and determine your eligibility for a real property tax exemption.

Form Details:

- Released on April 1, 2005;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE24P by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.