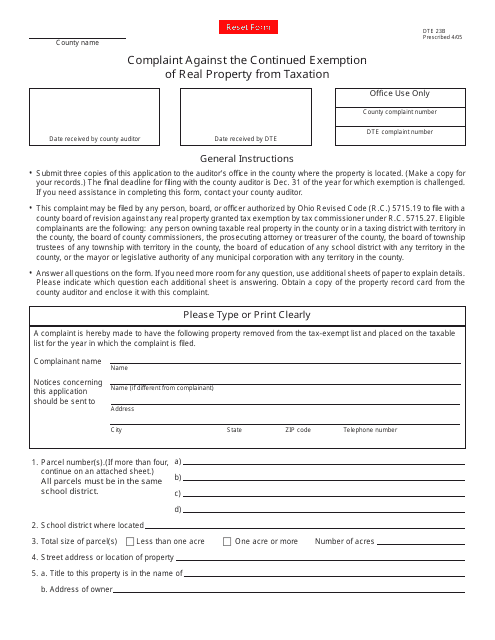

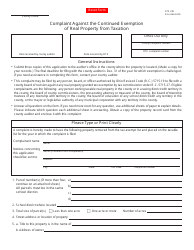

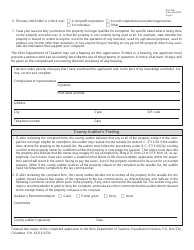

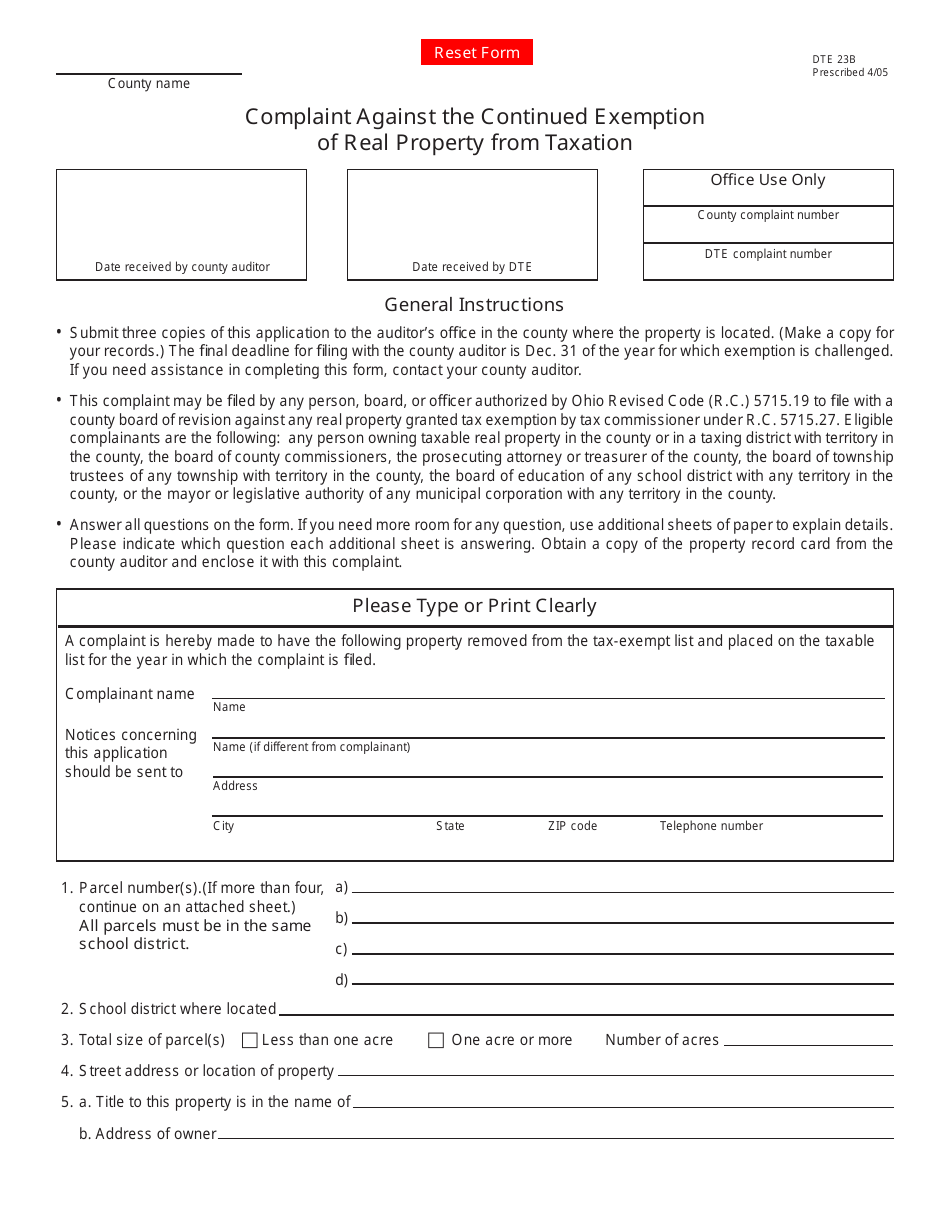

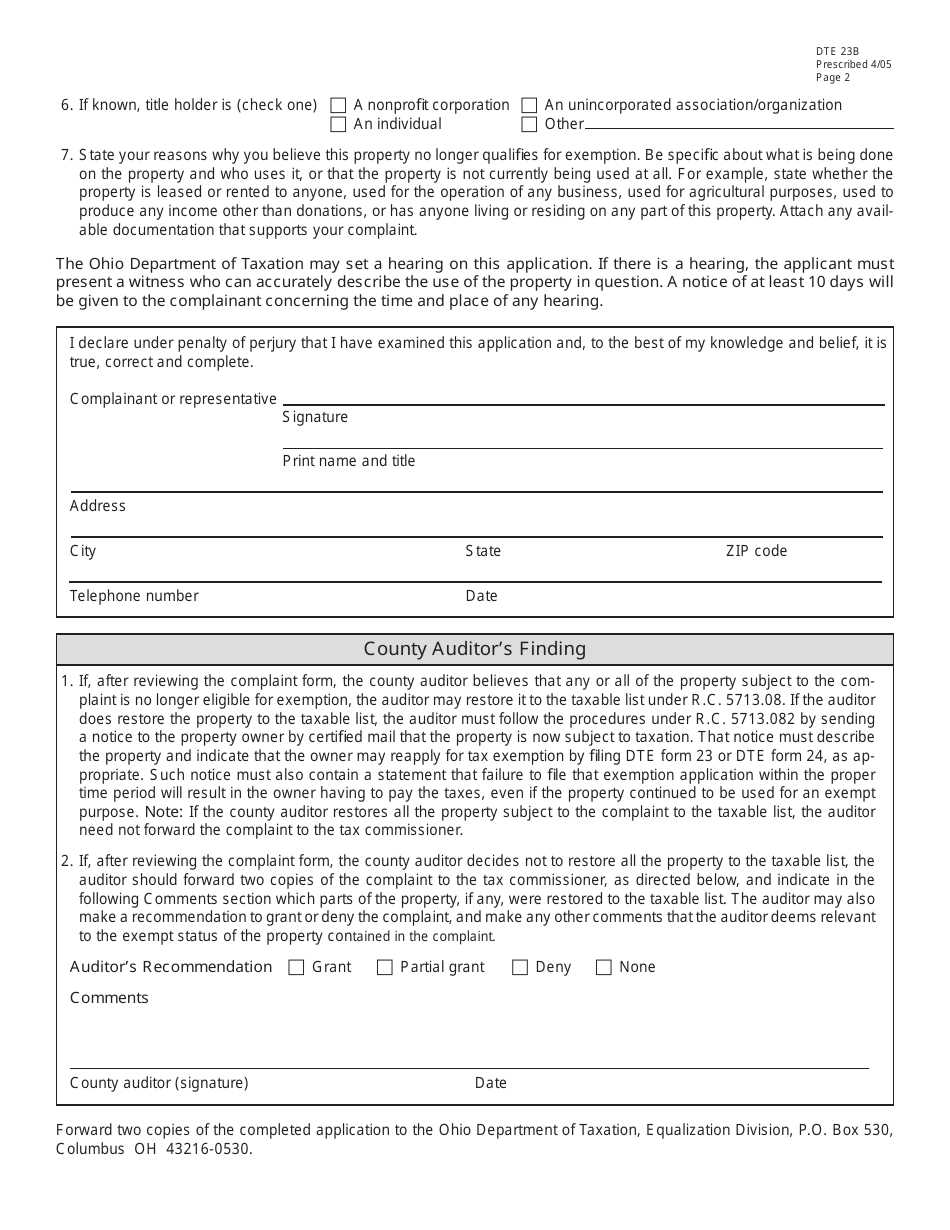

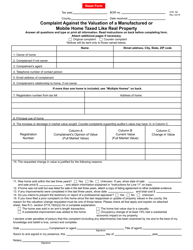

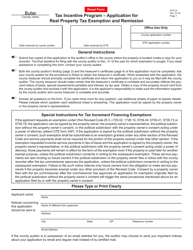

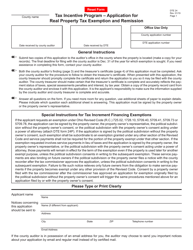

Form DTE23B Complaint Against the Continued Exemption of Real Property From Taxation - Ohio

What Is Form DTE23B?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE23B Complaint Against the Continued Exemption of Real Property From Taxation in Ohio?

A: Form DTE23B is a complaint filed in Ohio to challenge the exemption of real property from taxation.

Q: Who can file Form DTE23B in Ohio?

A: Any individual or organization who believes that a property's exemption from taxation is not warranted can file Form DTE23B.

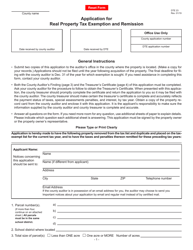

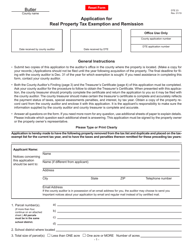

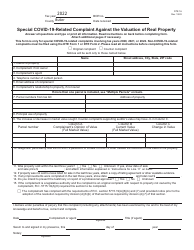

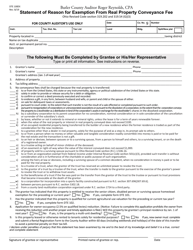

Q: What information is required to complete Form DTE23B?

A: You will need to provide detailed information about the property, the reasons why you believe the exemption is not valid, and any supporting documentation.

Q: Is there a filing fee for Form DTE23B in Ohio?

A: Yes, there is a filing fee associated with Form DTE23B. The fee amount varies by county, so you should check with your local county auditor's office for the exact fee.

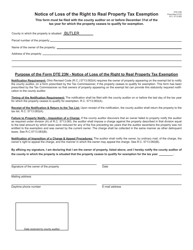

Q: What happens after I file Form DTE23B in Ohio?

A: After you file Form DTE23B, your complaint will be reviewed by the appropriate authorities, and you may be called for a hearing to present your case.

Q: Can I appeal a decision made based on Form DTE23B in Ohio?

A: Yes, if you disagree with the decision made based on Form DTE23B, you have the right to appeal within a specified timeframe.

Q: Are there any deadlines for filing Form DTE23B in Ohio?

A: Yes, there are specific deadlines for filing Form DTE23B. You should consult the Ohio Department of Taxation or your local county auditor's office for the current deadlines.

Q: Can I seek legal assistance when filing Form DTE23B in Ohio?

A: Yes, you have the option to seek legal assistance when filing Form DTE23B in Ohio to ensure that your complaint is properly prepared and presented.

Q: What are the potential outcomes of filing Form DTE23B in Ohio?

A: The outcome of filing Form DTE23B can vary. It may result in the removal of the property's tax exemption, a modification of the exemption, or a determination that the exemption is valid.

Form Details:

- Released on April 1, 2005;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE23B by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.