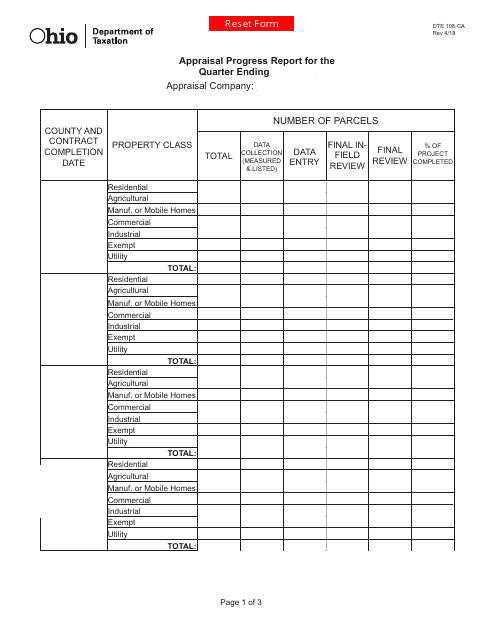

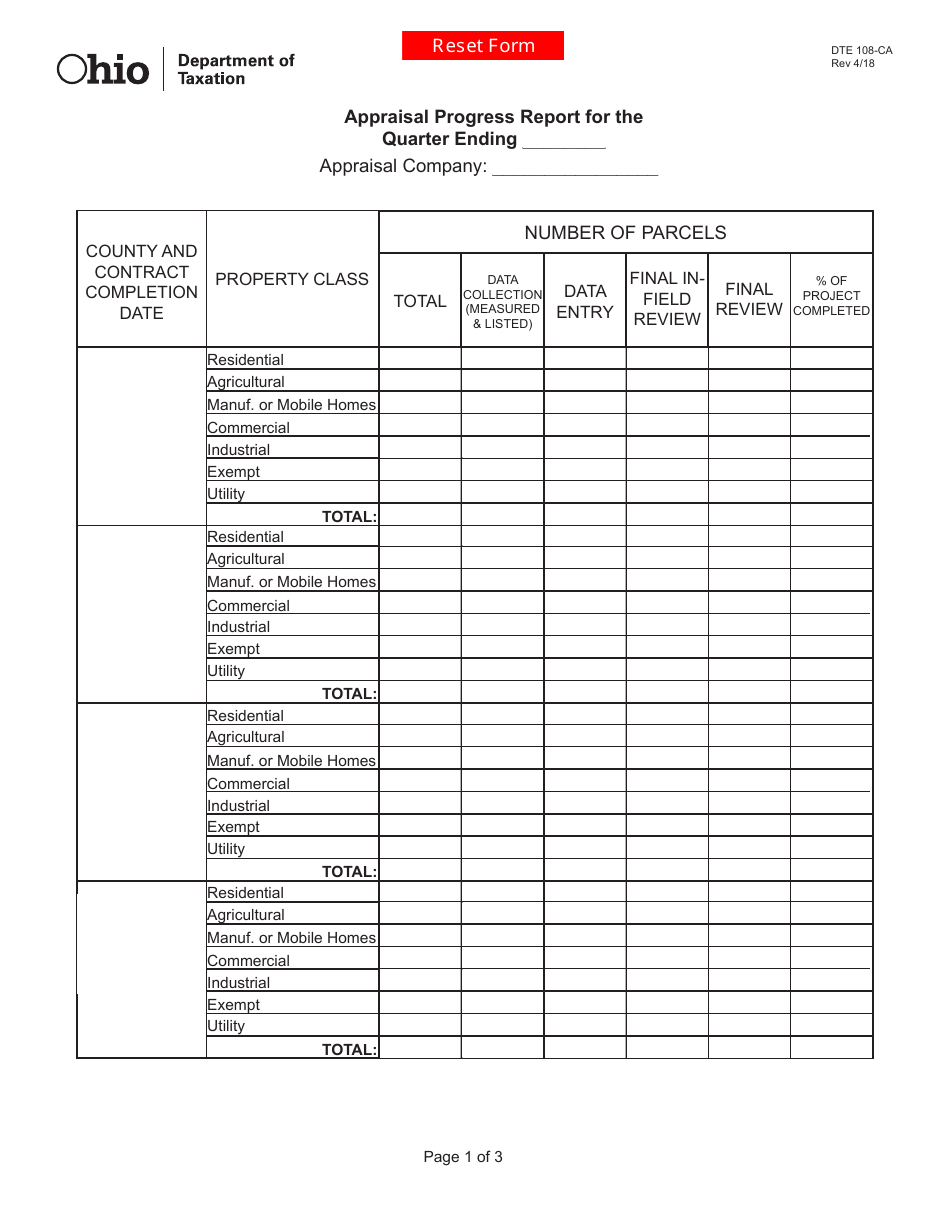

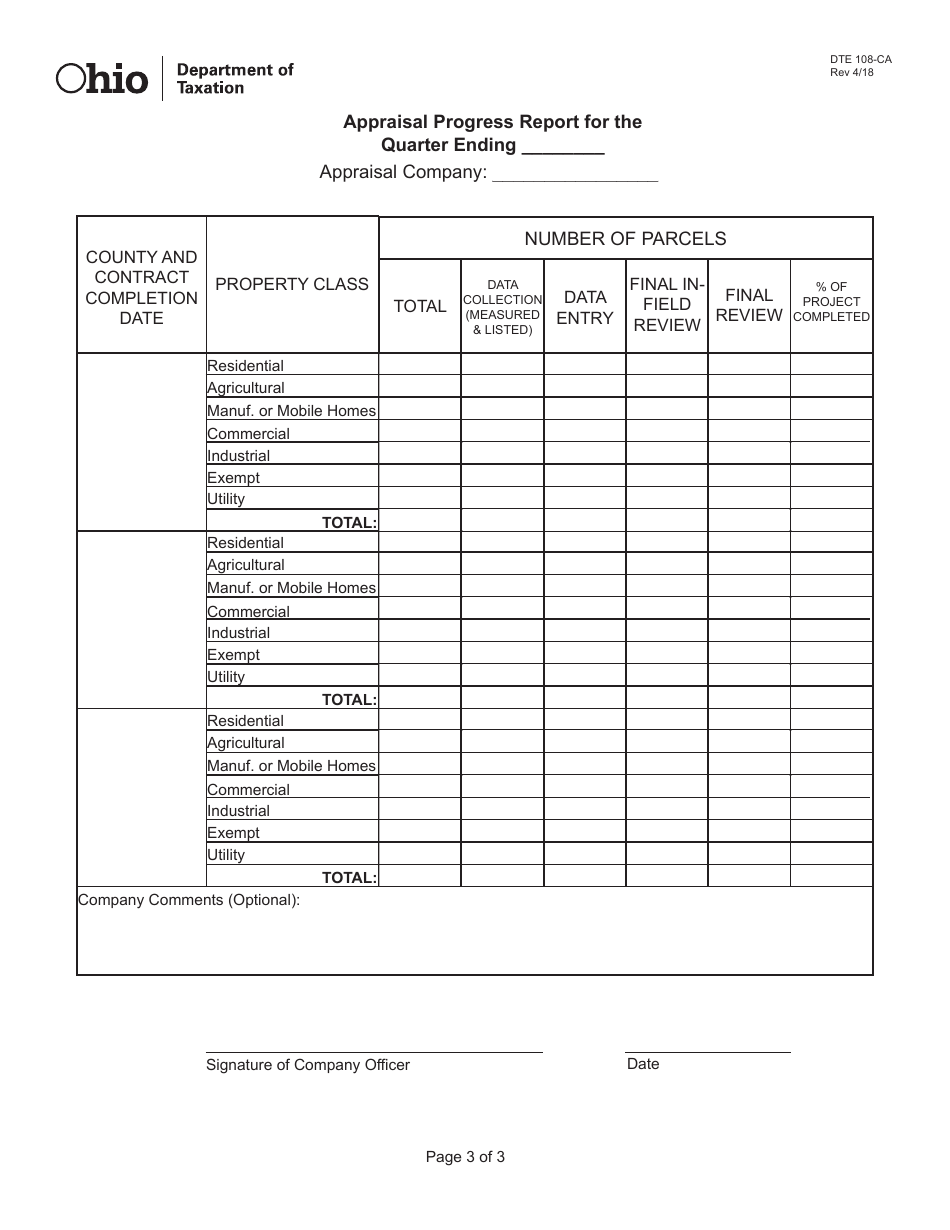

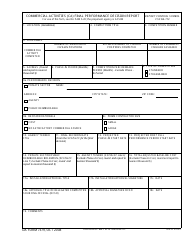

Form DTE108-CA Appraisal Progress Report for the Quarter - Ohio

What Is Form DTE108-CA?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE108-CA?

A: Form DTE108-CA is an Appraisal Progress Report for the Quarter.

Q: What is the purpose of Form DTE108-CA?

A: The purpose of Form DTE108-CA is to provide information about the progress of an appraisal for a property.

Q: Who uses Form DTE108-CA?

A: Form DTE108-CA is used by appraisers in Ohio.

Q: What information is included in Form DTE108-CA?

A: Form DTE108-CA includes details about the property being appraised, the appraiser's contact information, and updates on the progress of the appraisal.

Q: How frequently is Form DTE108-CA submitted?

A: Form DTE108-CA is submitted quarterly, meaning every three months.

Q: Is Form DTE108-CA specific to Ohio?

A: Yes, Form DTE108-CA is specific to Ohio.

Q: Is there a different form for other states?

A: Yes, other states may have their own appraisal progress report forms.

Q: Are there any fees associated with Form DTE108-CA?

A: There may be fees associated with submitting Form DTE108-CA, depending on the requirements of the Ohio Department of Taxation.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE108-CA by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.