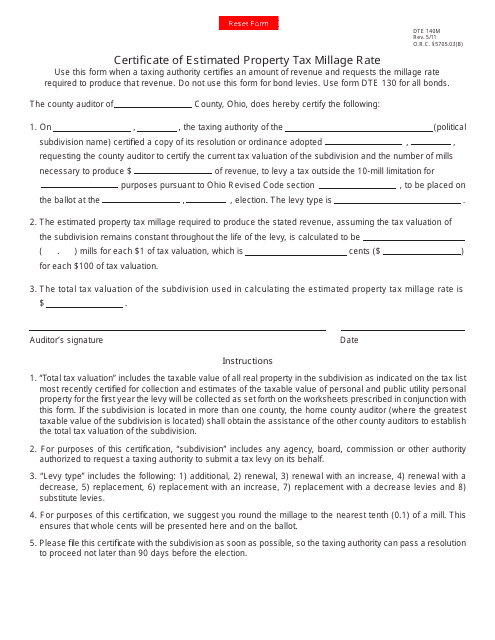

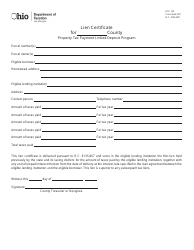

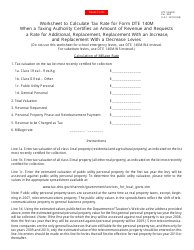

Form DTE140M Certificate of Estimated Property Tax Millage Rate - Ohio

What Is Form DTE140M?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE140M?

A: Form DTE140M is the Certificate of Estimated Property Tax Millage Rate in Ohio.

Q: What is the purpose of Form DTE140M?

A: The purpose of Form DTE140M is to provide an estimated property tax millage rate for a specific taxing district in Ohio.

Q: Who needs to file Form DTE140M?

A: Property owners in Ohio who are required to pay property taxes in a specific taxing district need to file Form DTE140M.

Q: When should Form DTE140M be filed?

A: Form DTE140M should be filed by property owners in Ohio before the first Monday in September.

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE140M by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.