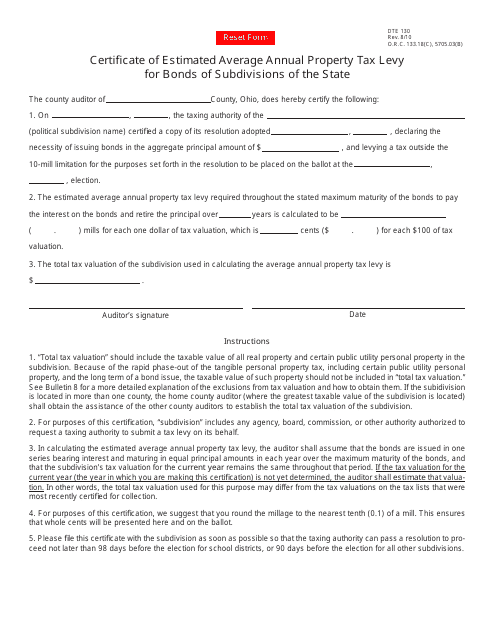

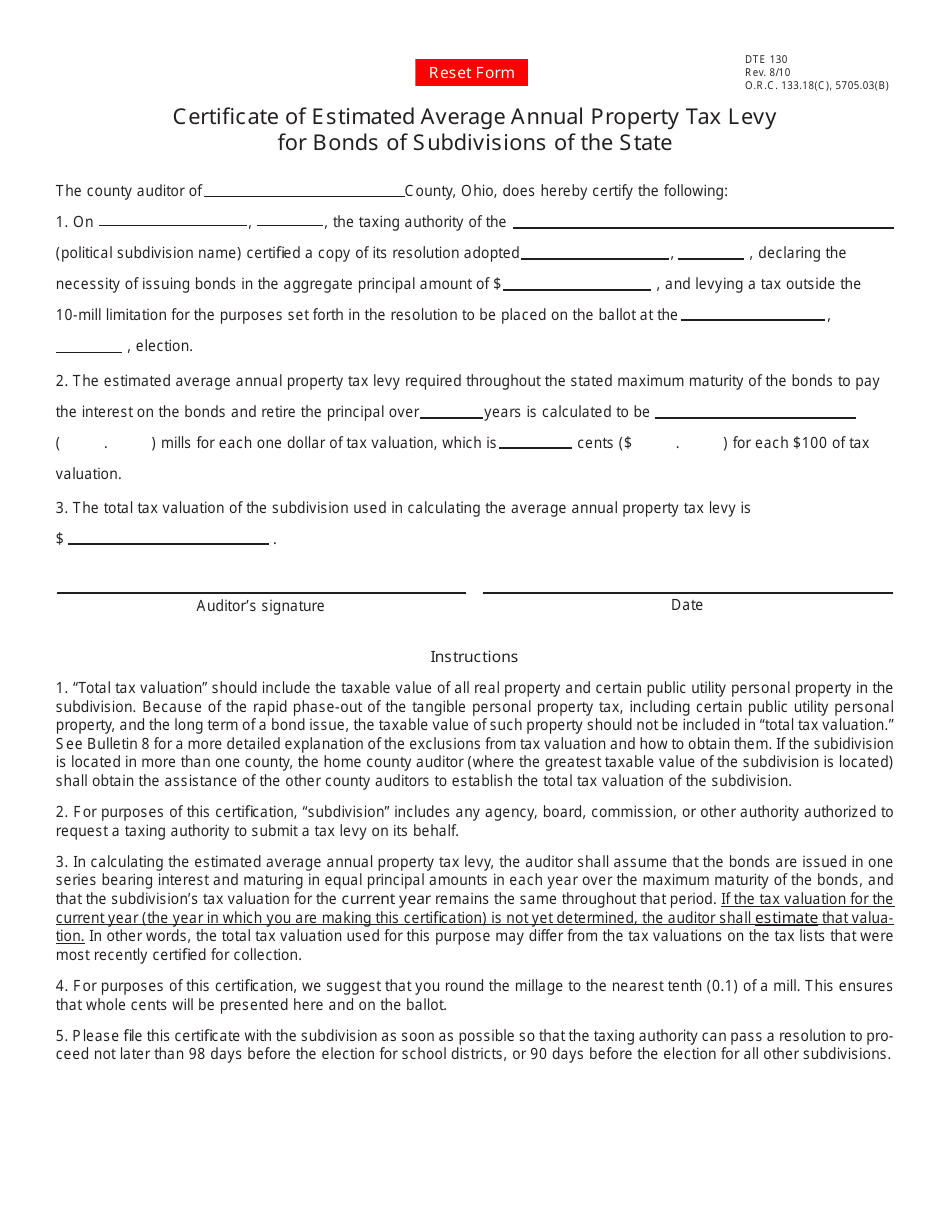

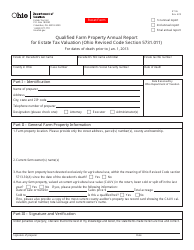

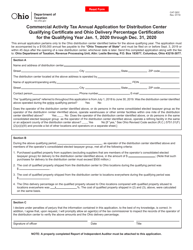

Form DTE130 Certificate of Estimated Average Annual Property Tax Levy for Bonds of Subdivisions of the State - Ohio

What Is Form DTE130?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form DTE130 Certificate of Estimated Average Annual Property Tax Levy for Bonds of Subdivisions of the State?

A: The Form DTE130 is a certificate used in Ohio to estimate the average annual property tax levy for bonds of subdivisions of the state.

Q: Who uses the Form DTE130 Certificate?

A: Subdivisions of the state in Ohio use the Form DTE130 Certificate.

Q: What is the purpose of the Form DTE130 Certificate?

A: The purpose of the Form DTE130 Certificate is to provide an estimate of the average annual property tax levy for bonds of subdivisions of the state.

Q: Do I need to file the Form DTE130 Certificate?

A: If you are a subdivision of the state in Ohio issuing bonds, you are required to file the Form DTE130 Certificate to estimate the average annual property tax levy for those bonds.

Q: What information do I need to fill out the Form DTE130 Certificate?

A: You will need information such as the type of bond, the total principal amount of the bond issue, the estimated interest rate, and the estimated term of the bond.

Q: When should I file the Form DTE130 Certificate?

A: The Form DTE130 Certificate should be filed at least 75 days prior to the date on which the bonds are to be issued.

Q: Are there any fees associated with filing the Form DTE130 Certificate?

A: There are no fees associated with filing the Form DTE130 Certificate.

Q: What happens after I file the Form DTE130 Certificate?

A: After you file the Form DTE130 Certificate, the Ohio Department of Taxation will review the information and provide you with an estimate of the average annual property tax levy for the bonds.

Q: Can I make changes to the Form DTE130 Certificate after filing?

A: If you need to make changes to the Form DTE130 Certificate after filing, you must submit an amended certificate to the Ohio Department of Taxation.

Form Details:

- Released on August 1, 2010;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE130 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.