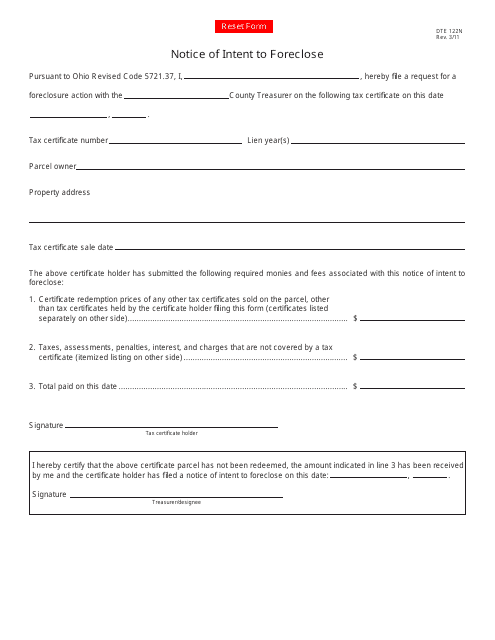

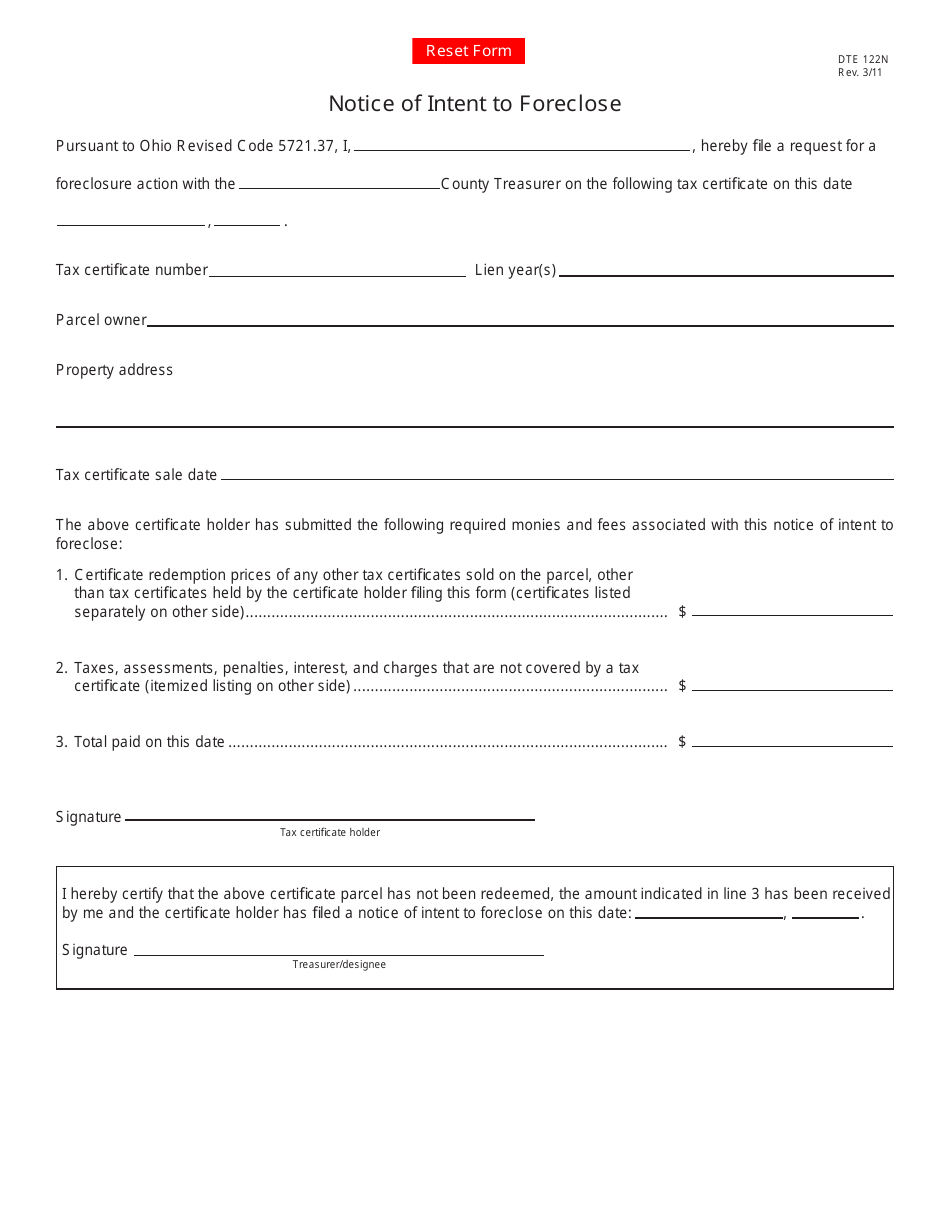

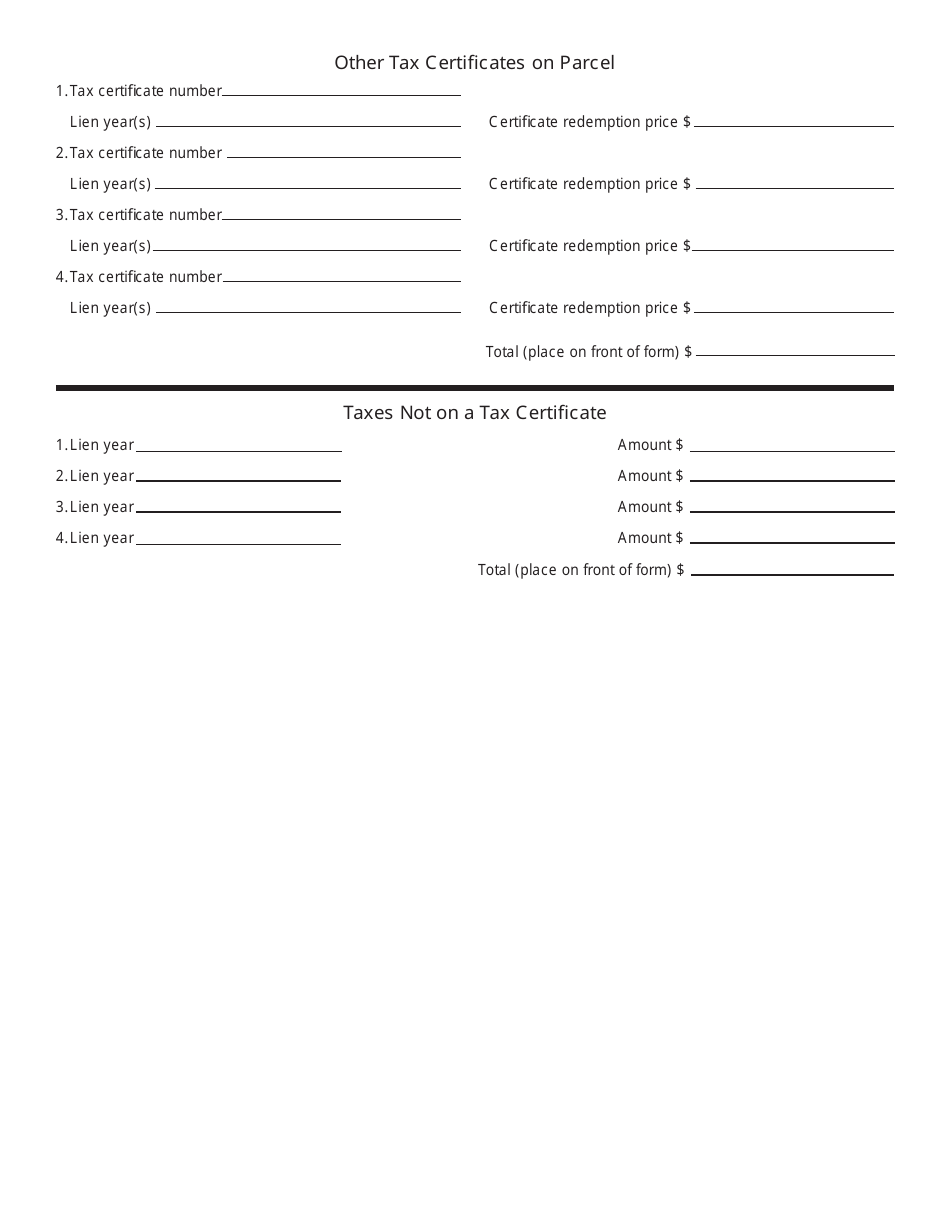

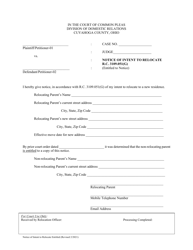

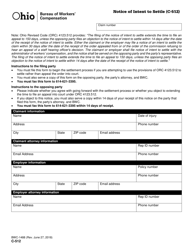

Form DTE122N Notice of Intent to Foreclose - Ohio

What Is Form DTE122N?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form DTE122N?

A: Form DTE122N is a Notice of Intent to Foreclose in the state of Ohio.

Q: Who uses Form DTE122N?

A: Form DTE122N is used by mortgage lenders or their authorized representatives in Ohio who intend to foreclose on a property.

Q: What is the purpose of Form DTE122N?

A: The purpose of Form DTE122N is to provide notice to the property owner and any other interested parties of the mortgage lender's intent to foreclose on the property.

Q: When should Form DTE122N be filed?

A: Form DTE122N should be filed at least 90 days before the date of the intended foreclosure sale.

Q: Is there a fee for filing Form DTE122N?

A: Yes, there is a filing fee associated with submitting Form DTE122N. The fee amount may vary depending on the county.

Q: What happens after Form DTE122N is filed?

A: After Form DTE122N is filed, the county auditor will provide the mortgage lender with a certificate of foreclosure, which is required to proceed with the foreclosure process.

Q: Can Form DTE122N be rescinded?

A: Yes, the mortgage lender can rescind Form DTE122N by filing a Form DTE122NR (Notice of Rescission of Notice of Intent to Foreclose) if the foreclosure is no longer necessary.

Form Details:

- Released on March 1, 2011;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE122N by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.