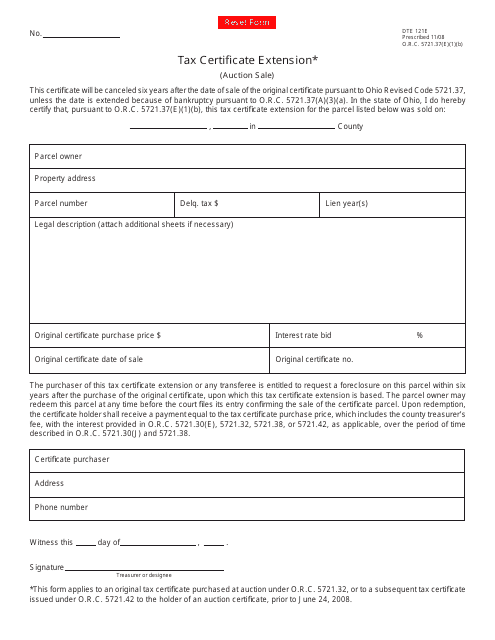

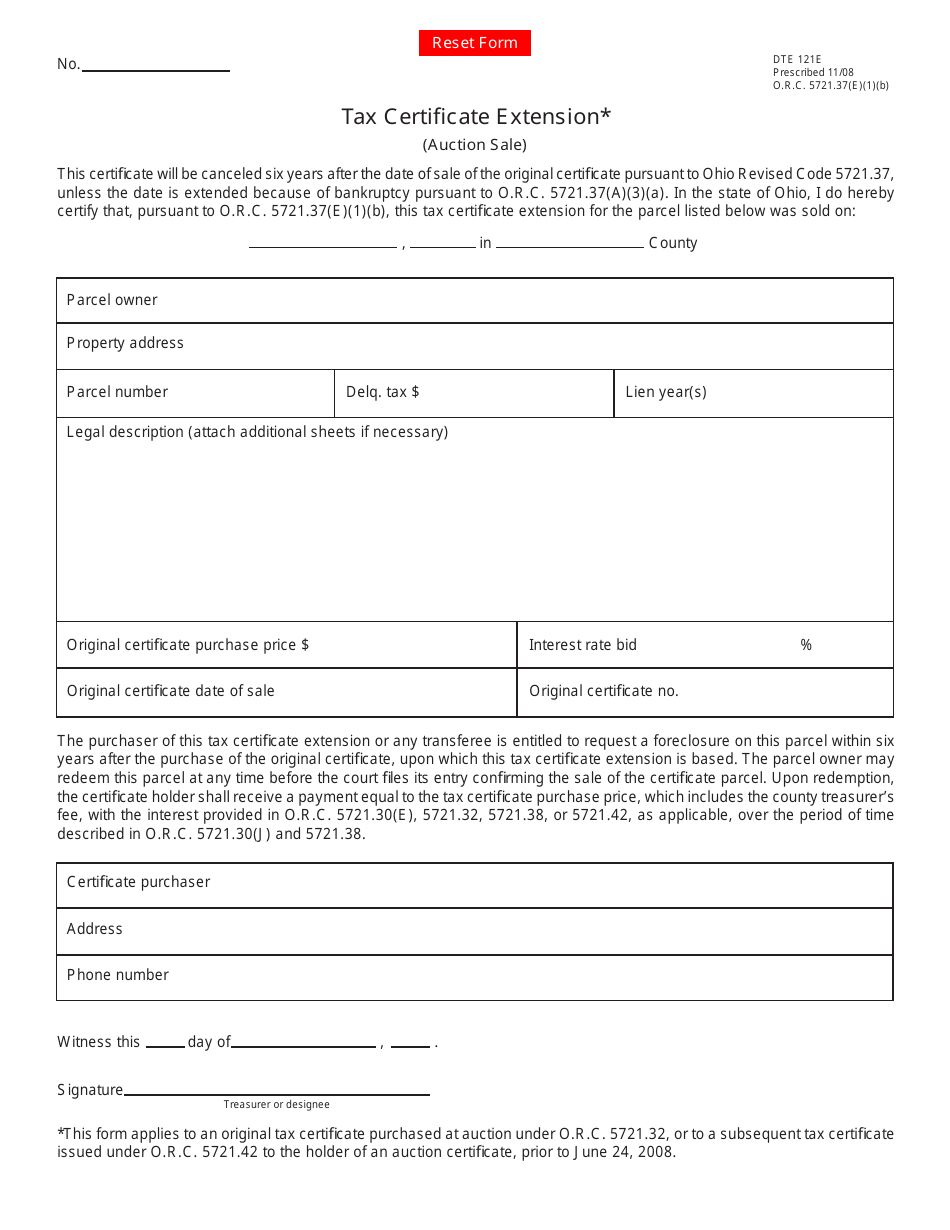

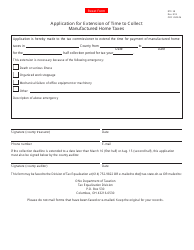

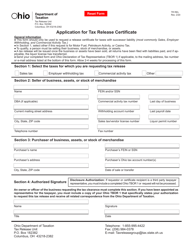

Form DTE121E Tax Certificate Extension - Ohio

What Is Form DTE121E?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE121E?

A: Form DTE121E is a tax certificate extension form in Ohio.

Q: What is a tax certificate extension?

A: A tax certificate extension allows taxpayers to request additional time to complete and submit their tax certificate.

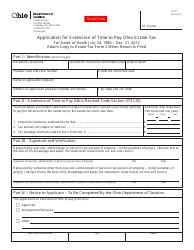

Q: Who needs to file Form DTE121E?

A: Anyone in Ohio who needs more time to complete their tax certificate must file Form DTE121E.

Q: What information do I need to provide on Form DTE121E?

A: You will need to provide your name, contact information, tax year, and any other information requested on the form.

Q: What is the deadline for filing Form DTE121E?

A: The deadline for filing Form DTE121E varies and will be specified on the form or in the instructions.

Q: Can I file Form DTE121E after the deadline?

A: It is best to file Form DTE121E before the deadline, but if you miss the deadline, you may still be able to file and request an extension.

Q: Does filing Form DTE121E guarantee a tax certificate extension?

A: Filing Form DTE121E does not guarantee a tax certificate extension. The Ohio Department of Taxation will review your request and determine if an extension will be granted.

Q: Are there any fees associated with filing Form DTE121E?

A: There may be fees associated with filing Form DTE121E, depending on the instructions provided by the Ohio Department of Taxation.

Form Details:

- Released on November 1, 2008;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE121E by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.