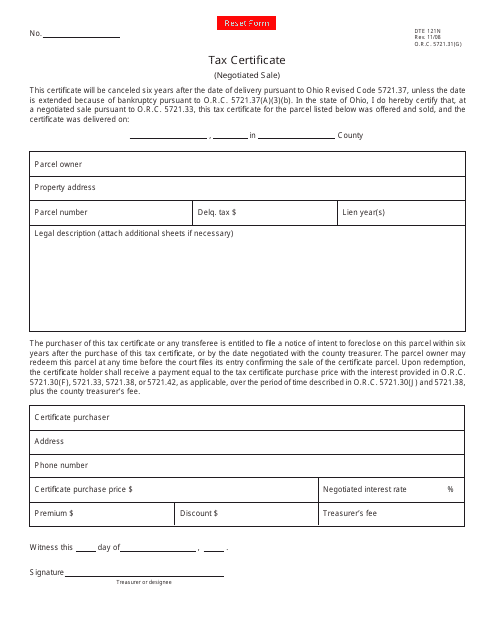

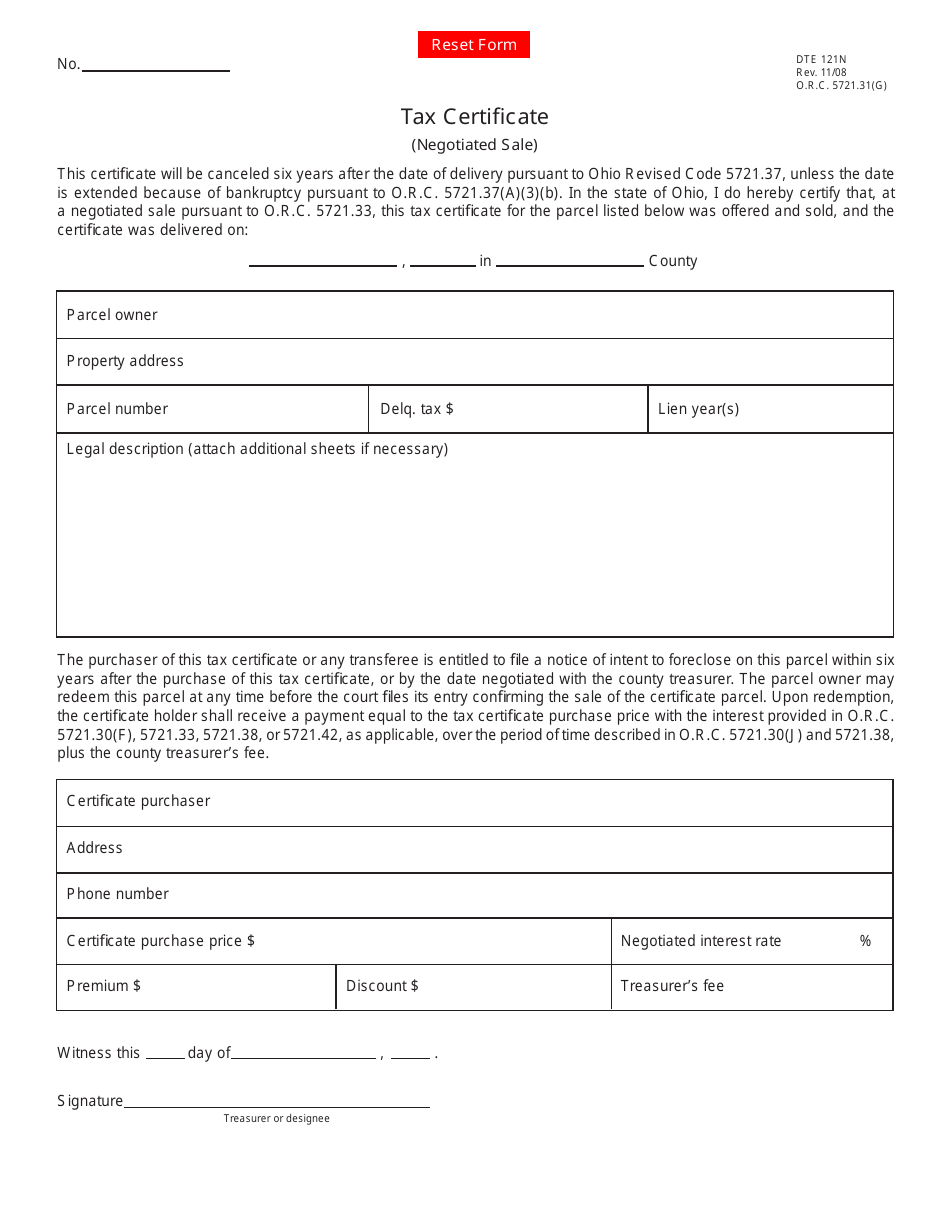

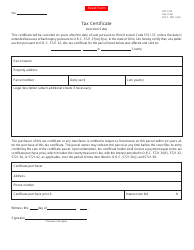

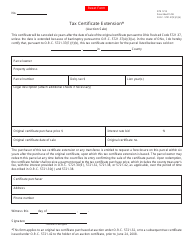

Form DTE121N Tax Certificate (Negotiated Sale) - Ohio

What Is Form DTE121N?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE121N Tax Certificate?

A: Form DTE121N Tax Certificate is a document used in Ohio for a negotiated sale of a property.

Q: Who uses Form DTE121N Tax Certificate?

A: Form DTE121N Tax Certificate is used by the seller and buyer of a property in a negotiated sale.

Q: What is the purpose of Form DTE121N Tax Certificate?

A: The purpose of Form DTE121N Tax Certificate is to provide information about the property's tax status and any outstanding taxes.

Q: Is Form DTE121N Tax Certificate required for all property sales in Ohio?

A: Form DTE121N Tax Certificate is required for negotiated sales of property in Ohio, but not for foreclosure or sheriff's sales.

Form Details:

- Released on November 1, 2008;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE121N by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.