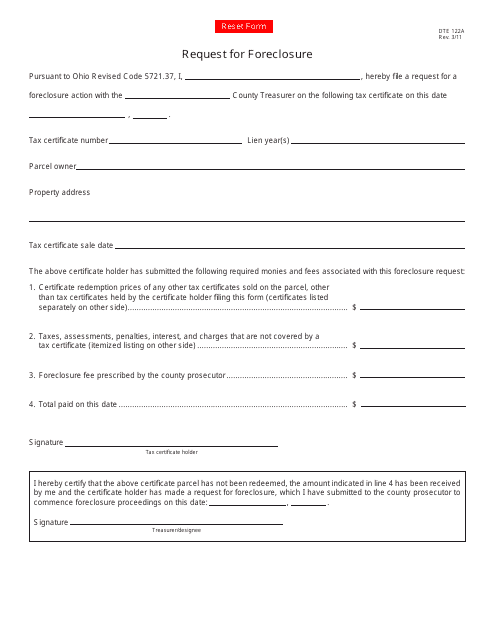

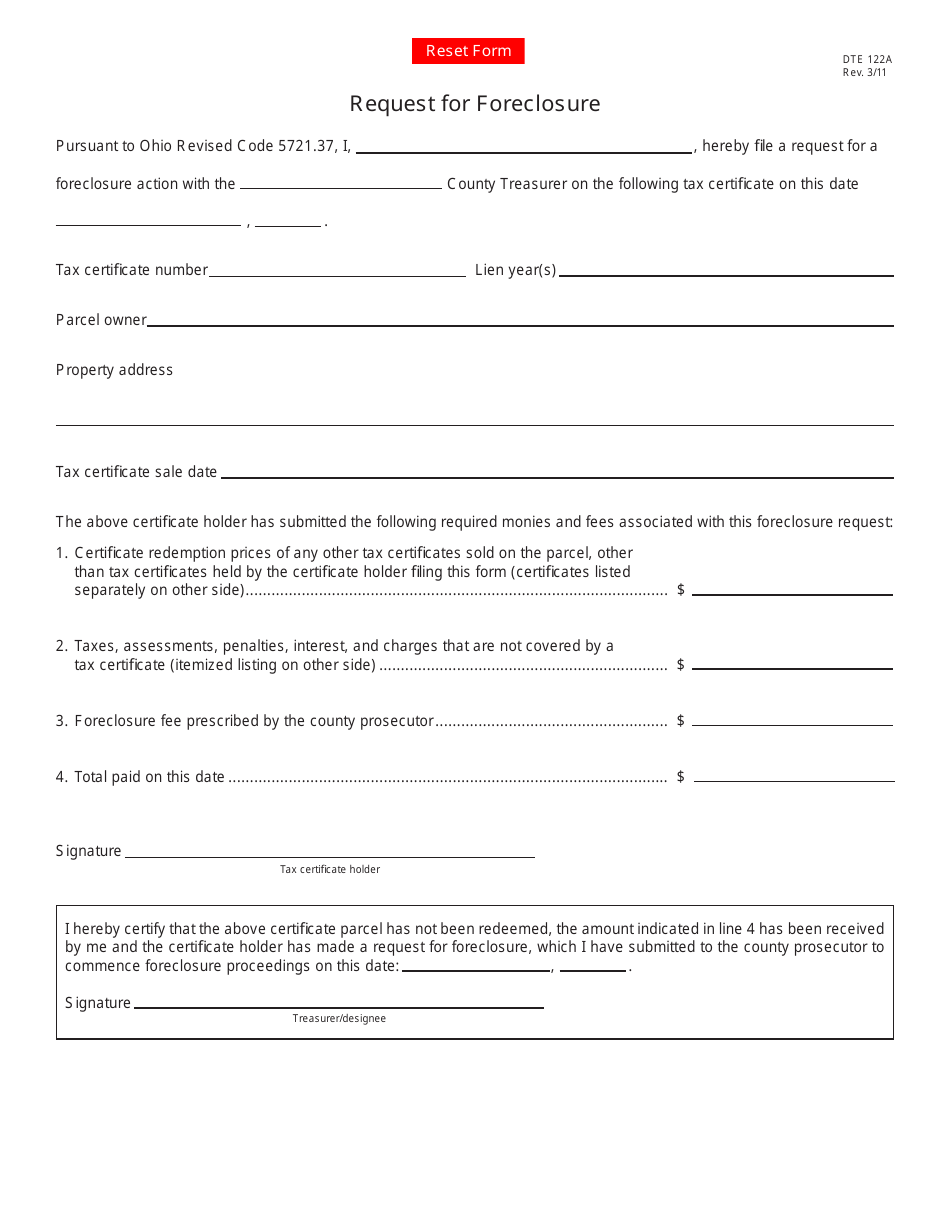

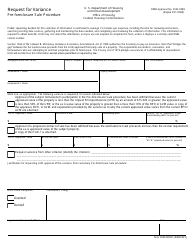

Form DTE122A Request for Foreclosure - Ohio

What Is Form DTE122A?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE122A?

A: Form DTE122A is a Request for Foreclosure form in Ohio.

Q: Why would someone use Form DTE122A?

A: Form DTE122A is used to request a foreclosure on a property in Ohio.

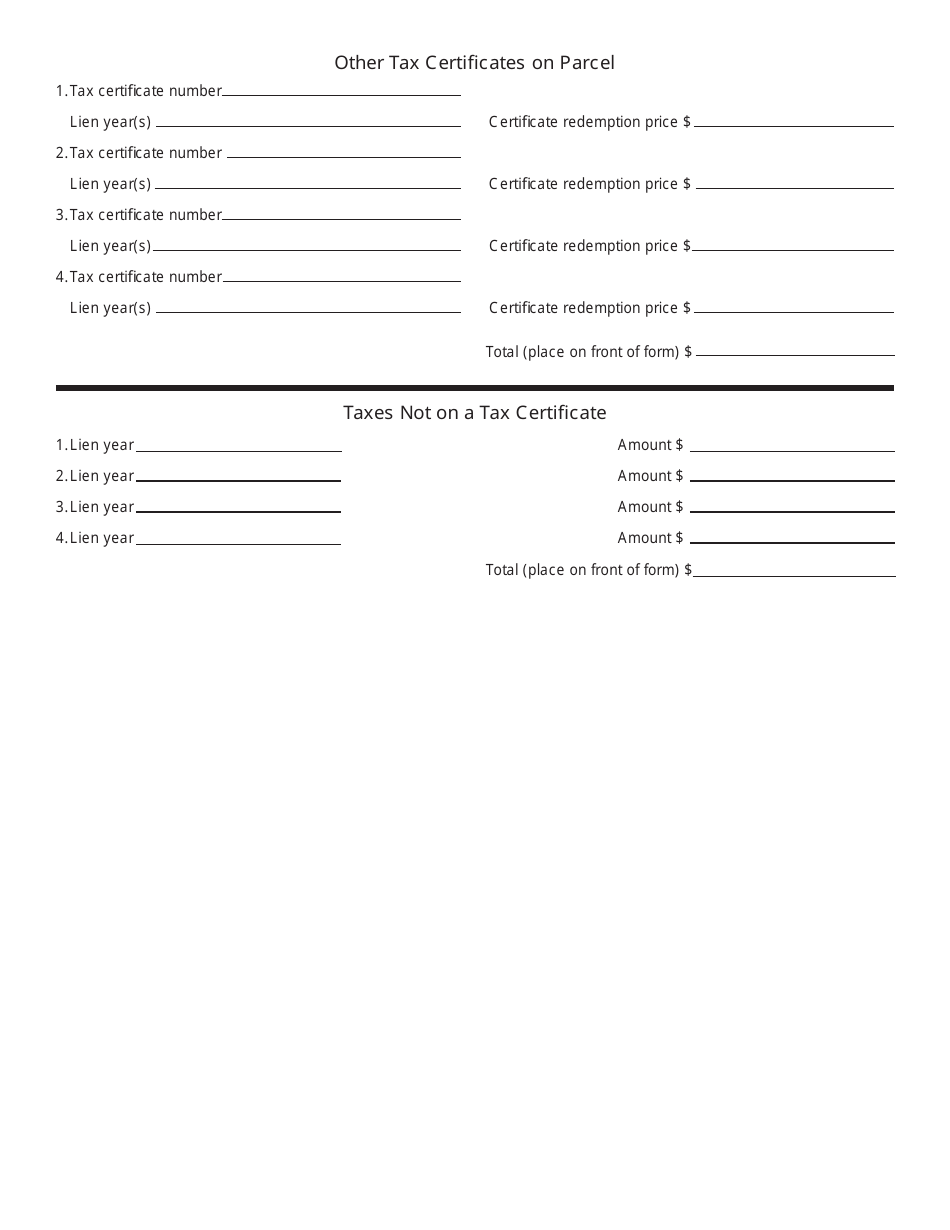

Q: What information is required on Form DTE122A?

A: Form DTE122A requires information such as the property owner's name, address, and tax parcel number, as well as the reason for the foreclosure request.

Q: What should I do after completing Form DTE122A?

A: After completing Form DTE122A, you should submit it to the appropriate county treasurer's office along with any required documentation and fees.

Q: What happens after submitting Form DTE122A?

A: After submitting Form DTE122A, the county treasurer's office will review your request and determine if the foreclosure will proceed.

Q: Can I appeal a decision made based on Form DTE122A?

A: Yes, you may have the right to appeal a decision made based on Form DTE122A. Contact your local county treasurer's office for more information about the appeal process.

Form Details:

- Released on March 1, 2011;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE122A by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.