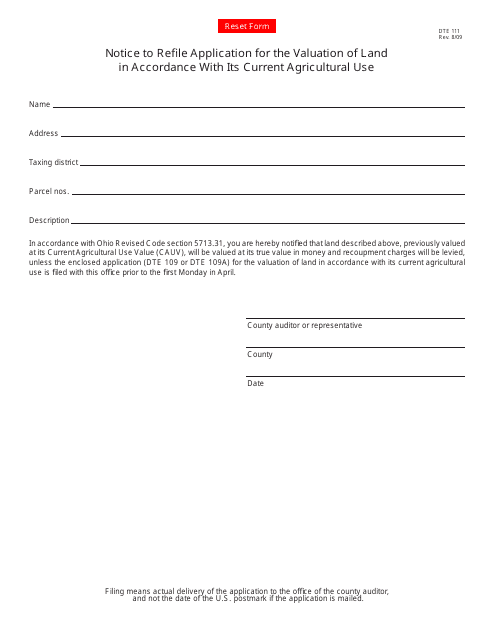

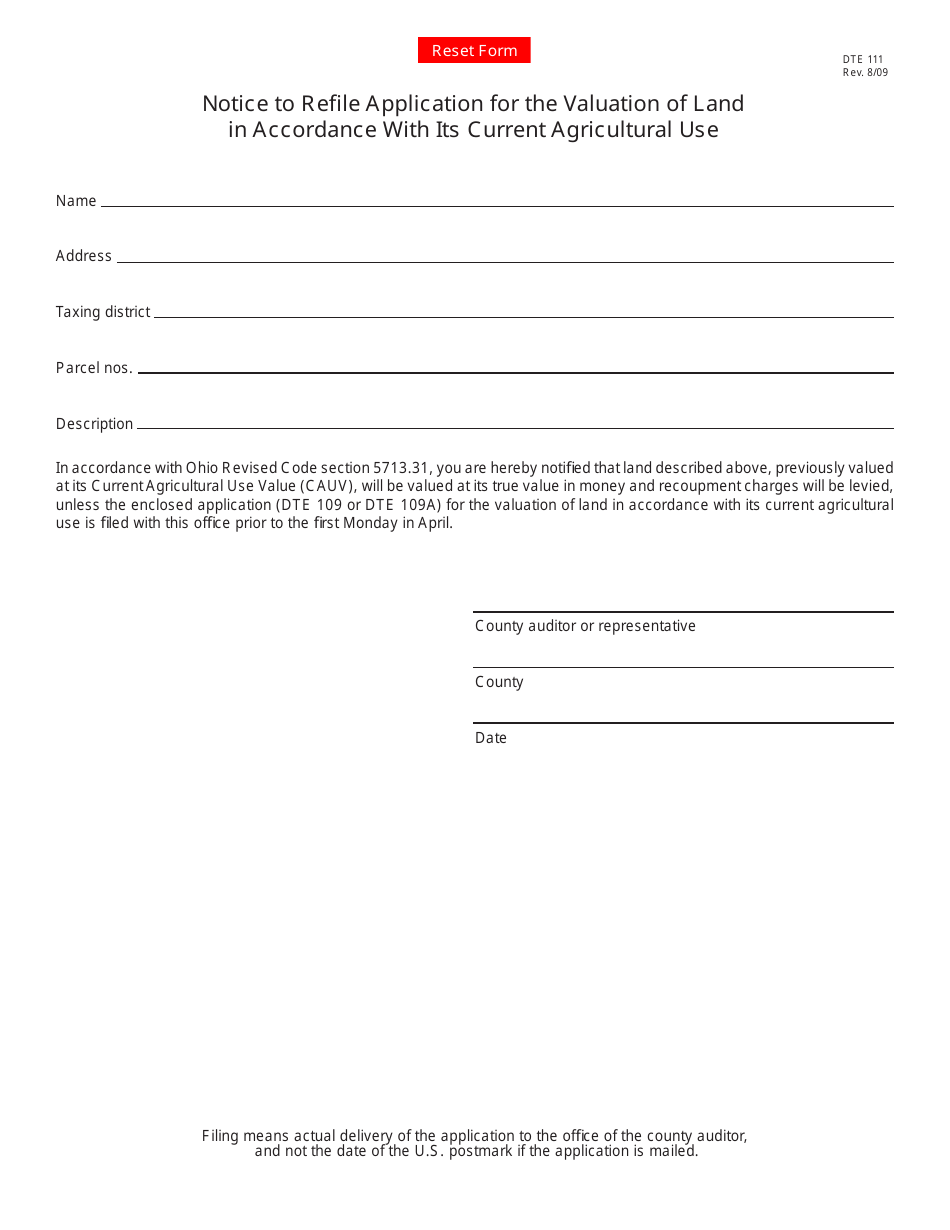

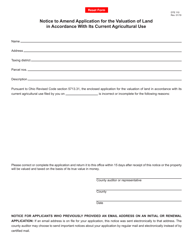

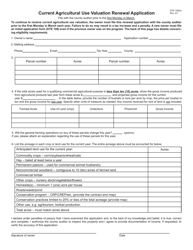

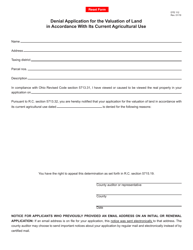

Form DTE111 Notice to Refile Application for the Valuation of Land in Accordance With Its Current Agricultural Use - Ohio

What Is Form DTE111?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE111?

A: Form DTE111 is a notice to refile application for the valuation of land in accordance with its current agricultural use in Ohio.

Q: What is the purpose of Form DTE111?

A: The purpose of Form DTE111 is to request a revaluation of land based on its current agricultural use in Ohio.

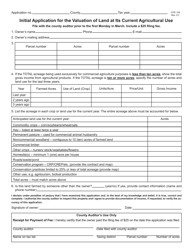

Q: Who should file Form DTE111?

A: Landowners in Ohio who want their land to be revalued based on its current agricultural use should file Form DTE111.

Q: When should I file Form DTE111?

A: Form DTE111 should be filed during the annual renewal period which varies by county in Ohio. Check with your local county auditor's office for the specific deadline.

Q: What documents should I include with Form DTE111?

A: You should include any supporting documents that demonstrate the current agricultural use of the land, such as lease agreements, income statements, or production records.

Q: What happens after I file Form DTE111?

A: After you file Form DTE111, the county auditor will review your application and determine whether the land qualifies for the agricultural use valuation. You will be notified of the decision.

Q: Can I appeal the decision if my land is not granted agricultural use valuation?

A: Yes, you can appeal the decision by filing an appeal with the county board of revision within 30 days of receiving the notice of denial.

Q: Is there a fee for filing Form DTE111?

A: There is no fee for filing Form DTE111 in Ohio.

Q: Can I submit Form DTE111 electronically?

A: Some counties in Ohio allow electronic submission of Form DTE111. Check with your local county auditor's office to see if this option is available.

Form Details:

- Released on August 1, 2009;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE111 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.