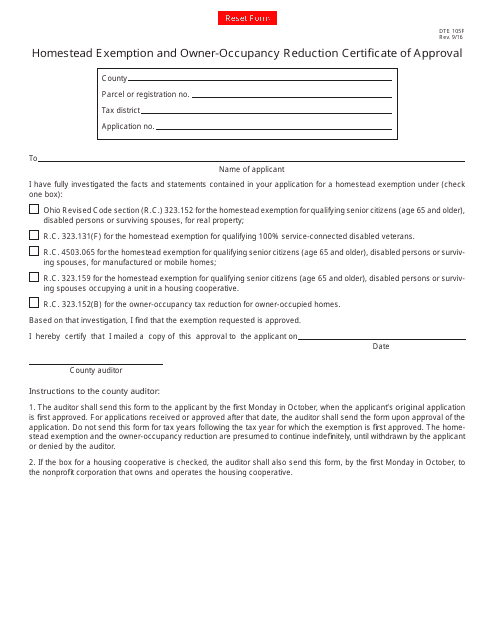

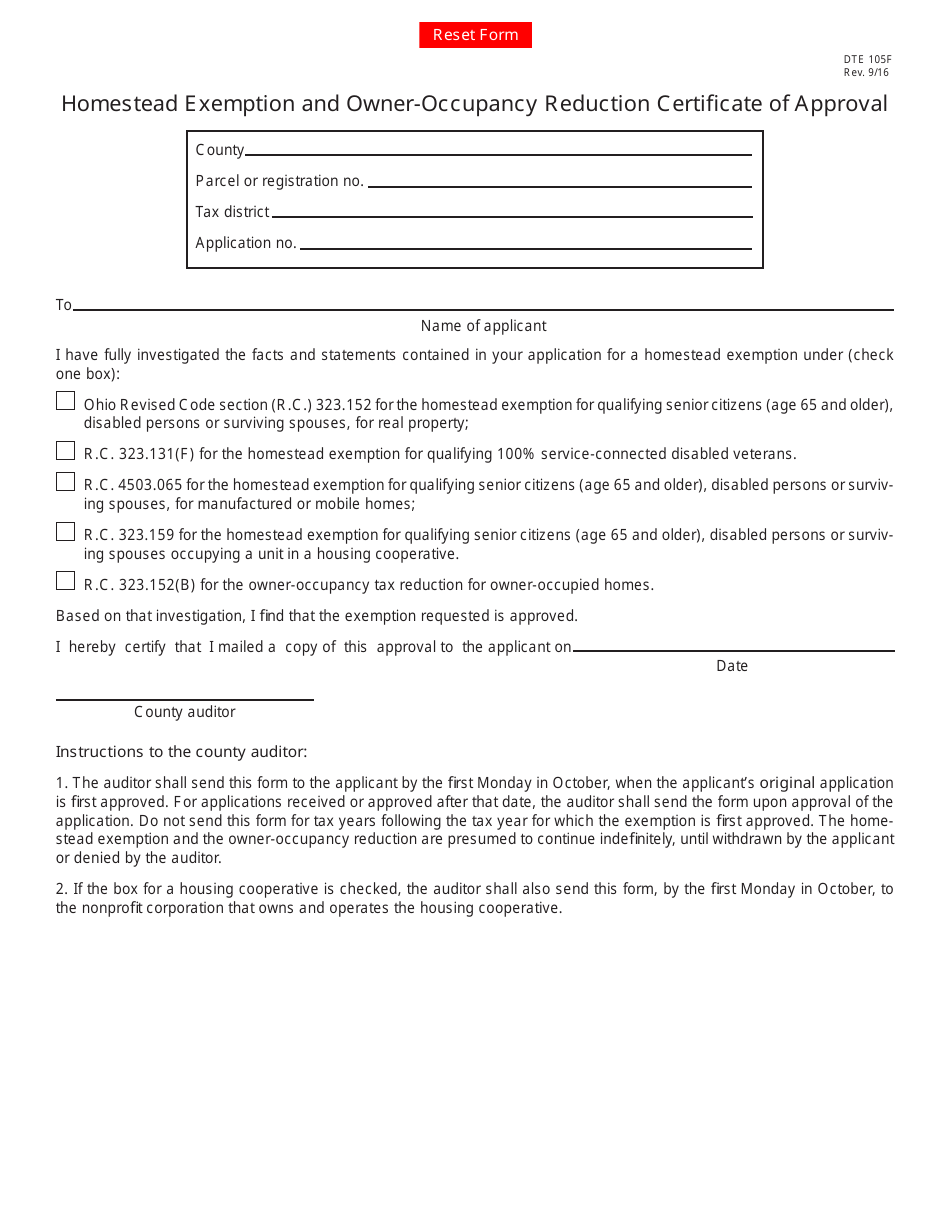

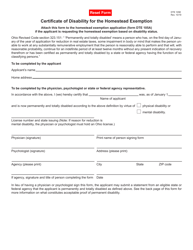

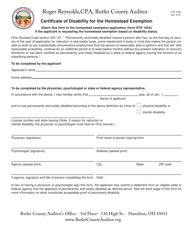

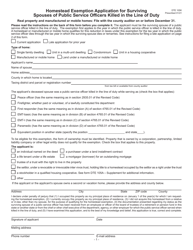

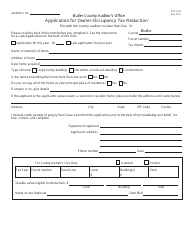

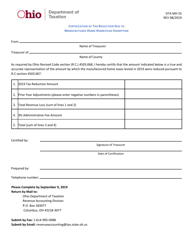

Form DTE105F Homestead Exemption and Owner-Occupancy Reduction Certificate of Approval - Ohio

What Is Form DTE105F?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form DTE105F?

A: The Form DTE105F is the Homestead Exemption and Owner-Occupancy Reduction Certificate of Approval form for the state of Ohio.

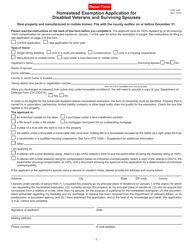

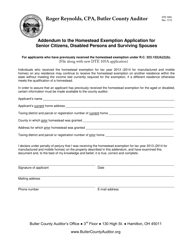

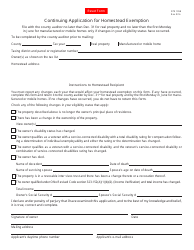

Q: What is the Homestead Exemption?

A: The Homestead Exemption is a program in Ohio that provides a reduction in property taxes for qualifying homeowners.

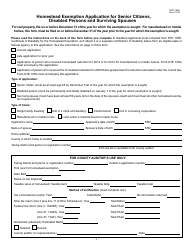

Q: Who is eligible for the Homestead Exemption?

A: To be eligible for the Homestead Exemption in Ohio, you must be at least 65 years old, or permanently and totally disabled, and you must own and occupy your home as your primary residence.

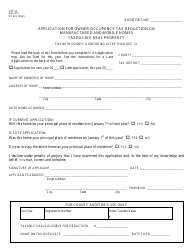

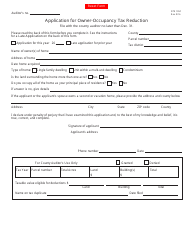

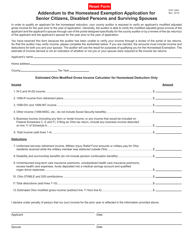

Q: What is the Owner-Occupancy Reduction?

A: The Owner-Occupancy Reduction is an additional reduction in property taxes for eligible homeowners in Ohio.

Q: How do I fill out the Form DTE105F?

A: The Form DTE105F requires you to provide your personal information, property details, and certifications. Follow the instructions on the form and provide accurate information.

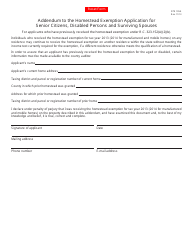

Q: What is the deadline for filing the Form DTE105F?

A: The deadline for filing the Form DTE105F varies by county in Ohio. Check with your local county auditor's office for the specific deadline in your area.

Q: Are there any fees associated with the Form DTE105F?

A: There are no fees associated with filing the Form DTE105F for the Homestead Exemption in Ohio.

Q: What are the benefits of the Homestead Exemption?

A: The benefits of the Homestead Exemption include a reduction in property taxes, which can help lower the overall cost of homeownership for eligible individuals and families.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE105F by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.