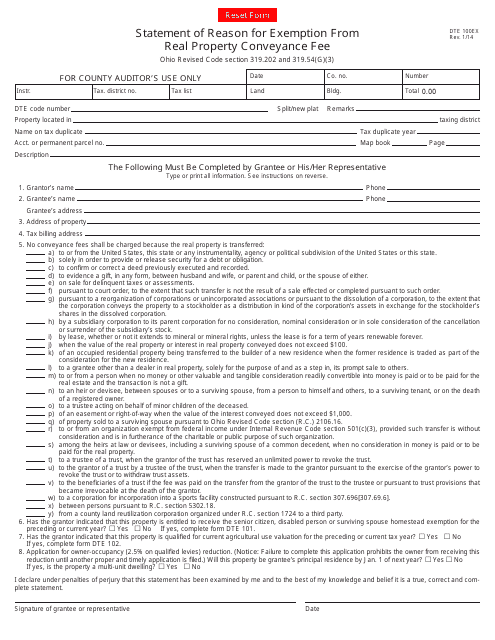

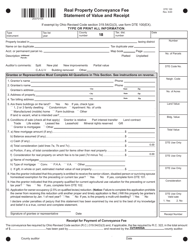

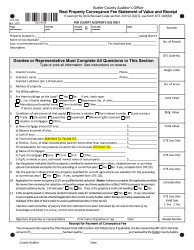

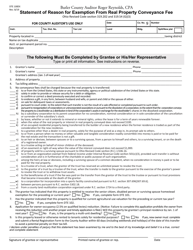

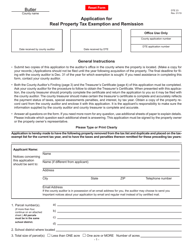

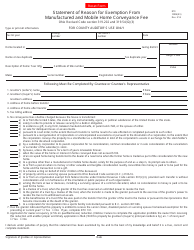

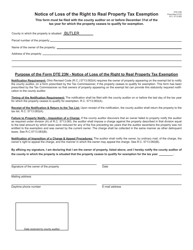

Form DTE100EX Statement of Reason for Exemption From Real Property Conveyance Fee - Ohio

What Is Form DTE100EX?

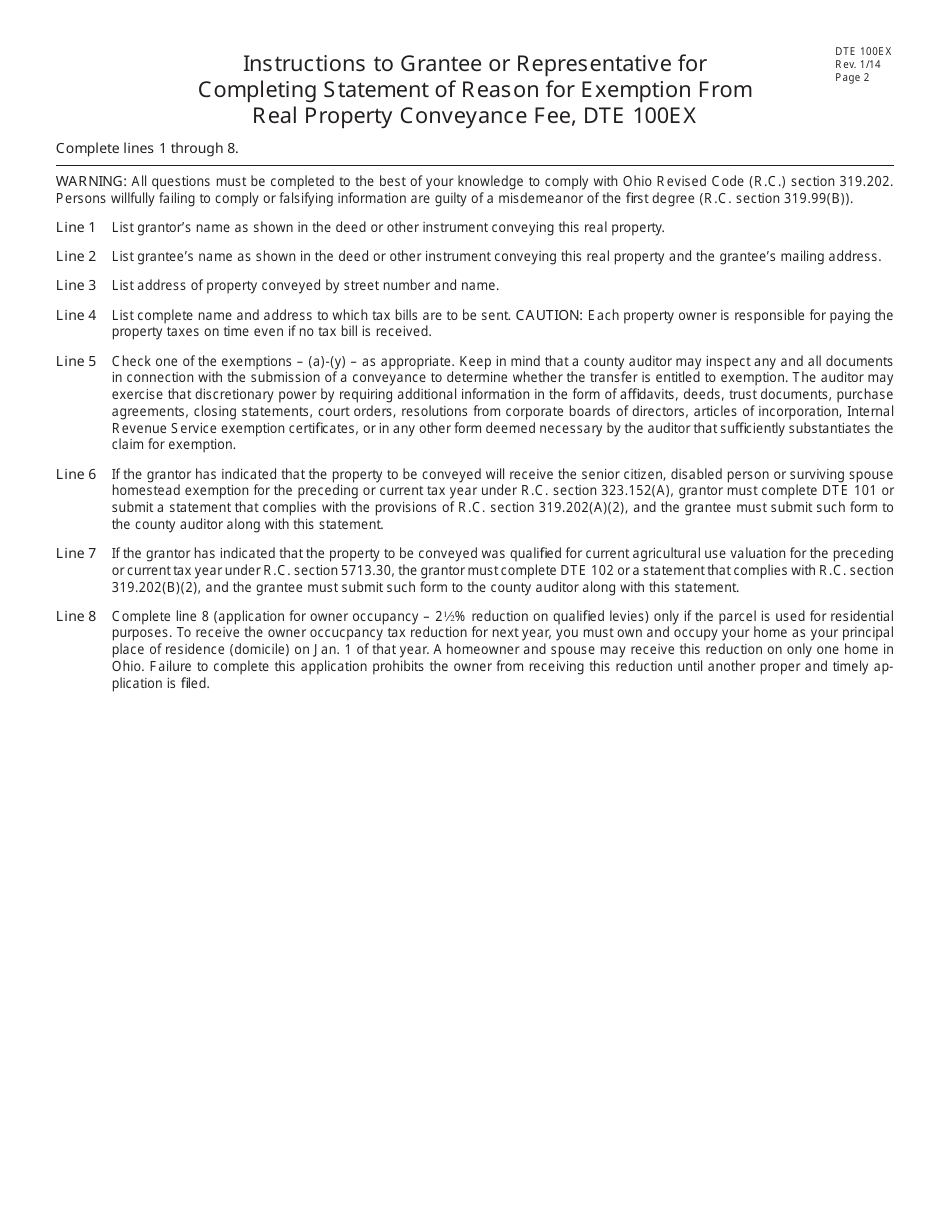

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE100EX?

A: Form DTE100EX is the Statement of Reason for Exemption From Real PropertyConveyance Fee in Ohio.

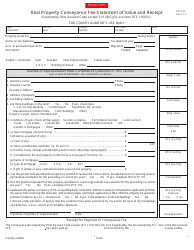

Q: What is the Real Property Conveyance Fee in Ohio?

A: The Real Property Conveyance Fee is a fee imposed on the transfer of real property in Ohio.

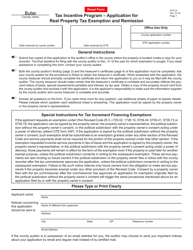

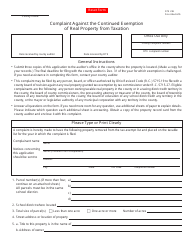

Q: Who needs to file Form DTE100EX?

A: Anyone who is claiming an exemption from the Real Property Conveyance Fee in Ohio needs to file Form DTE100EX.

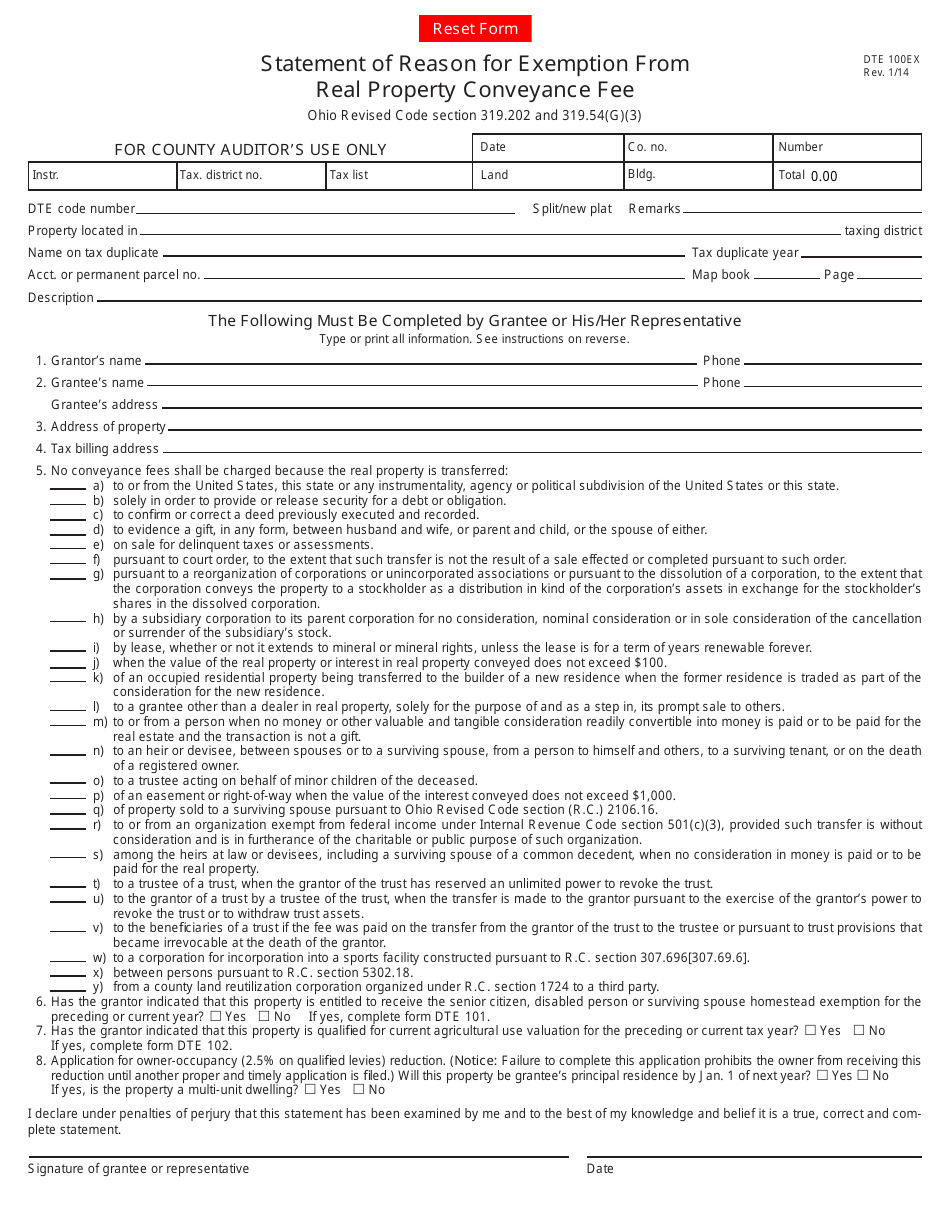

Q: What exemptions are available for the Real Property Conveyance Fee in Ohio?

A: There are several exemptions available, such as transfers between spouses, transfers to certain nonprofit organizations, and transfers between governmental entities.

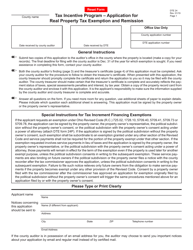

Q: Is there a deadline for filing Form DTE100EX?

A: Yes, Form DTE100EX must be filed within 30 days from the date of the transfer of real property.

Q: Are there any fees associated with filing Form DTE100EX?

A: There is no fee to file Form DTE100EX.

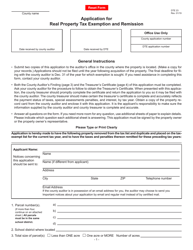

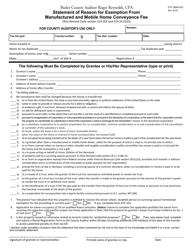

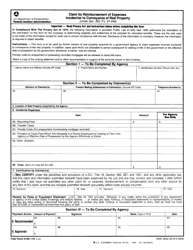

Q: What should I do if I am unsure about whether I qualify for an exemption?

A: If you are unsure about whether you qualify for an exemption, it is recommended to consult with an attorney or tax professional.

Q: What happens after I file Form DTE100EX?

A: After you file Form DTE100EX, the Ohio Department of Taxation will review your application and determine whether you qualify for an exemption from the Real Property Conveyance Fee.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE100EX by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.