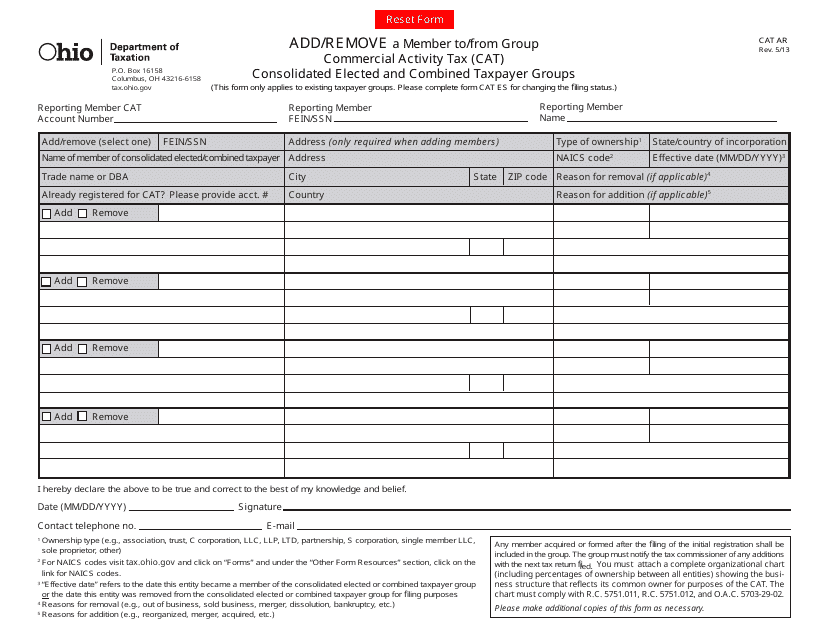

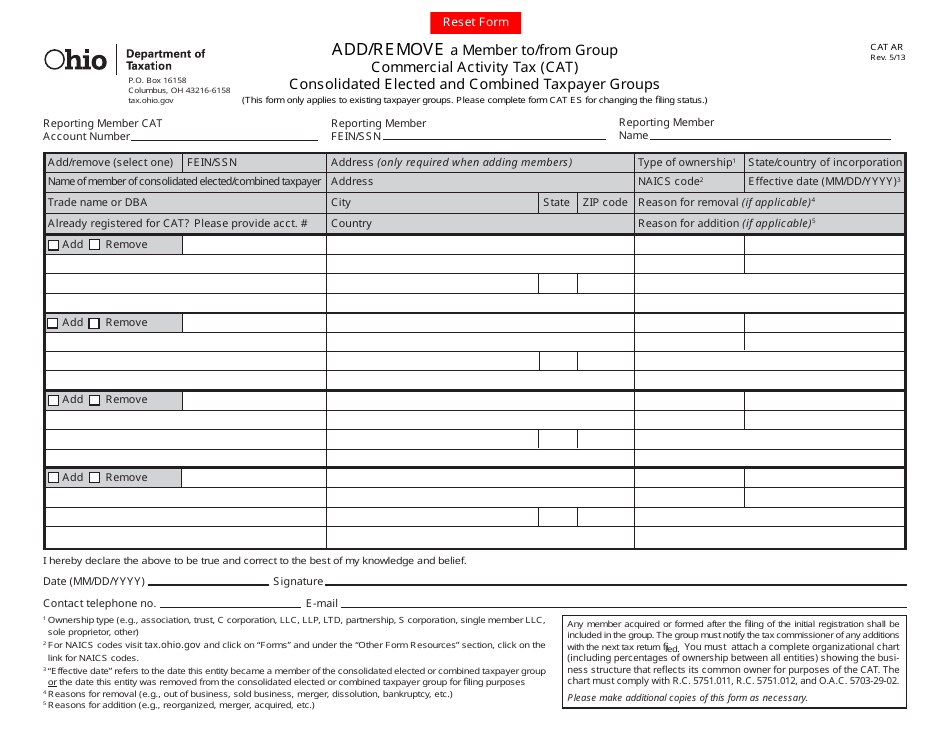

Form CAT AR Add / Remove Cat Ar a Member to / From Group Commercial Activity Tax (CAT) Consolidated Elected and Combined Taxpayer Groups - Ohio

What Is Form CAT AR?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CAT AR?

A: CAT AR stands for Commercial Activity Tax Add/Remove.

Q: What does CAT AR do?

A: CAT AR is used to add or remove a member from a group for Commercial Activity Tax purposes.

Q: What is CAT?

A: CAT stands for Commercial Activity Tax.

Q: What are Consolidated Elected and Combined Taxpayer Groups in Ohio?

A: Consolidated Elected and Combined Taxpayer Groups are groups of taxpayers who elect to file a combined Commercial Activity Tax return in Ohio.

Q: What is the purpose of Consolidated Elected and Combined Taxpayer Groups?

A: The purpose of these groups is to simplify the filing process and calculation of the Commercial Activity Tax for related entities.

Q: Is CAT applicable only in Ohio?

A: Yes, CAT is the tax that applies to commercial activities in Ohio.

Form Details:

- Released on May 1, 2013;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CAT AR by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.