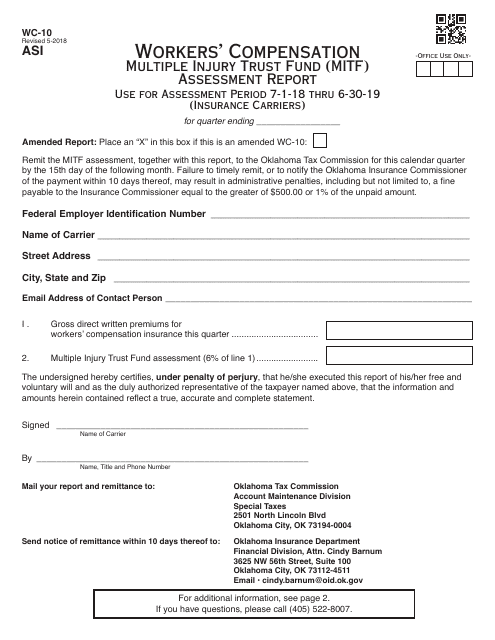

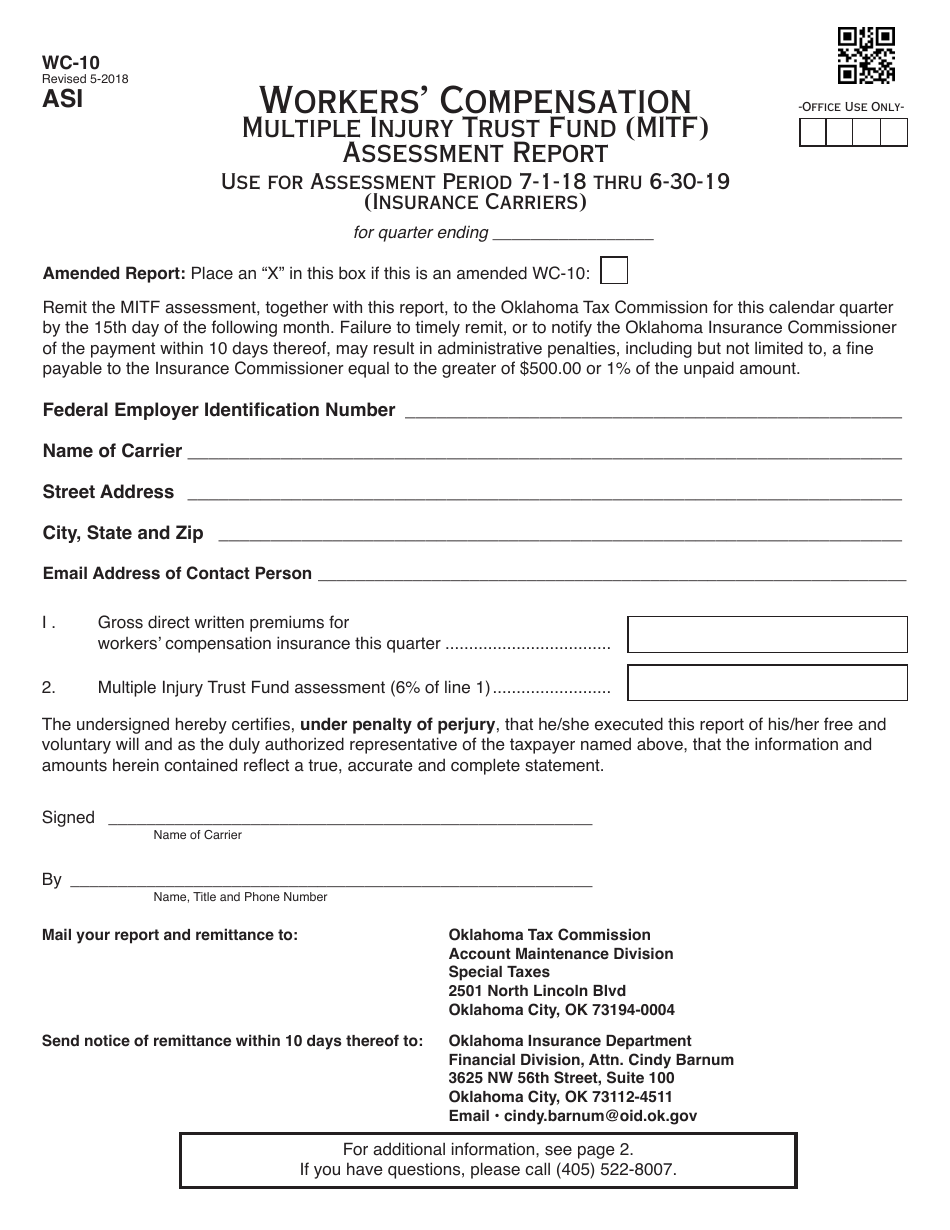

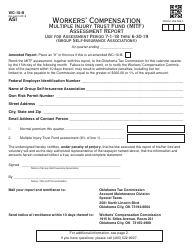

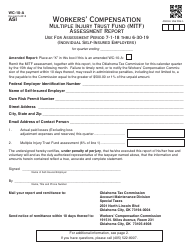

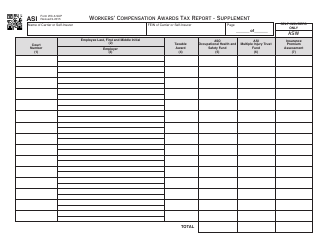

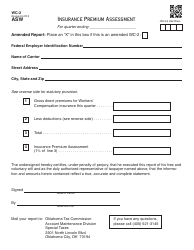

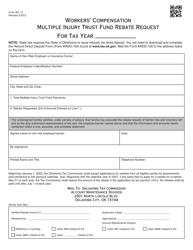

OTC Form WC-10 Workers' Compensation Multiple Injury Trust Fund (Mitf) Assessment Report - Oklahoma

What Is OTC Form WC-10?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

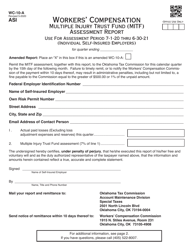

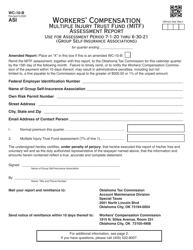

Q: What is the OTC Form WC-10 Workers' Compensation Multiple Injury Trust Fund (Mitf) Assessment Report?

A: The OTC Form WC-10 is a report used to assess the Workers' Compensation Multiple Injury Trust Fund (MITF) in Oklahoma.

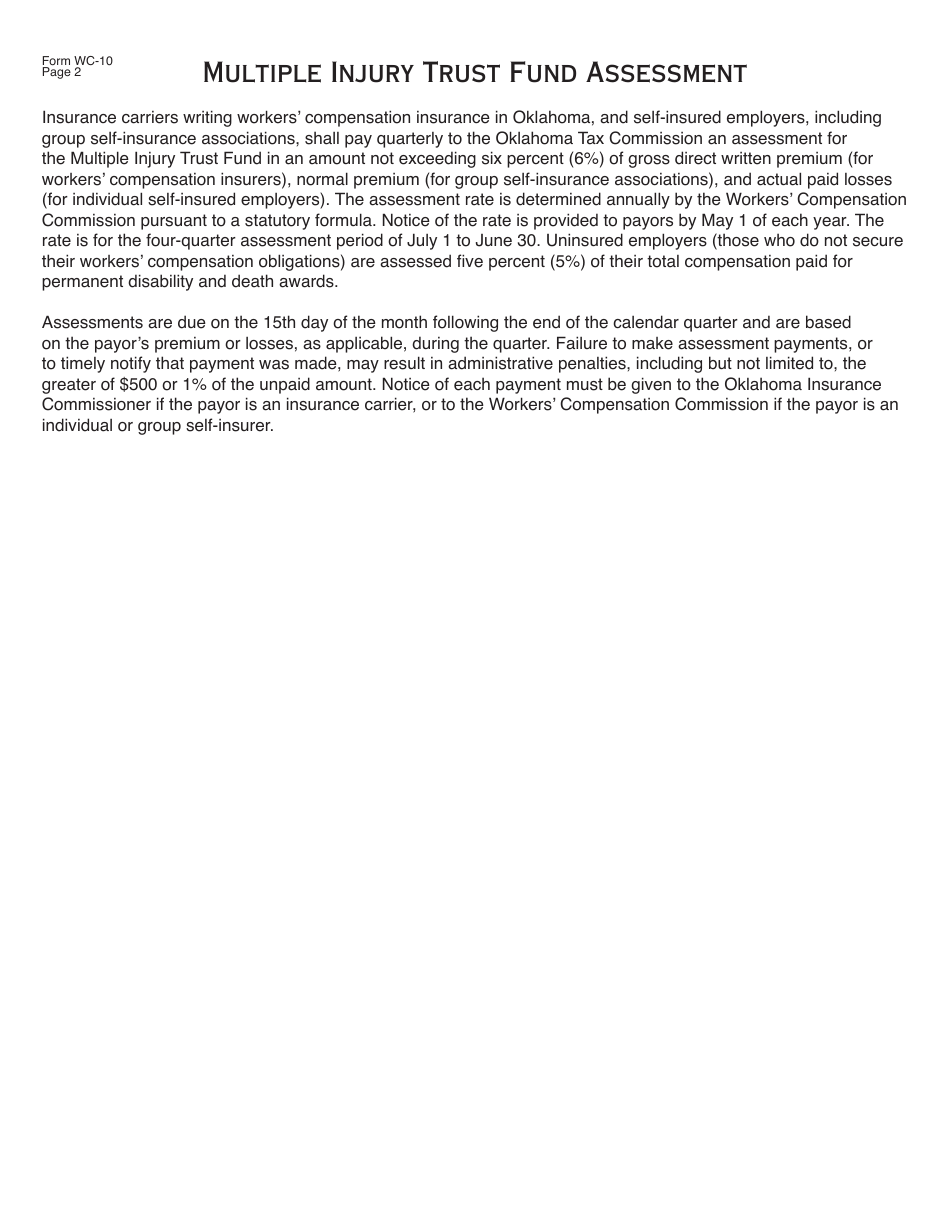

Q: What is the Workers' Compensation Multiple Injury Trust Fund (MITF)?

A: The Workers' Compensation Multiple Injury Trust Fund (MITF) is a fund in Oklahoma that provides benefits to workers who have multiple work-related injuries.

Q: Who is required to file the OTC Form WC-10?

A: Employers who are insured for workers' compensation coverage in Oklahoma and have paid premiums to the Multiple Injury Trust Fund (MITF) are required to file the OTC Form WC-10.

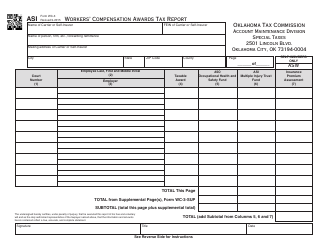

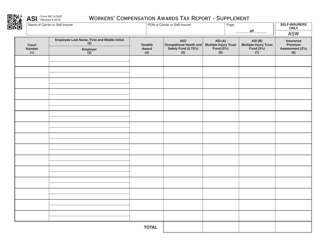

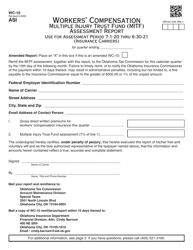

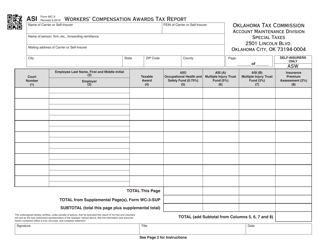

Q: What information is required in the OTC Form WC-10?

A: The OTC Form WC-10 requires information such as the employer's name and address, the total wages paid to workers in Oklahoma, and the amount of workers' compensation premiums paid to the Multiple Injury Trust Fund (MITF).

Q: What is the purpose of the assessment report?

A: The assessment report is used to calculate the amount of assessment due to the Multiple Injury Trust Fund (MITF) based on the employer's total wages and workers' compensation premiums.

Q: When is the OTC Form WC-10 due?

A: The OTC Form WC-10 is due on or before March 1st of each year for the preceding calendar year.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form WC-10 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.