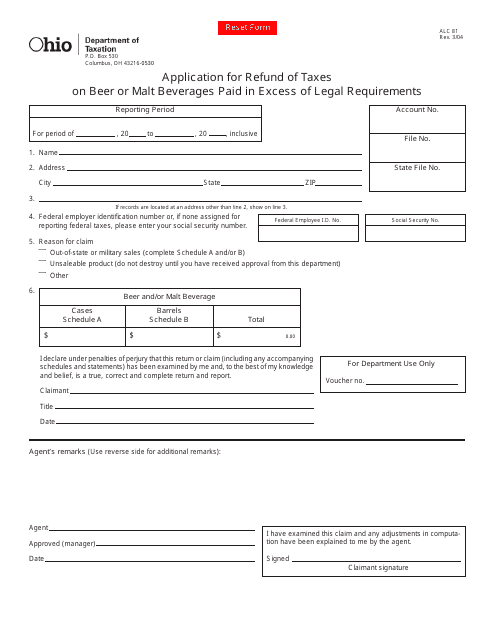

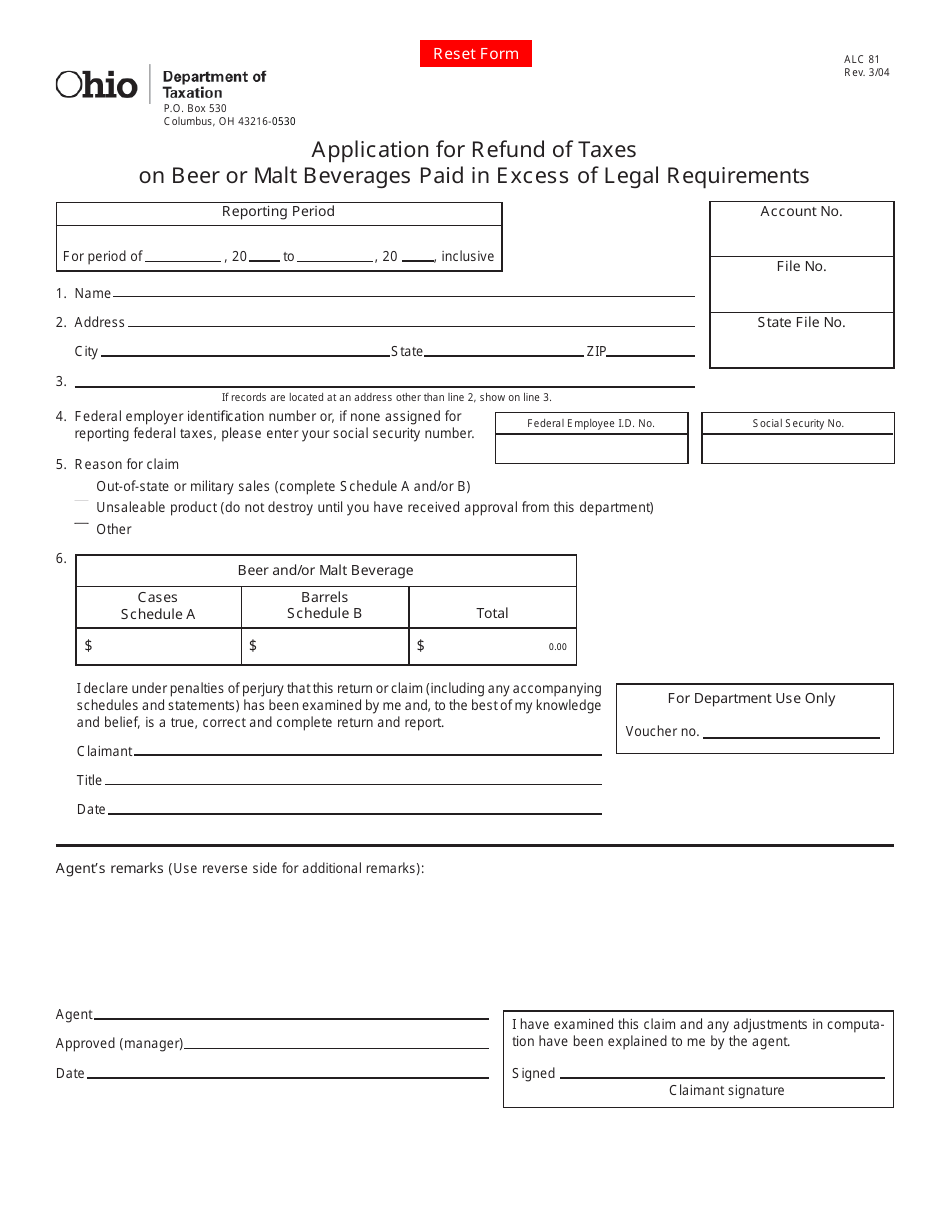

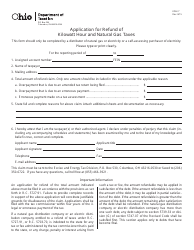

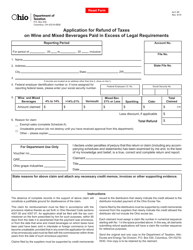

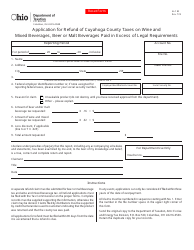

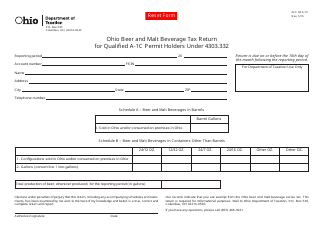

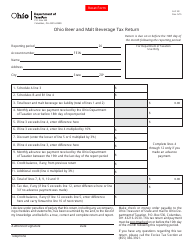

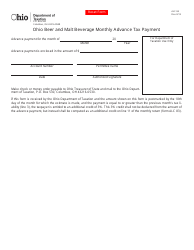

Form ALC81 Application for Refund of Taxes on Beer or Malt Beverages Paid in Excess of Legal Requirements - Ohio

What Is Form ALC81?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ALC81?

A: Form ALC81 is an application for refund of taxes on beer or malt beverages paid in excess of legal requirements in Ohio.

Q: Who can use Form ALC81?

A: Any individual or business that has paid taxes on beer or malt beverages in excess of the legal requirements in Ohio can use Form ALC81.

Q: What is the purpose of Form ALC81?

A: The purpose of Form ALC81 is to request a refund for taxes paid on beer or malt beverages in Ohio that exceed the legal requirements.

Q: Is there a deadline for filing Form ALC81?

A: Yes, Form ALC81 must be filed within one year from the date of purchase of the beer or malt beverages.

Q: What supporting documents are required with Form ALC81?

A: You must include copies of invoices or receipts showing the taxes paid, as well as any other supporting documentation as requested on the form.

Q: How long does it take to process Form ALC81?

A: The processing time for Form ALC81 can vary, but it typically takes several weeks to receive a refund.

Q: Can I file Form ALC81 electronically?

A: No, Form ALC81 must be filed by mail or in-person.

Q: Is there a fee to file Form ALC81?

A: No, there is no fee to file Form ALC81.

Form Details:

- Released on March 1, 2004;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ALC81 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.