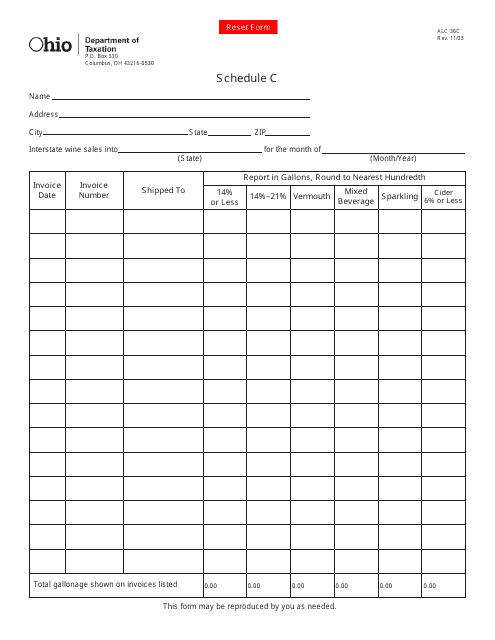

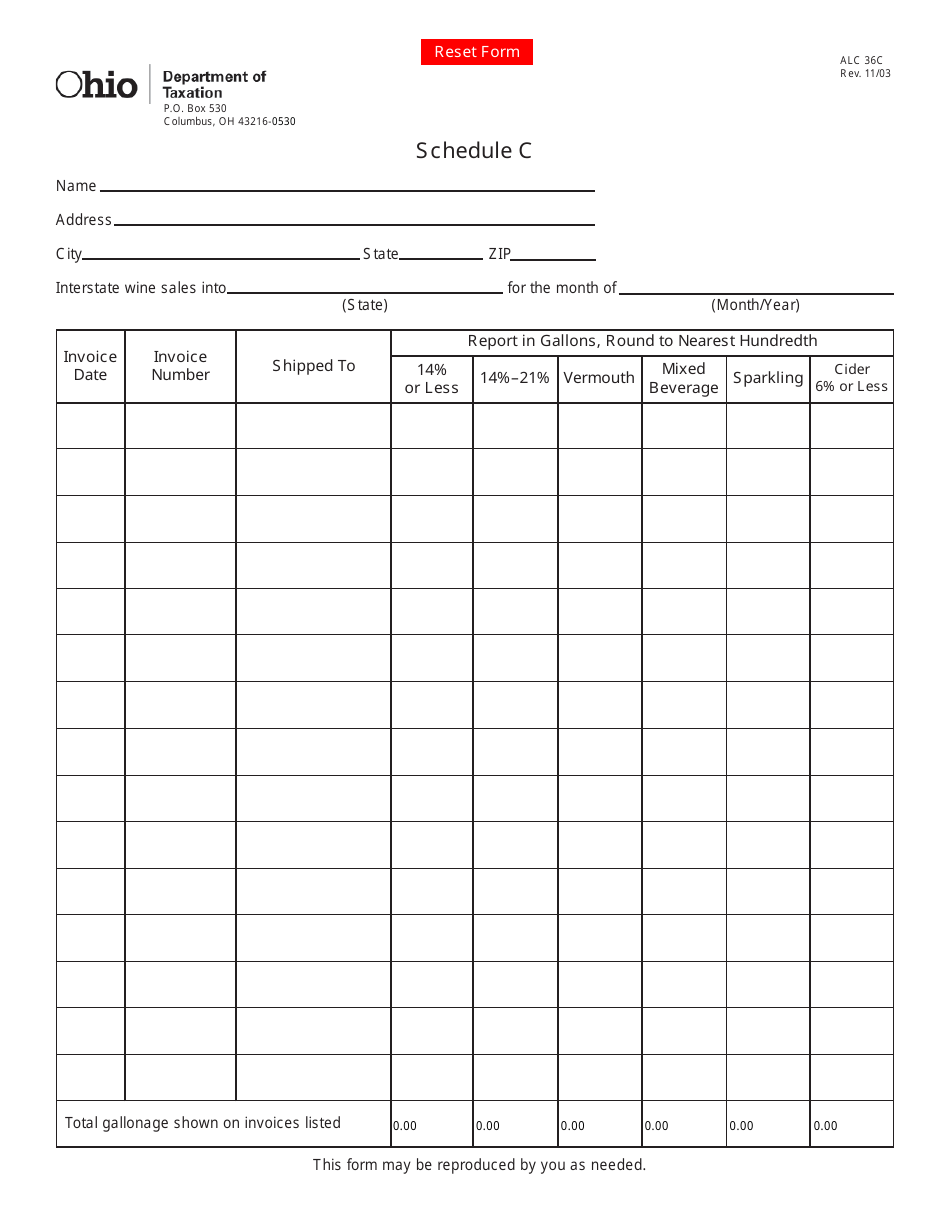

This version of the form is not currently in use and is provided for reference only. Download this version of

Form ALC36C Schedule C

for the current year.

Form ALC36C Schedule C - Ohio

What Is Form ALC36C Schedule C?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

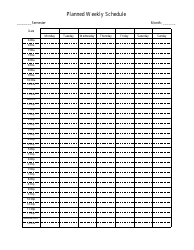

Q: What is Form ALC36C Schedule C?

A: Form ALC36C Schedule C is a schedule that is used in the state of Ohio to report and pay alcoholic beverage taxes.

Q: Who needs to file Form ALC36C Schedule C?

A: Any person or business who sells alcoholic beverages in Ohio is required to file Form ALC36C Schedule C.

Q: What information is required on Form ALC36C Schedule C?

A: Form ALC36C Schedule C requires information such as the total gallons or liters of alcoholic beverages sold, the type of beverage, and the tax due.

Q: When is Form ALC36C Schedule C due?

A: Form ALC36C Schedule C is due on a monthly basis, with the due date falling on the 23rd day of the following month.

Form Details:

- Released on November 1, 2003;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ALC36C Schedule C by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.