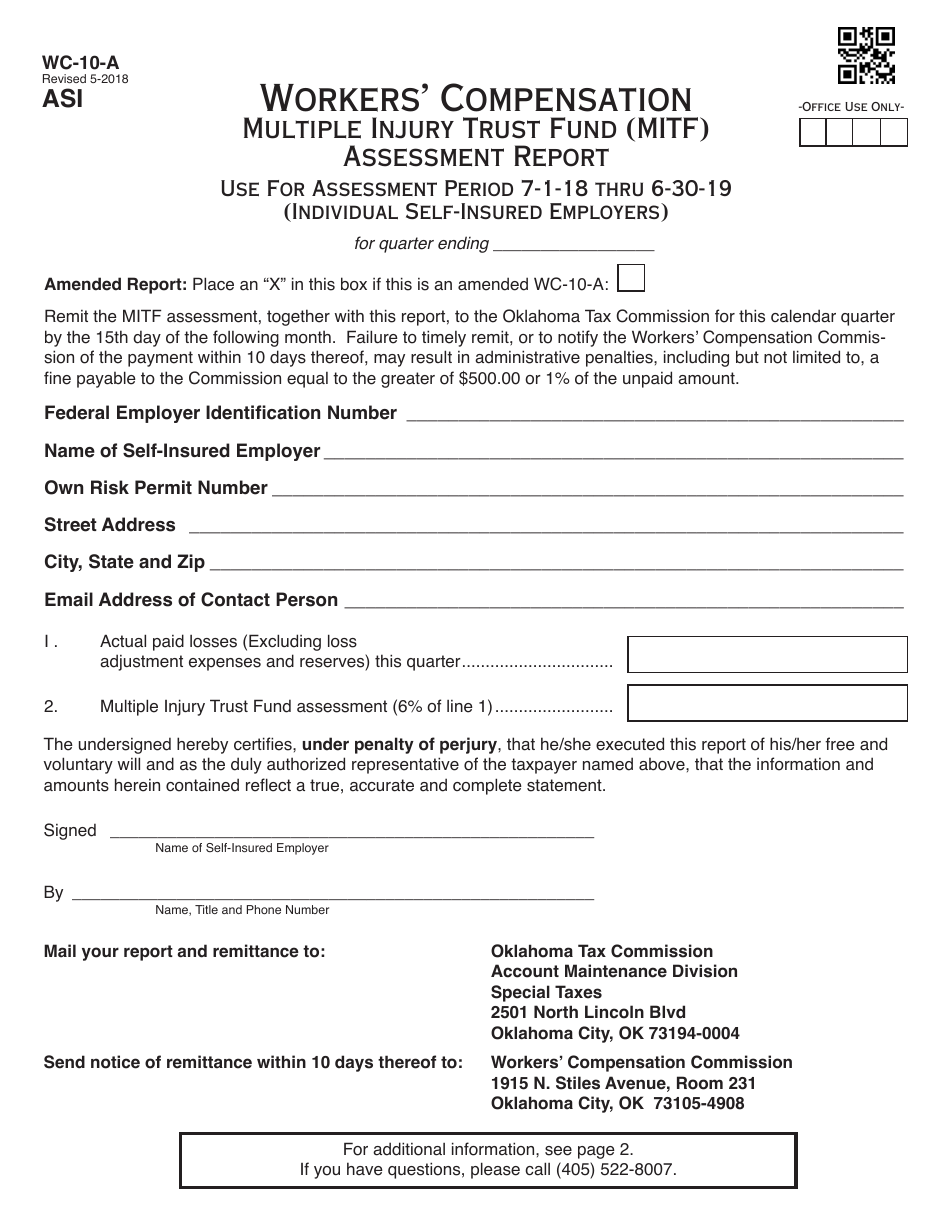

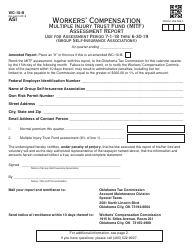

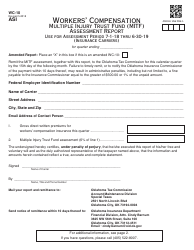

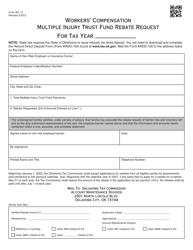

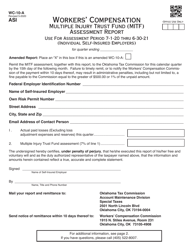

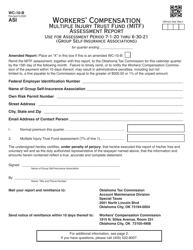

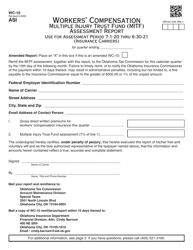

OTC Form WC-10-A Workers' Compensation Multiple Injury Trust Fund (Mitf) Assessment Report - Individual Self-insured Employers - Oklahoma

What Is OTC Form WC-10-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OTC Form WC-10-A?

A: The OTC Form WC-10-A is a Workers' Compensation Multiple Injury Trust Fund (MITF) Assessment Report.

Q: Who is required to file the OTC Form WC-10-A?

A: Individual self-insured employers in Oklahoma are required to file the OTC Form WC-10-A.

Q: What is the purpose of the OTC Form WC-10-A?

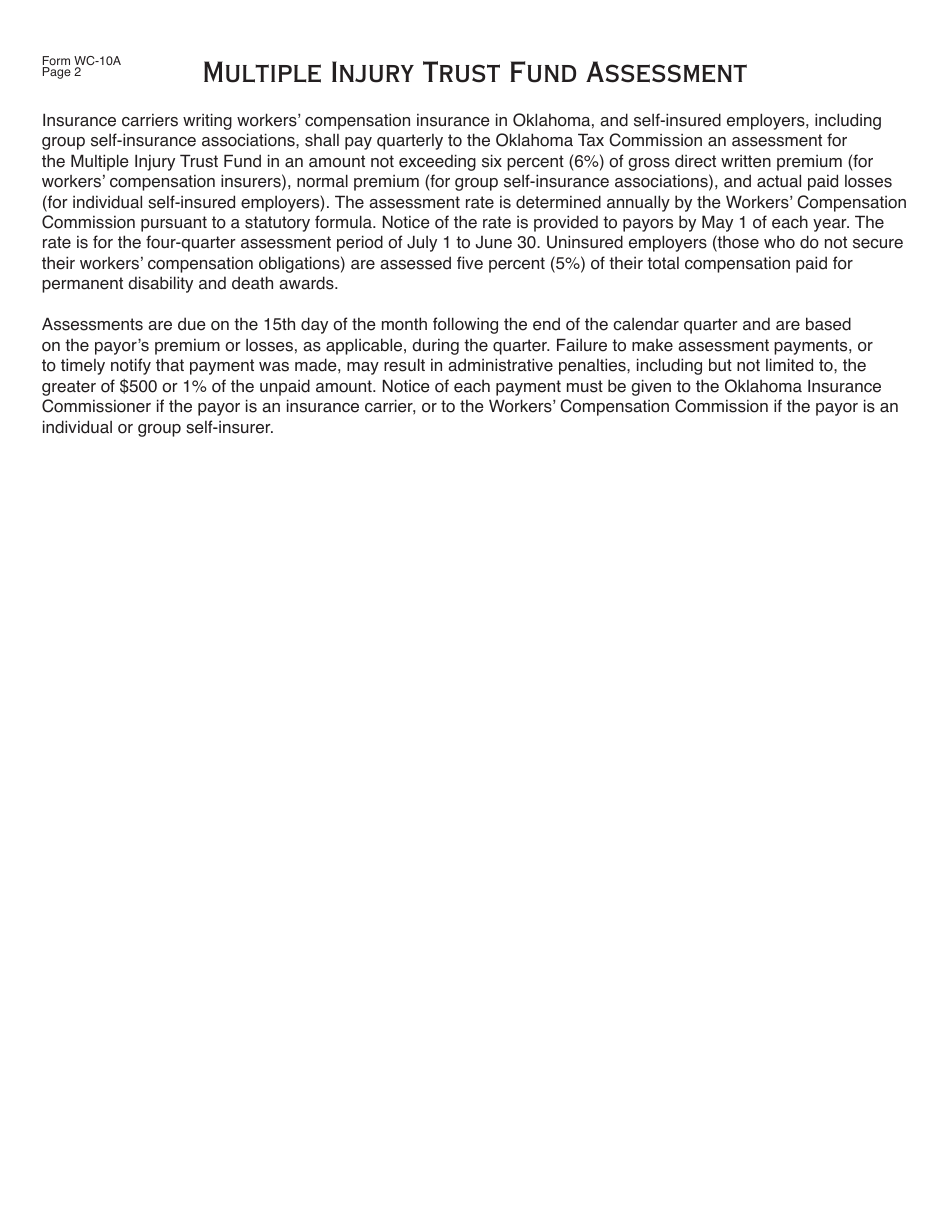

A: The purpose of the OTC Form WC-10-A is to report the assessment owed to the Workers' Compensation Multiple Injury Trust Fund (MITF) by individual self-insured employers.

Q: What is the Workers' Compensation Multiple Injury Trust Fund (MITF)?

A: The Workers' Compensation Multiple Injury Trust Fund (MITF) is a fund established in Oklahoma to provide benefits to injured workers when their employer fails to maintain workers' compensation insurance.

Q: What is an assessment?

A: An assessment is a fee or charge that is required to be paid to the Workers' Compensation Multiple Injury Trust Fund (MITF) by individual self-insured employers.

Q: Are all employers in Oklahoma required to file the OTC Form WC-10-A?

A: No, only individual self-insured employers in Oklahoma are required to file the OTC Form WC-10-A.

Q: Is there a deadline for filing the OTC Form WC-10-A?

A: Yes, individual self-insured employers must file the OTC Form WC-10-A on or before February 28th of each year.

Q: What happens if an employer fails to file the OTC Form WC-10-A or pay the assessment?

A: If an employer fails to file the OTC Form WC-10-A or pay the assessment, they may be subject to penalties and interest.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form WC-10-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.