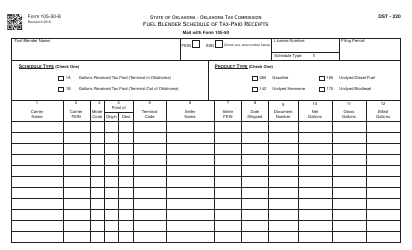

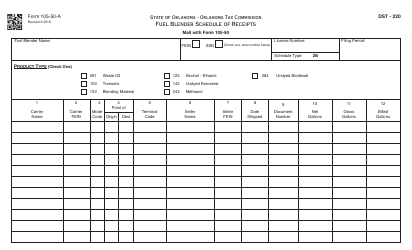

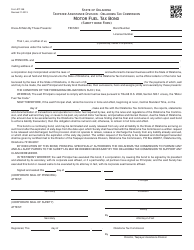

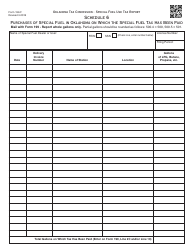

OTC Form DST-220 (105-50) Fuel Blender Tax Calculation - Oklahoma

What Is OTC Form DST-220 (105-50)?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

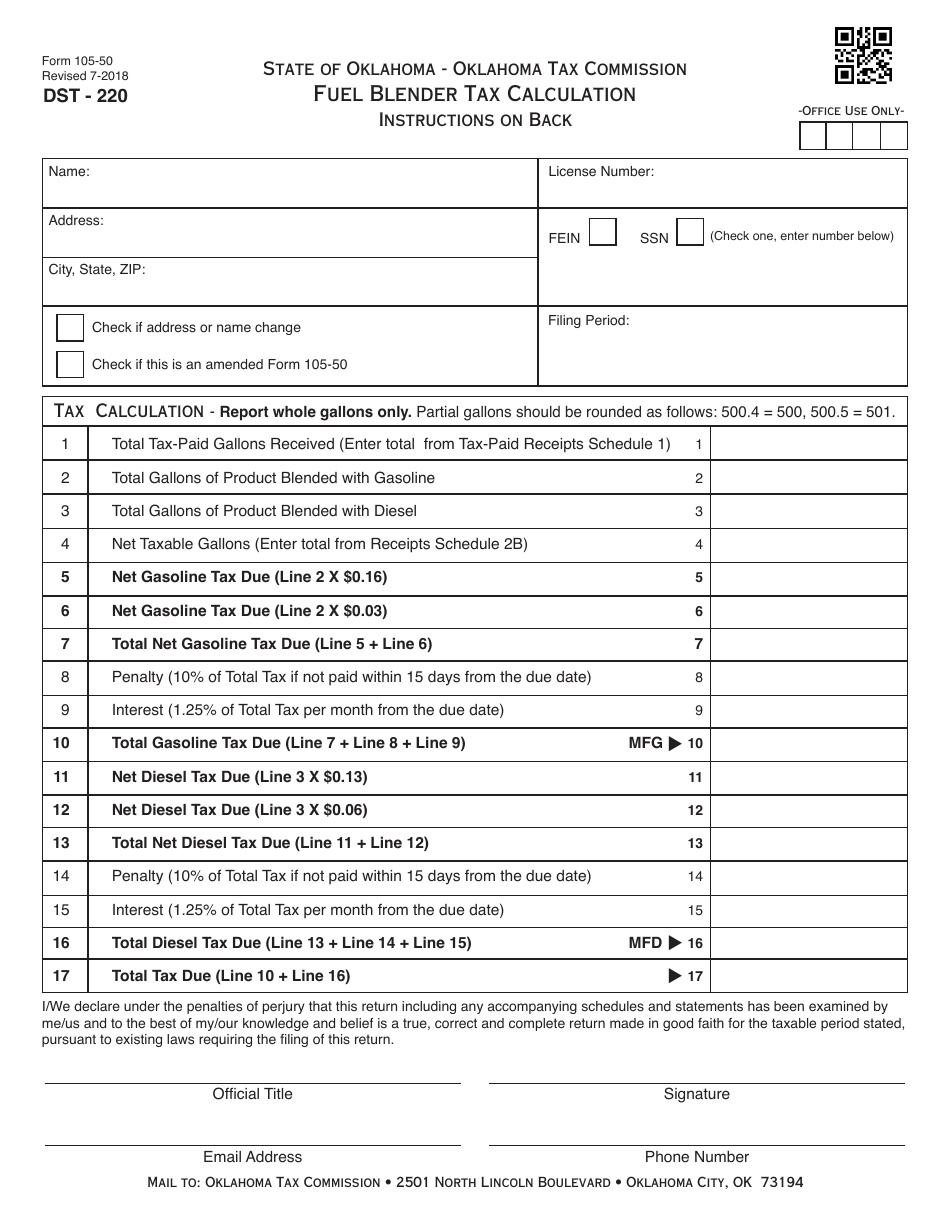

Q: What is OTC Form DST-220 (105-50)?

A: OTC Form DST-220 (105-50) is a form used for Fuel Blender Tax Calculation in Oklahoma.

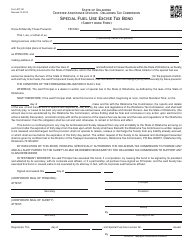

Q: Who needs to file OTC Form DST-220 (105-50)?

A: Fuel blenders in Oklahoma are required to file OTC Form DST-220 (105-50).

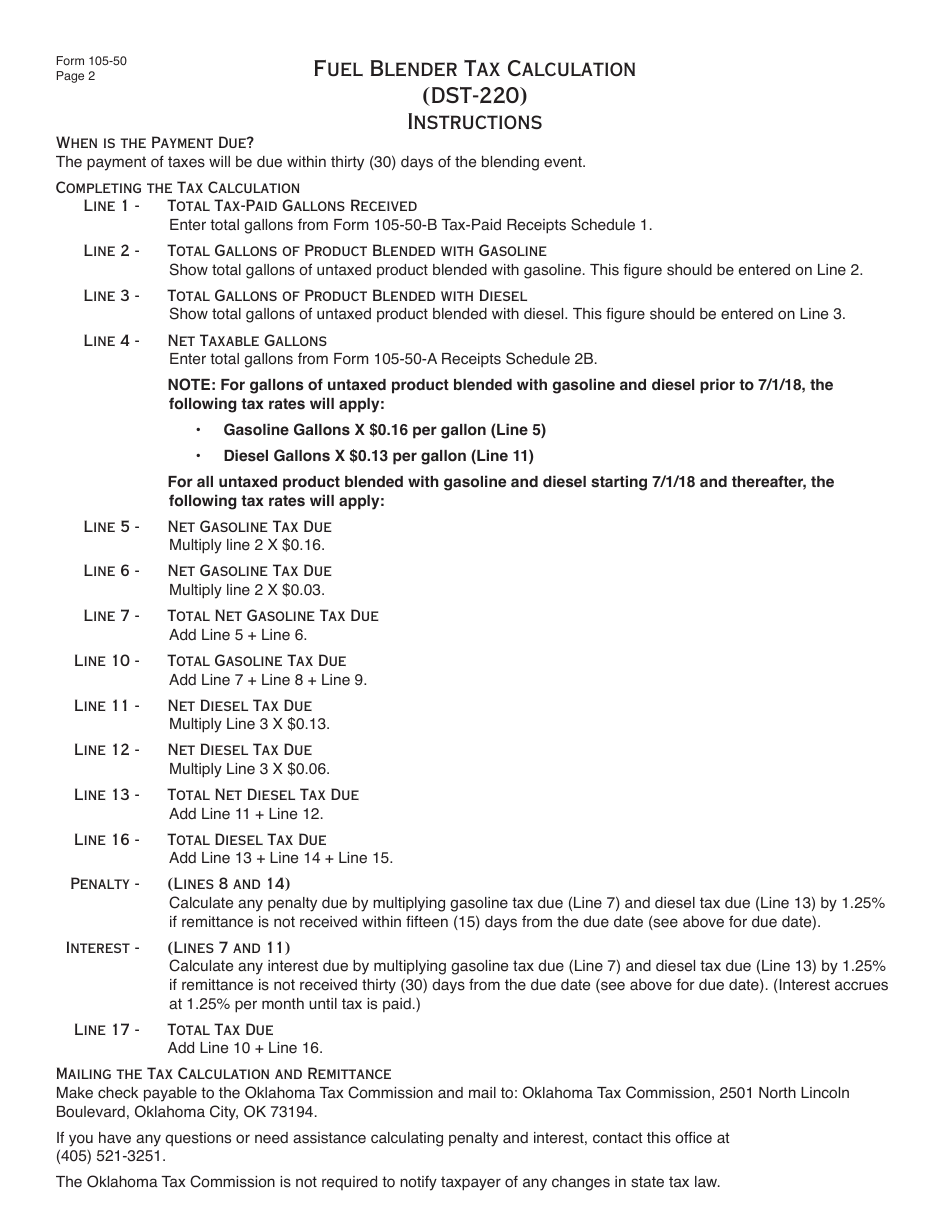

Q: What is Fuel Blender Tax Calculation?

A: Fuel Blender Tax Calculation is the process of determining the tax owed by fuel blenders in Oklahoma based on the amount of fuel blended.

Q: When is the deadline to file OTC Form DST-220 (105-50)?

A: The deadline to file OTC Form DST-220 (105-50) is the same as the state's fuel tax reporting and payment deadline, which is typically the 20th day of the following month.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance. It is important to file OTC Form DST-220 (105-50) on time to avoid these penalties.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form DST-220 (105-50) by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.