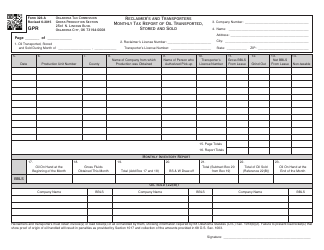

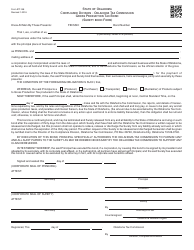

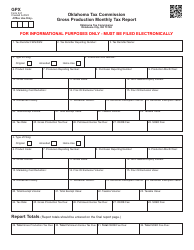

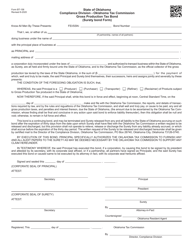

OTC Form 300-C Gross Production and Petroleum Excise Tax Remittance Form - Oklahoma

What Is OTC Form 300-C?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

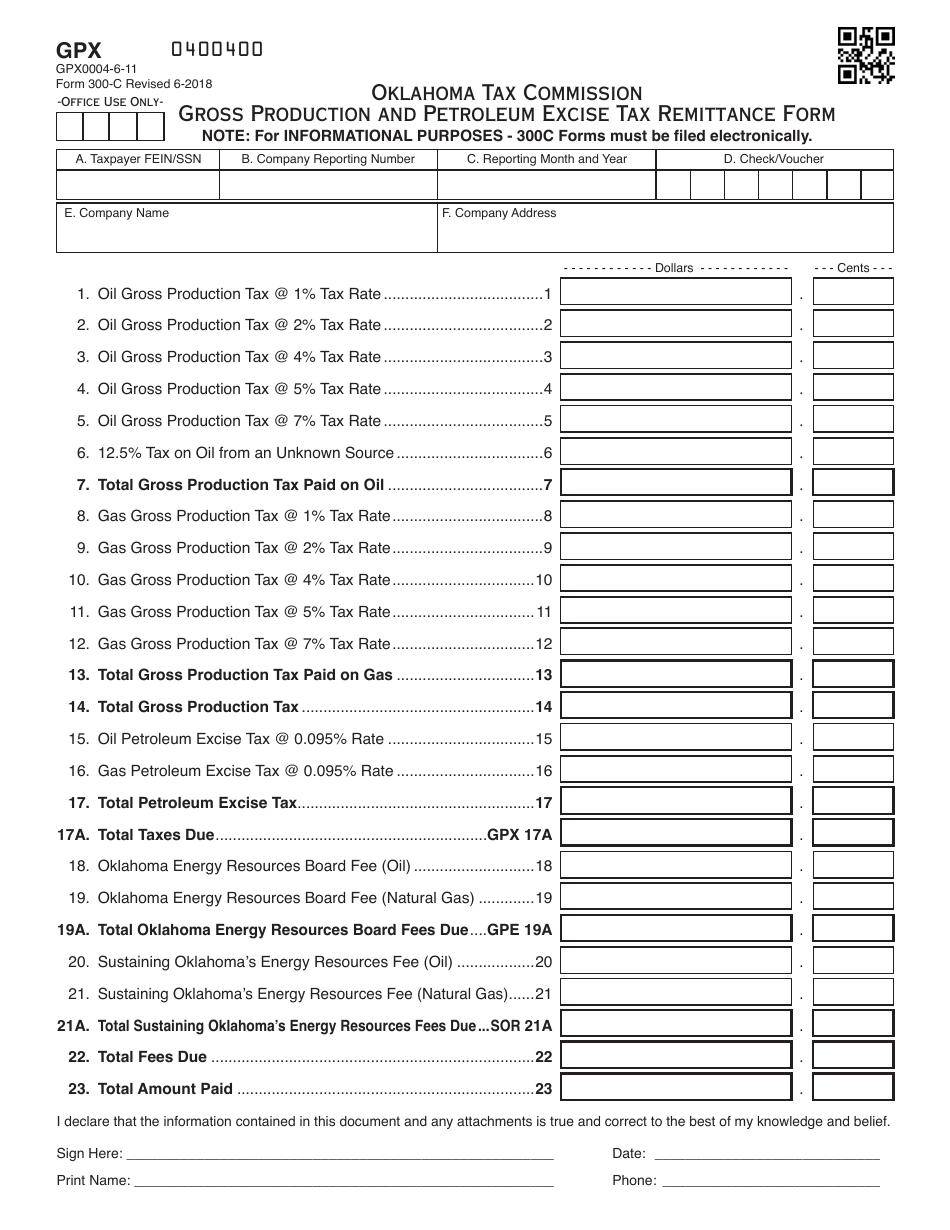

Q: What is OTC Form 300-C?

A: OTC Form 300-C is the Gross Production and Petroleum Excise Tax Remittance Form in Oklahoma.

Q: What is the purpose of OTC Form 300-C?

A: The purpose of OTC Form 300-C is to remit gross production and petroleum excise taxes in Oklahoma.

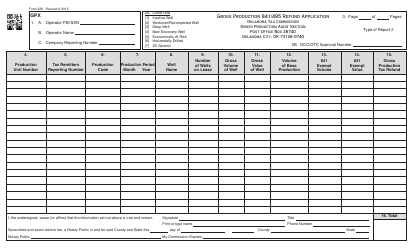

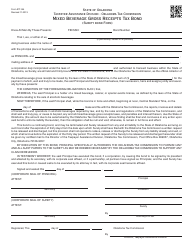

Q: Who needs to file OTC Form 300-C?

A: Anyone engaged in the production, exploration, or transportation of petroleum products in Oklahoma needs to file OTC Form 300-C.

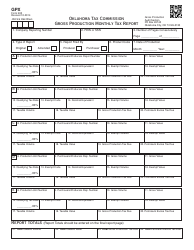

Q: What are gross production and petroleum excise taxes?

A: Gross production tax is a tax levied on the value of oil and gas produced, while petroleum excise tax is a tax on the first sale or transfer of petroleum products.

Q: When is the deadline for filing OTC Form 300-C?

A: The deadline for filing OTC Form 300-C is typically the 20th day of the following month.

Q: Are there any penalties for late filing of OTC Form 300-C?

A: Yes, there may be penalties for late filing, including interest charges on the unpaid tax amount.

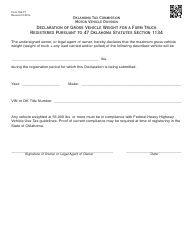

Q: Is OTC Form 300-C applicable only to Oklahoma residents?

A: No, OTC Form 300-C is applicable to anyone engaged in petroleum production, exploration, or transportation in Oklahoma, regardless of residency.

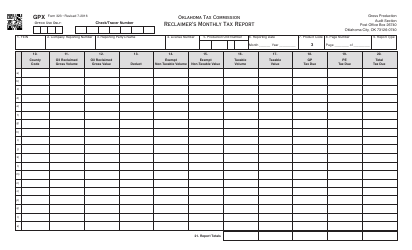

Q: What other tax forms are related to OTC Form 300-C?

A: Other related tax forms include OTC Form 300 for gross production tax and OTC Form 60 for petroleum excise tax.

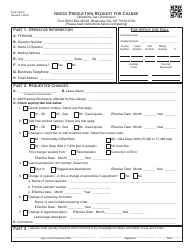

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 300-C by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.